Bitcoin price rises as investors turn to self-custody

On-chain data shows that bitcoin (BTC) has entered the accumulation phase over the past few months despite the high price fluctuations.

According to data provided by Glassnode, the number of bitcoins on exchanges has been constantly falling since May and recently plunged to 2.2 million coins, marking a five-year low.

The BTC balance on exchanges is currently worth $69 billion. The movement shows that investors are transitioning their assets to non-custodial wallets, addressing long-term investments.

Moreover, according to Glassnode, the bitcoin balance on exchanges was at one of its highest points, around 3.2 million coins, in early 2020, when BTC was trading at $5,380.

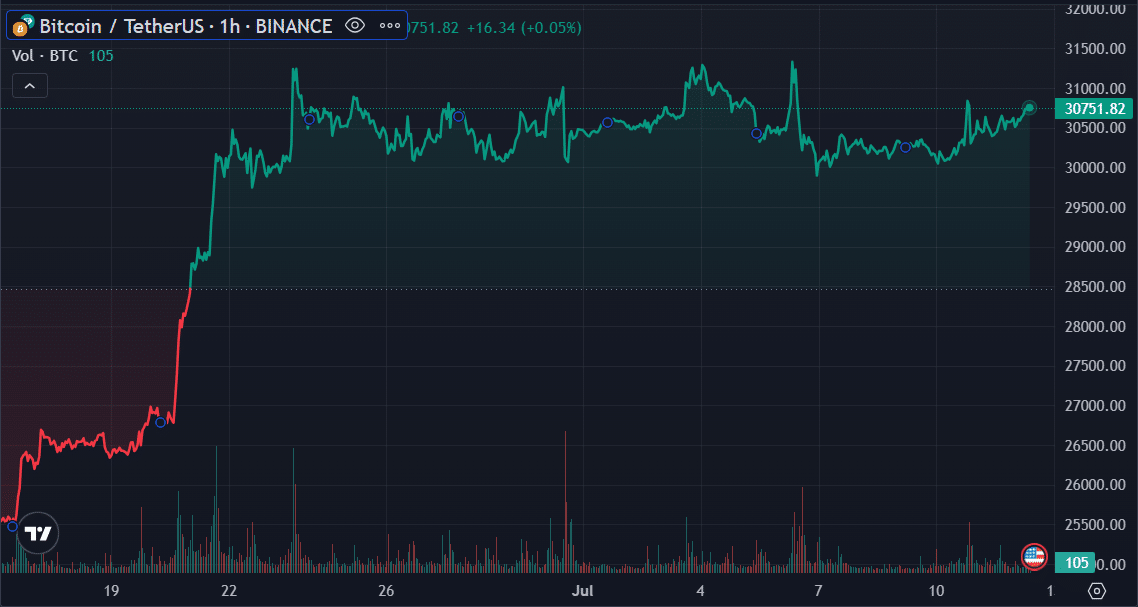

Bitcoin is up by 0.6% in the past 24 hours and trading at $30,700 at the time of writing. However, the asset’s 24-hour trading volume is down by more than 20%, standing at $11.8 billion with a total market capitalization of $596.8 billion — dominating 50% of the global crypto market value.

The digital gold has been consolidating between the $30,000 and $31,000 mark over the past three weeks after witnessing significant pressure in June.

Moreover, the accumulation phase comes as the number of new Bitcoin addresses hit a three-month high of 20,360.