Bitcoin or Gold for 2017?

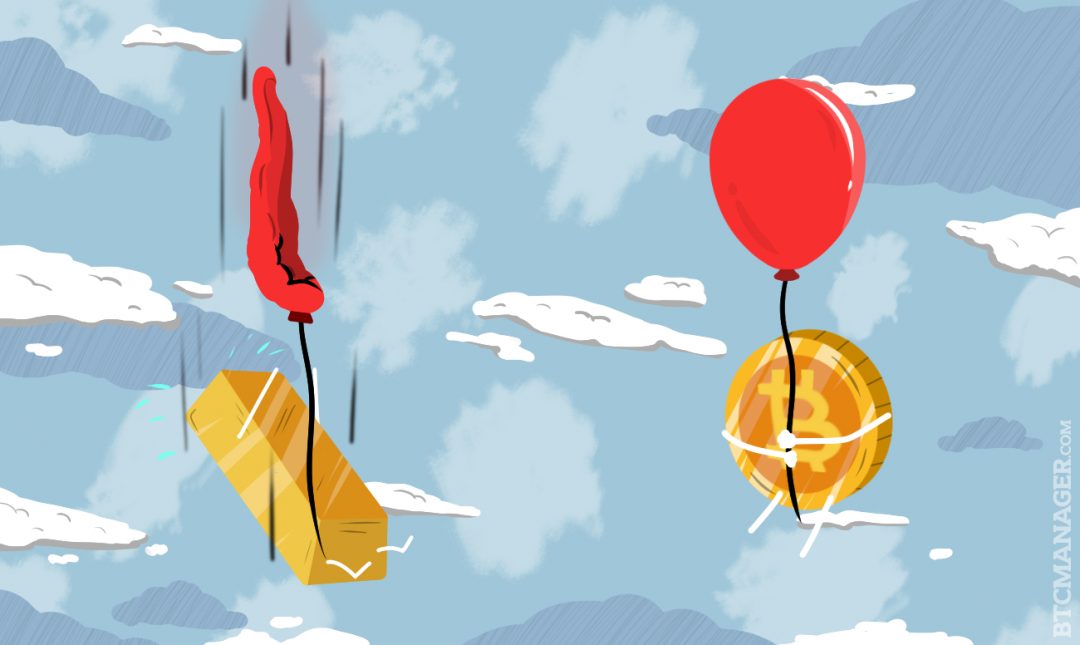

For many people, 2016 is a year they would rather forget. But for some investors Bitcoin’s steady rise, in response to 2016’s political and financial surprises, suggests the cryptocurrency is poised to take the safe-haven mantle away from gold in 2017.

Whether it was the post-Brexit BTC-GBP prices helping the global value breach the psychological milestones of $800 and then $900 per coin, or most recently the response to India’s cash crusade; bitcoin’s value has increased in the second half of 2016. Gold’s price, however, has steadily fallen since the Summer.

The tale of these two assets seems to have gone in different directions ever since the short-lived ‘Trump pump‘ for both gold and bitcoin. While bitcoin recovered from the dip, after the preceding media hype and the quick spike in value, gold has continued to suffer.

Vinny Lingham, the founder of Civic.com, in his recent post ‘Bitcoin 2017: A Currency Devaluation Hedge for Emerging Markets‘ explained that this divergence could be pinned on the idea that investors who have faith in gold are hedging against inflation and economic collapse. The Fed’s protection of the dollar, with Quantitative Easing and Interest Rate hikes, are preventing inflation in the US. As a result, gold has become overvalued, while:

“The recent Fed rate hike puts pressure on emerging market currencies, strengthens the dollar and in turn creates a surge in the forex/BTC trading price. This in turn creates additional foreign buying and demand for Bitcoin as a forex hedge.”

When we consider the likelihood that Trump will continue the US’s efforts to bolster the dollar, it is not a giant leap of faith to side with Vinny’s prediction for a steady doubling or tripling in the value of bitcoin in 2017.

Previous performance is not a guarantee of future success, so what other reasons might help persuade a long-term investor to convert their savings into a relatively brand new cryptocurrency, instead of the ancient storage of value offered by the precious metal?

In a comparison made by precious metals asset firm, Roslan Capital – dissected on the Inflation Data blog – the three factors where Bitcoin seems to outperform gold are portability, divisibility, and security.

Portability

The superiority in the property of portability is a pretty straight forward win for Bitcoin. A Ledger Nano S fits into your pocket and can hold as much value as even Scrooge McDuck’s vault, although it does depend on how much you want to carry. For gold, $100,000 worth only weighs about five pounds, but it is still harder to take across international borders than any cryptocurrency.

Divisibility

A closer call, but still an advantage for bitcoin. The cryptocurrency is infinitesimally divisible, while gold in its physical form clearly has limits.

Security

The fungibility and liquidity of gold lead to some serious security issues. Whereas, if you are sensible, you can enjoy the in-built security of Bitcoin.

With all that in mind, let us hope for less turmoil in 2017 – wherever each of us chooses to store our long-term savings.