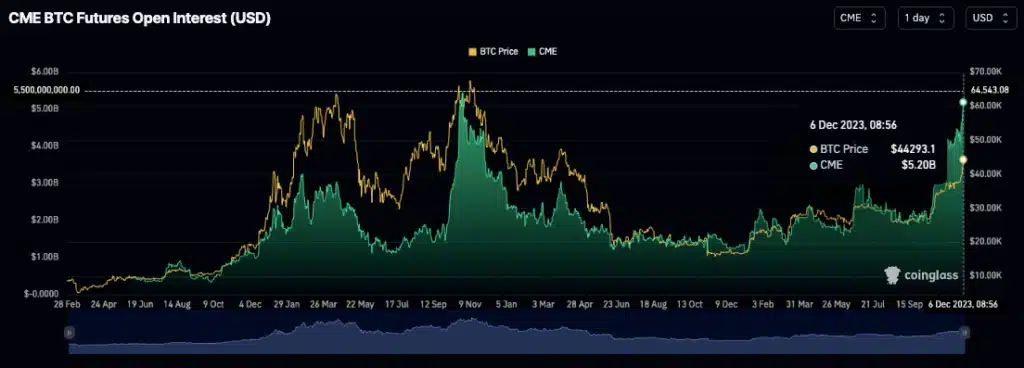

Bitcoin OI inches towards 2021 ATH

Open interest (OI) in Bitcoin futures on the Chicago Mercantile Exchange (CME) has approached record highs not seen since October 2021.

Bitcoin’s (BTC) OI on the CME has risen to $5.2 billion, just $200 million less than the ATH hit in Oct. 2021 when the price of a single BTC neared $69,000. The recent surge in OI has paralleled Bitcoin’s 26% rise over the last several months, with the price of the cryptocurrency now trading at just below $44,000.

Open Interest is a concept borrowed from traditional financial markets, and in crypto, it’s used to describe the total number of outstanding derivative contracts, such as futures or options, that have not been settled.

The active phase of new growth in OI also parallels approval of a spot Bitcoin ETF in the U.S., and the approaching halving of the total supply of BTC, an event that sees the supply of BTC available to miners decrease by half.

Today as large financial institutions have reportedly launced applications for their own Bitcoin ETFs (by some estimates as many as nine financial institutions have put in applications), the SEC is expected to approve the bulk of them at once sometime in early Q1 2024. According to CryptoQuant analysts, if issuers invest 1% of their assets in these ETFs, the price of one Bitcoin could rise to as much as $50,000-70,000.

In November 2023, the CME also overtook Binance as leading Bitcoin futures exchange, a shift analysts say marks renewed institutional interest in cryptocurrency as an asset class by traditional finance.