Bitcoin Miner’s Future Looks Bleak as Hash Rate Drops by 24% in Three Months

According to a report published by Bloomberg, November 26, 2018, the Bitcoin Network’s hash rate has dropped by a whopping 24 percent from its ATH in late August 2018. This, in turn, could force many small and medium scale bitcoin miners to abandon their mining operations due to the inability to breakeven costs.

Falling Hash Rate Forces the Miners to Quit

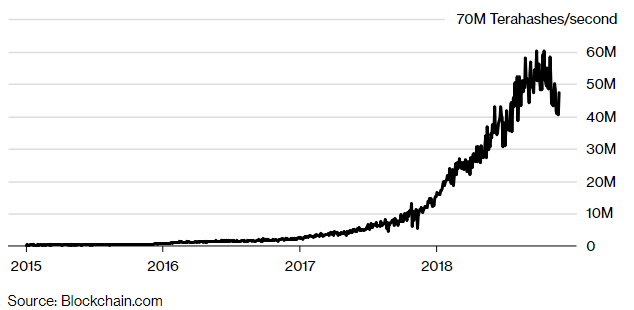

From the graph below, it can be inferred that the Bitcoin Network hash rate (a metric used to measure the computing power consumed while mining the cryptocurrency,) reached its peak of just above 60 million tera-hashes around August 2018.

For the uninitiated, a tera-hash is 1 trillion hashes or values generated by miners per second to solve a complex “proof of work” problem and earn bitcoin.

The rising tail prior to the peak is a testimony to the growing interest in mining bitcoin, which resulted in an influx of miners en masse, consequently increasing the hash rate of the network.

However, after reaching its peak, the Bitcoin Network hash rate has witnessed a downward trend ever since, just brushing the 40 million tera-hash rate in November 2018.

“This suggests that prices have declined to a point where mining is becoming uneconomical for some,” JPMorgan strategists led by Nikolaos Panigirtzoglou stated in a November 23 report, in reference to the falling hash rate.

Further, according to a recent report by Fundstrat Global Advisors, the breakeven cost of mining a single bitcoin using Bitmain’s Antminer S9 rig was estimated to be around $7000. This, of course, varies from place to place according to the rate of electricity, ease of mining, surrounding climatic conditions, and other factors.

Cause and Effect of the Falling Hash Rate

With regard to the possible reasons behind the falling hash rate, many believe the infamous November 15, Bitcoin Cash (BCH) hard-fork to be one of the prime culprits for it. The dramatic hard-fork forced many miners to switch to mining BCH in lieu of BTC.

Unsurprisingly enough, the hard-fork didn’t bode well for the global crypto markets, as the price of bitcoin and altcoins took a heavy beating from which they’re yet to recover. The premier cryptocurrency has fallen by as much as 30 percent since, while all the major altcoins are still reeling from the losses suffered, with no end in sight.

Notably, it is not only the miners who stand to lose due to the declining hash rate, as mining equipment manufacturing MNCs like Nvidia Corp. and Taiwan Semiconductor Manufacturing Co. have reported sluggish sales in their cryptocurrency business segment for Q3 2018.