Bitcoin rally expected to surpass $50k by 2024 due to halving event

Crypto analysts predict the upcoming bitcoin halving in April 2024 will drive the digital currency’s value past $50,000, building on its recent rebound.

The largest digital asset, bitcoin, has experienced a 67% increase since December 31, following an extreme downturn in 2022. Crypto analysts predict that the upcoming bitcoin halving, reducing the number of tokens miners receive for their work, will propel the cryptocurrency past $50,000 by April 2024.

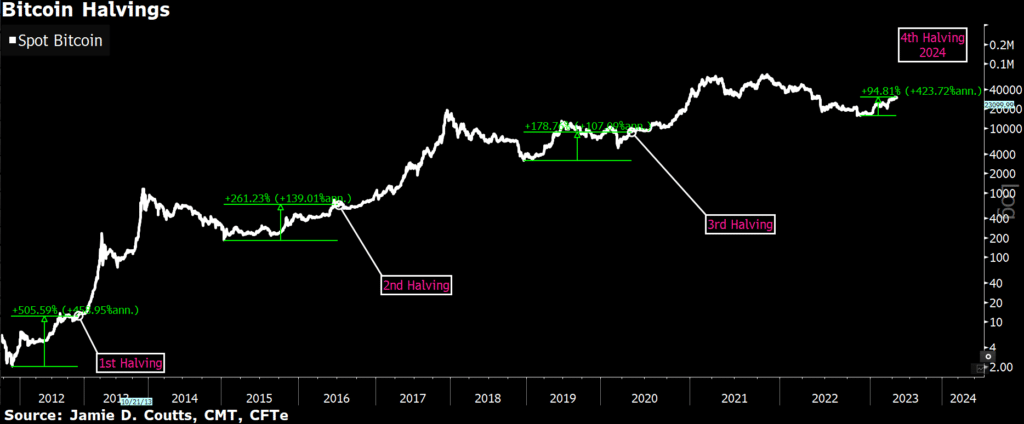

The halving event, scheduled for around April 2024, is integral in maintaining bitcoin’s supply cap at 21 million tokens. Historically, the cryptocurrency has hit record highs following the previous three halvings.

Jamie Douglas Coutts, a Bloomberg Intelligence analyst, states that the upcoming halving is approximately 50% priced based on previous cycles.

Coutts believes the current bitcoin cycle mirrors past ones, with the bottom occurring 12-18 months before the halving event. Despite a stronger network, bitcoin has not yet experienced a prolonged severe economic contraction.

However, the bitcoin rebound has recently slowed, impacted by reduced expectations of Federal Reserve interest-rate cuts due to ongoing inflation. Additionally, the US regulatory crackdown on cryptocurrency following the collapse of the FTX exchange in November 2022 poses a potential threat to the market outlook.

According to Jacob Joseph, an analyst at CCData, if the FTX collapse marked the bottom of the current cycle, there are still approximately 350 days of “accumulation” before the post-halving breakout. Markus Thielen, research head at Matrixport, projects bitcoin to reach around $65,623 by April 2024.

Despite these optimistic projections, bitcoin is still approximately $41,000 below its all-time high of nearly $69,000 in November 2021, which occurred 18 months after the 2020 halving.

Joseph of CCData suggests that although bitcoin may achieve a new all-time high, it is unlikely to experience the same growth as previous cycles due to increased market size and competition from other digital assets.

On April 25, bitcoin’s value decreased slightly to $27,260. At the same time, other cryptocurrencies like ethereum, cardano, and solana also experienced modest gains at the beginning of the trading week in the Asia-Pacific region.