Bitcoin is a distinct asset class, diverges with gold

A finding by analyst James V. Straten and shared on Reddit on July 21 determined that Bitcoin is a distinct asset class and does not exhibit significant correlations with equities and most traditional trading instruments. However, it is highly correlated with Ethereum and diverges with gold.

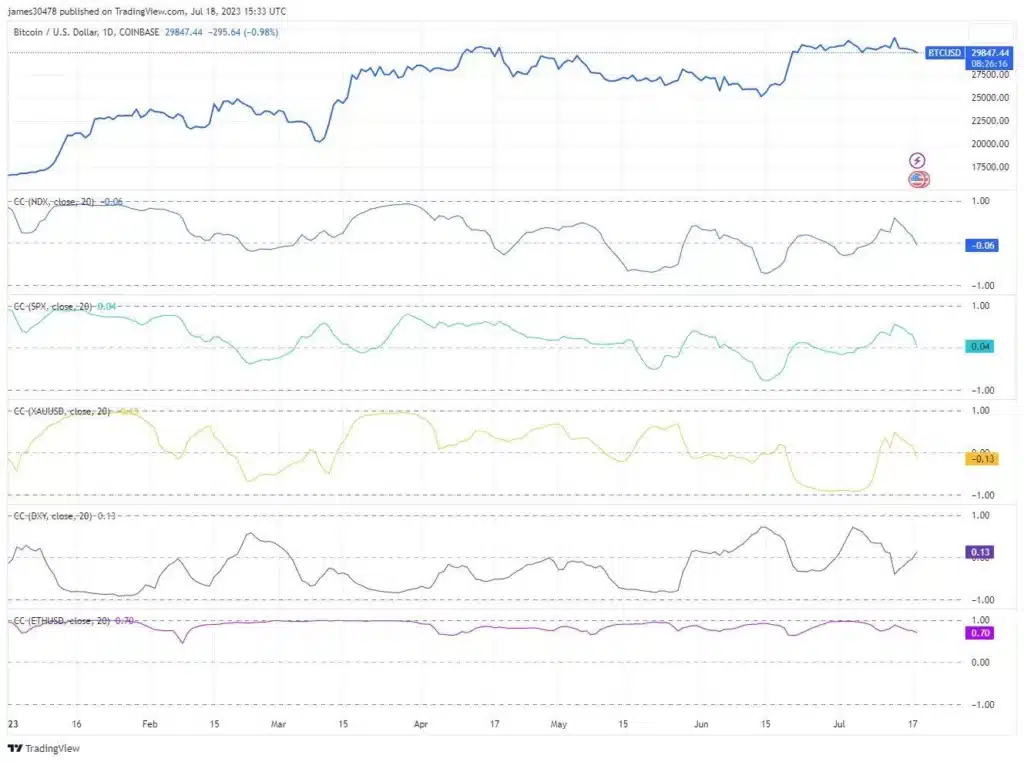

Data shows that S&P 500 and gold diverge with Bitcoin with a correlation of -0.05 and -0.12, respectively. Meanwhile, the greenback and Nasdaq slightly moved in sync with the king of crypto since their correlation figures stood at 0.04 and 0.12, respectively. Notably, Bitcoin and Ethereum have the highest positive correlation at 0.70.

Overall, the study’s results suggest that Bitcoin is a distinct asset class since its correlations with major traditional financial assets are generally weak or negligible. This independent nature suggests that Bitcoin’s performance may, under ordinary market conditions, not be significantly influenced by the volatility of other assets, especially in traditional finance, including stocks and precious metals.

The decrease in correlation is seen as a net positive for Bitcoin. Subsequently, this may make Bitcoin a more appealing investment option for those seeking portfolio diversification.

The bitcoin-equities correlation might continue falling in the coming months, considering recent developments in the crypto sphere. For example, the recent spot Bitcoin ETF filings by major financial institutions like BlackRock and Fidelity, have sparked optimism and increased investor interest in Bitcoin.

Although the United States Securities and Exchange Commission (SEC) has been cautious and has yet to approve a spot Bitcoin ETF, the community is overly upbeat that there have been improvements, and the regulator could eventually green-light one.

Approving this crypto derivative will likely support Bitcoin prices as institutions would have a means of diversifying into the world’s most liquid crypto asset, finding exposure for potential high growth in months ahead.

Despite the positive outlook for Bitcoin due to reduced correlation, analysts remain cautious about potential macroeconomic factors that could impact prices, such as monetary policy changes as seen throughout 2022 and the better half of 2021.

However, the long-term outlook for Bitcoin remains optimistic for now, given its deflationary nature and increasing adoption. In Q2 2024, the Bitcoin network will adjust its emissions, slashing miner rewards by half to 3.125 BTC, increasing the coin’s scarcity.