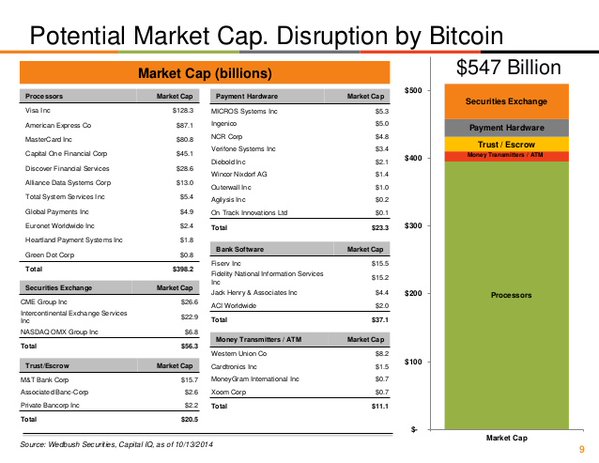

Bitcoin Has Potential to Disrupt a $547 Billion Market

Recently, Bitcoin has been described as the “copper of the Internet,” which operates as the foundation of peer-to-peer transactions and decentralized settlements. An increasing number of banks are embracing the technology behind Bitcoin, the distributed ledger technology to reduce banking and IT management costs which add up to billions of dollars every year.

Leading financial networks and remittance outlets have also begun to recognize the potential of Bitcoin and its inevitable disruption of the conventional finance sector. Visa for example, an American multinational services corporation and operator of the largest payment network in the world today, stated that the Bitcoin blockchain has become a technology which the financial industry cannot live without.

“2015 has turned blockchain into something the industry has to live with. It is no longer a choice anymore. Recent news speculating about the identity of its creator and the formalization of virtual money as a commodity, just makes it more real than ever before,” said the Visa team.

One significant feature of the Bitcoin blockchain technology is its ability to process irrefutable and unalterable transactions at a negligible cost. Since the transactions on the blockchain network are settled and processed by miners contributing their computing power and bandwidth in a decentralized protocol, the blockchain network eliminates the need for intermediaries and third party applications. Which essentially means, that most if not all transaction processors in existence will become redundant and ineffective.

According to an infographic provided by Bitcoin hardware wallet manufacturer Trezor, Bitcoin has the potential to disrupt a US$547 billion market. Interestingly, the market share of payment processors account for a staggering 73%, or US$398.2 billion.

As seen in the data chart above, market cap of credit card issuers and administrators such as Discover Financial Services and MasterCard Inc totals around $300 billion USD. However, these networks on average can take between three working days to two weeks for domestic and international transactions, which is inefficiecnt for both large and small payment settlements alike. Furthermore, credit cards and financial platforms like PayPal charge from 3% to 10% in transaction and conversion fees, which most individuals in developing countries can’t afford.

Experts also predict that the Bitcoin blockchain will capitalize on the limitation of the trust and escrow market which accounts for over $20.5 billion USD of the entire market cap. Financial institutions, trading platforms, and e-commerce applications require the presence of a trusted party or a mediator to resolve a dispute on a fiat currency-based platform.

Some of the built-in functions and features of the Bitcoin network, like multisignature technology, act as autonomous and cost-less mediators by disbursing funds once both parties confirm the successful completion of an agreement. For example, e-commerce platforms strictly require the integration of a third-party application to resolve disputes between buyers and sellers. If the buyer receives a damaged product or poor service, the mediator can interrupt and reimburse the funds of the buyer.

However, the traditional method of third party-based escrow systems cost e-commerce networks and payment processors millions of dollars annually, with added IT management costs. Bitcoin’s multisignature technology, however, allows buyers to sent the payment once they confirm the quality of the product or service. Since the payment of the buyer is deposited in the multisignature wallet which involves the seller and possibly the e-commerce platform, it is much simpler either to process the payment or to reimburse the transaction.