Bitcoin mining: record-breaking in 2023, facing challenges in 2024

In 2023, Bitcoin miners saw a profit surge, yet challenges like the halving event loom over smaller players.

After facing a downturn in 2022, Bitcoin (BTC) miners reported healthy margins in 2023, especially those with access to inexpensive energy.

According to Compass Mining, companies like TeraWulf and Cipher Mining achieved gross margins exceeding 60%. On average, prominent mining companies reported margins of nearly 47% in the first quarter of 2023.

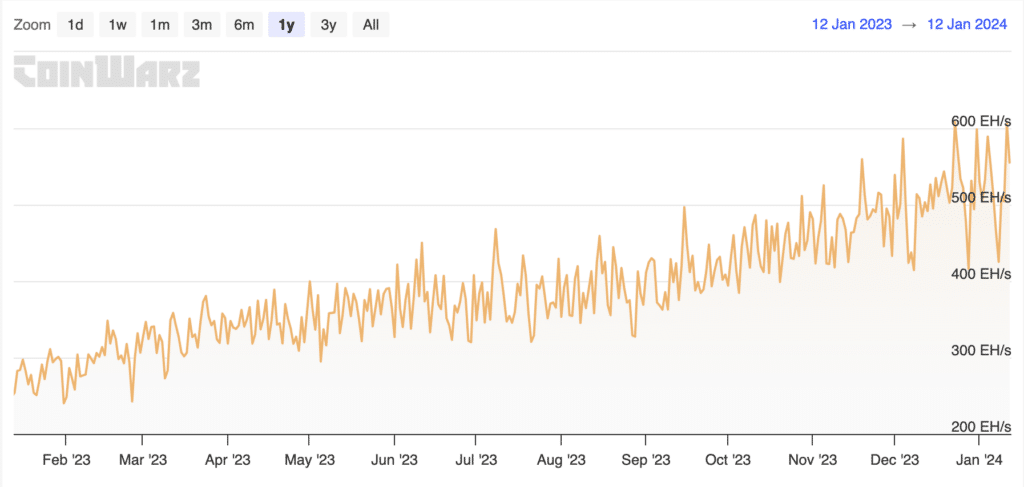

Concurrently, the Bitcoin network’s hashrate, a measure of its computing power, witnessed significant growth over the past couple of months, reflecting a bullish market cycle.

By Jan. 11, the hashrate surged to a lifetime high of almost 700 exahashes per second (EH/s), a considerable increase from 265 EH/s in Jan. 2023, signaling a more active and competitive mining landscape.

However, the industry also faces challenges. The anticipated Bitcoin halving event in April 2024, which will halve the block rewards from 6.25 to 3.125 Bitcoins, looms large. With fewer new Bitcoins rewarded for mining, miners may face challenges covering their operational costs, particularly if the Bitcoin price and transaction fees don’t rise proportionally. The reduction in rewards could lead to less efficient miners shutting down their operations, affecting the overall network. Smaller miners may need a price surge to maintain profitability.

The SEC’s approval of 11 spot BTC ETF applications on Jan. 10 has filled the crypto market with optimism. It is likely to affect Bitcoin prices and, consequently, mining profits. Let’s delve into these aspects to understand the future of Bitcoin mining better.

Bitcoin mining recap 2023

2023 emerged as a landmark period in Bitcoin mining, marked by several achievements and developments.

Record-breaking revenue and hashrate

Dec. 2023 stood out as the most rewarding month for Bitcoin miners since the market peak of Nov. 2021.

The mining rewards amassed 36,657 BTC, with a significant 21.75% originating from transaction fees, largely fueled by inscription activities.

This period also saw Bitcoin’s average market price stabilizing above $42,000, peaking at around $44,000. This market rally pushed the total mining revenue in Dec. 2023 over $1.5 billion, the highest since the $1.7 billion recorded in Nov. 2021.

Massive investment in mining infrastructure

In 2023, a milestone was achieved in the average monthly hashrate, surpassing 500 EH/s for the first time. This surge in hashrate indicates a substantial investment in the mining sector.

An estimated $5 billion was invested in hardware, doubling the network’s hashrate from 250 EH/s in Q4 2022 to 507 EH/s in Q4 2023. This investment was accompanied by a corresponding increase in power capacity, estimated at 5.5 gigawatts.

New corporate mining records

Large mining companies experienced strong success, with Marathon’s MaraPool mining 1,853 BTC from 221 blocks in Dec. 2023, a substantial increase from the 475 BTC in Dec. 2022.

There was also an impressive 18% month-over-month (MoM) increase in the average operational hash rate for Marathon Digital, reaching 22.4 EH/s, signaling a robust growth in mining efficiency and capacity.

Rising profitability and investments

Throughout 2023, miners enjoyed a 400% increase in average daily income from transaction fees, approximately $2 million per day.

According to a recent Messari report, BTC miners received substantial venture capital investments in Nov. 2023. Out of 98 crypto-related deals during that month, around 90%, totaling $1.75 billion, were directed towards Bitcoin miners.

This boost in profitability influenced Bitcoin’s market dynamics, as miners were less inclined to sell their holdings, thereby reducing the selling pressure on Bitcoin.

How did top crypto mining companies fare in 2023?

Core Scientific (CORZQ)

Core Scientific had a productive 2023, generating 1,177 Bitcoin in Dec. 2023 alone and a total of 13,762 Bitcoin throughout 2023.

This was achieved through an increased operational hash rate of 16.9 EH/s. Their revenue in Dec. soared to $49.7 million, a 38% increase from Nov., attributed to enhanced mining rewards and an uptick in Bitcoin’s price.

Riot Platform (RIOT)

Riot Platforms witnessed an increase in production in Dec. 2023, producing 619 Bitcoin at a daily rate of 20 BTC, marking a 35% increase from Nov.

Despite a better performance in Dec., the company’s effective utilization rate was 69%, raising questions about the lower mining performance compared to peers.

Riot Platforms is also advancing the development of its Corsicana Facility in Texas, aiming to elevate its self-mining hash rate to 28 EH/s by the end of 2024.

Bitdeer (BTDR)

Bitdeer’s Dec. 2023 performance was also notable, yielding 434 BTC, a 149.4% increase from Dec. 2022.

This surge in productivity was achieved despite a decrease in operational hash rate to 6.7 EH/s, owing to the retirement of 6,000 legacy mining machines.

The company’s strategic expansion for coming years includes constructing a 175MW immersion cooling data center in Norway and a 221MW data center in Ohio, with both projects slated for completion in 2025.

CleanSpark (CLSK)

CleanSpark witnessed strong growth in 2023, mining a total of 7,391 BTC. Their strategy heavily leaned towards “holding,” resulting in a Bitcoin reserve increase of 3,002 BTC, valued at approximately $126.9 million by the end of Dec. 2023.

In Dec. alone, CleanSpark mined 720 Bitcoins, maintaining an operational hash rate of 10.08 EH/s with a 99% utilization.

Hive Digital (HIVE)

Hive Digital experienced a slight reduction in their daily mining rate in Dec. 2023, mining a total of 282.8 Bitcoin at a rate of 9.1 BTC per day.

Despite this, their self-mining revenues increased by 15% to $12 million in December, bolstered by higher Bitcoin rewards and a rise in Bitcoin’s price.

Hive Digital sold 203 Bitcoin, which constituted 72% of their monthly production, and added 80 BTC to their “hodl,” totaling 1,707 BTC valued at $72.1 million as of the end of Dec.

Crypto mining in 2024: major players brace for halving

The SEC’s approval of spot Bitcoin ETFs on Jan. 10 could significantly affect Bitcoin’s market dynamics.

Larry Fink, CEO of BlackRock, highlighted Bitcoin ETFs as a game-changer for the finance industry, indicating a substantial interest from mainstream financial sectors.

Moreover, this development could introduce considerable capital into the Bitcoin market. Analysts have predicted that the approval could lead to upwards of $50 – $100 billion flowing into Bitcoin ETFs in the U.S. alone, potentially increasing BTC’s market value.

In the context of Bitcoin mining, an increase in Bitcoin’s market price, partly fueled by the influx of capital from ETFs, could positively impact miners’ profitability.

This is particularly relevant as the Bitcoin mining community braces for the halving event in 2024, which will reduce the block reward from 6.25 to 3.125 Bitcoins. Historically, halving events have led to an increase in Bitcoin’s price due to reduced supply growth.

In preparation for the 2024 Bitcoin halving, miners are strategically adapting. Key steps include upgrading to the latest, most efficient mining hardware, like the Antminer S19 XP, to maximize hash rate efficiency.

They’re also investing in sustainable and cheaper energy sources, crucial for profitability as block rewards drop. Additionally, miners are building cash reserves and diversifying into high-performance computing and cloud services, ensuring financial stability and operational resilience in the face of reduced mining rewards.