Bitcoin mining stock analyst discusses ‘Trump Bump’

Analysts from H.C. Wainwright believe the market’s positive reaction to crypto suggests increased confidence in Republican presidential candidate Donald Trump’s election prospects.

This confidence comes because Trump is known for his pro-crypto stance, particularly his support for Bitcoin (BTC) mining in the U.S.

Following a failed assassination attempt on Trump during a campaign rally in Butler, Pennsylvania, on Saturday, July 13, Bitcoin and BTC mining stocks saw a notable surge. BTC rallied over 9% since the incident, reaching a high of approximately $63,790 on Monday, while mining stocks gained around 10% in Monday’s session.

“Many believe the tragic event immediately boosted Trump’s odds of winning the election in November, and given Trump is widely viewed as the pro-crypto candidate, who has come out and publicly supported Bitcoin mining in the U.S., the markets rallied following the failed attempt,” wrote Mike Colonnese, CFA.

Selling pressure

This price boost coincides with the end of selling pressure from the German government, which liquidated its remaining 50,000 BTC seized from the Movie2k case. The overhang on BTC prices was alleviated, with U.S. spot BTC ETFs seeing over $1 billion in net inflows last week, acquiring over 18,000 BTC.

Furthermore, high on-chain selling pressure was partially due to the commencement of long-awaited Mt. Gox repayments. In 2010, Mt. Gox became the world’s largest Bitcoin exchange but faced a significant setback in 2014 when it halted trading, filed for bankruptcy, and disclosed the loss of approximately 850,000 BTC due to thefts. Recently, the movement of 47,228 BTC from a Mt. Gox-associated cold wallet has triggered market reactions, while miners’ selling pressure continues to affect prices following a recent halving that reduced mining rewards by 50%.

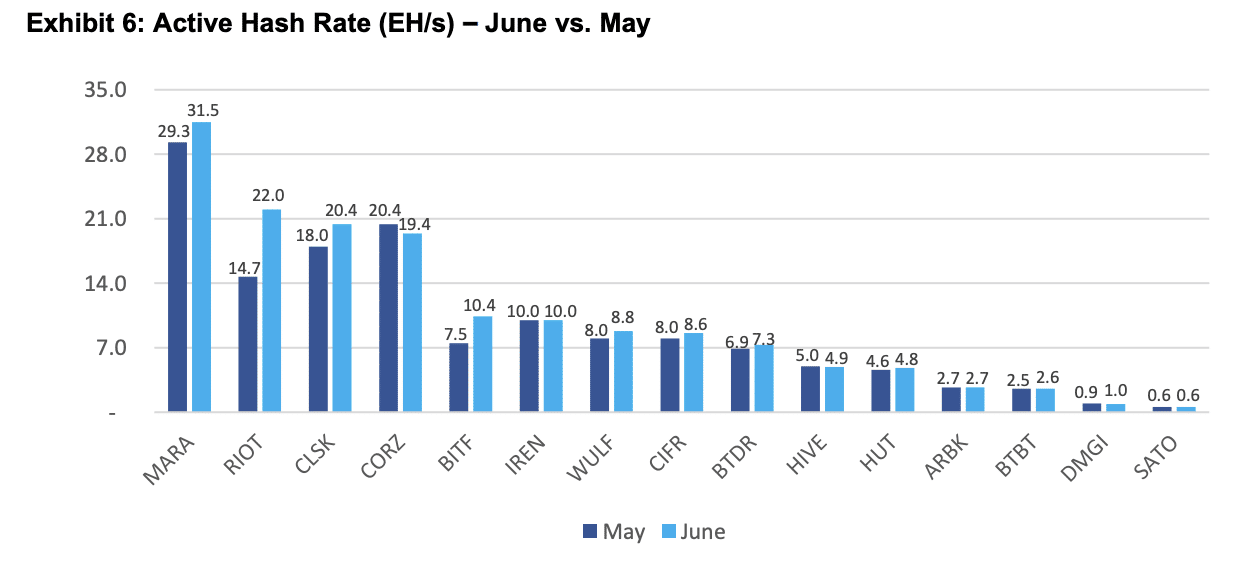

Increased hash rate

In the week ending July 7, BTC rallied 8.7% to $61,015, outperforming broader equity indices. The network hash rate increased by 2.7% to 598 EH/s, while network difficulty remained at 79.5T following a 5% adjustment on July 4.

Higher BTC prices compensated for lower transaction fees, raising hash prices by 5.2% to $0.049/TH/day, regaining the $0.05/TH/day mark for the first time in three weeks.