Bitcoin futures open interest hits $75B ATH as BTC price eyes $108K breakout

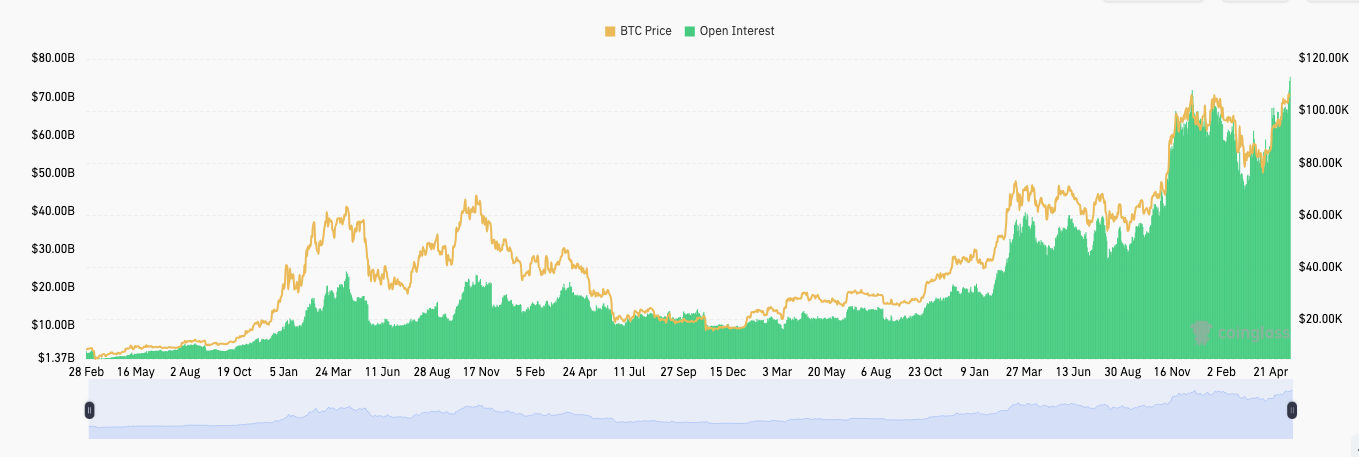

Bitcoin futures open interest has surged to a record $75 billion, signaling heightened leveraged exposure as traders are eyeing a breakout above the key $108K resistance level — where a dense cluster of bearish short positions could trigger a massive short squeeze.

Bitcoin (BTC) futures OI has reached a new ATH of over $75 billion, according to Coinglass data. Over the past 24 hours alone, total OI rose by 4.23%, signalling a strong buildup in leveraged positioning.

Chicago Mercantile Exchange leads with $17.43 billion in OI, followed by Binance with $12.41 billion, Bybit with $7.41 billion, Gate.io with $7.07 billion, and OKX with $4.6 billion. Hyperliquid recorded the highest 24-hour open interest growth at +30.21%, followed by MEXC with +10.63% and BitMEX with +8.13%.

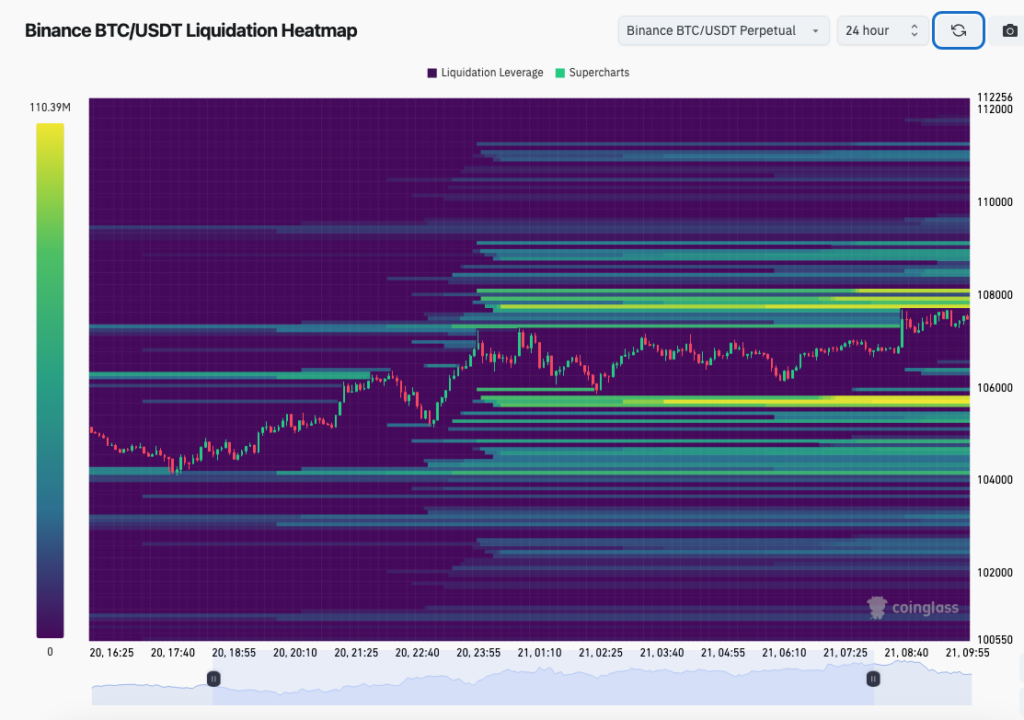

Within this highly leveraged environment, the potential for bearish liquidations — specifically of short positions—becomes a powerful force that could propel BTC to new highs.

Looking at the latest BTC/USDT liquidation heatmap reveals substantial clusters of short liquidations above the current price range, particularly concentrated around the $108K level. The heatmap also shows additional liquidity bands above $110K, suggesting that if the initial $108K is cleared, even more aggressive liquidations could be set off, further intensifying bullish momentum.

At press time, Bitcoin price hovers at $106.5K. It has been struggling to close above $107K, but yesterday it wicked as high as $107,307. If $108K level is broken, the next significant psychological level is $110K, which Arthur Hayes considers the critical threshold for the next leg up.

According to Hayes, BTC price must break above $110K and push toward $150–$200K to spark a true altcoin season. He sees this breakout potentially materializing by early Q3, fueled by rising liquidity and trading volume.