Bitcoin trades at a $600 premium on Binance.US exchange

Days after Binance Global, the world’s largest cryptocurrency exchange by client count, briefly suspended bitcoin (BTC) withdrawals, statistics show that its US arm, Binance.US, sold the coin at a premium on May 9.

The bitcoin premium

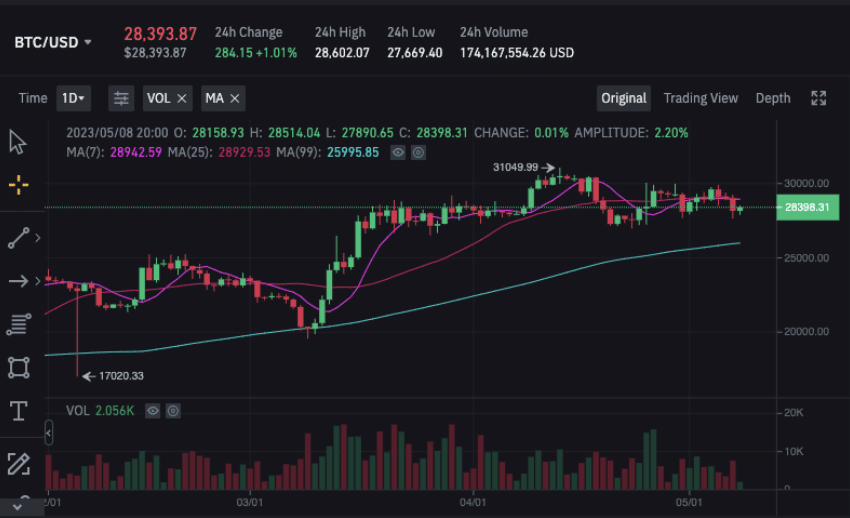

At 09:26 UTC on May 9, the BTC/USD pair traded at a $600 premium, significantly increasing from the $20 premium seen at the end of April.

A premium in crypto trading occurs when a given pair trades at different prices across centralized exchanges. There could be various reasons determining the size of the divergence, with liquidity a significant factor.

Intraday trading data also shows that Binance.US traded BTC at a significant premium compared to its market price. Specifically, bitcoin reached highs of $28,600 on Binance.US versus $28,004 on Binance Global and other major centralized exchanges. Meanwhile, the coin’s low fluctuated between $27,350 and $27,669.

On May 7, Binance Global temporarily halted bitcoin withdrawals citing mempool congestion and rising fees.

The 1-hr BTC withdrawal suspension window proved inconvenient for users.

Responding to a deluge of criticism, Binance’s CEO Changpeng Zhao said that though the exchange was resuming normalcy, they were also considering integrating the Bitcoin Lightning Network, a layer-2 platform allowing for the instantaneous settlement of BTC.