Bitcoin’s massive rally wiped out $6b in short positions in 2023

Short sellers in the cryptocurrency industry have faced losses exceeding $6 billion this year, primarily due to Bitcoin’s (BTC) remarkable rally since the start of January.

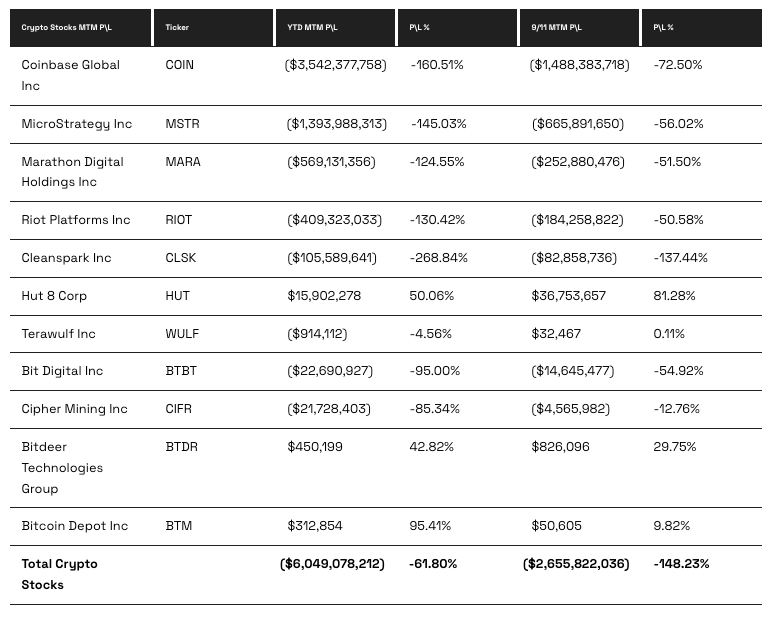

A Dec. 5 report by S3 Partners reveals that traders who took short positions against publicly listed cryptocurrency companies like Coinbase, MicroStrategy, and Marathon Digital are currently facing on-paper losses amounting to $6.05 billion.

Most of these losses have occurred in the past three months during a period marked by a dramatic turnaround in Bitcoin’s value, the report goes on to state.

After Bitcoin dropped to a quarterly low of $25,133 in September 2023, short sellers increased their positions, anticipating a downturn in what they perceived as an overbought sector.

However, contrary to their expectations, Bitcoin experienced a significant surge, recording a 76% increase and reaching a new yearly high of $44,345 on Dec. 5, according to CoinMarketCap. This unexpected rally resulted in approximately $2.65 billion in losses for short sellers.

Ihor Dusaniwsky, S3’s managing director of predictive analytics, noted that the buying-to-cover in heavily shorted crypto stocks coupled with long buying has been pushing stock prices upwards since late October.

The year-to-date rally of Bitcoin stands at 161%, which analysts believe has been a key factor driving up the share prices of crypto firms. Coinbase and MicroStrategy, for instance, have seen their values increase by 312% and 285%, respectively, within this time frame.

At the time of writing Bitcoin is trading at $43,935, with its recent surge partly attributed to the growing anticipation of a potential spot Bitcoin ETF approval in January.

Coinbase has been particularly impactful in the losses incurred by short sellers, with its 290% rally this year contributing to about $3.5 billion of the total losses. MicroStrategy’s more than 300% increase in stock value has added a further $1.4 billion to the losses.

Despite these setbacks, some short sellers continue to invest in these contrarian trades, hoping that the rally will lose momentum. Since mid-September, there has been nearly $700 million in new short selling.

However, if Bitcoin maintains its upward trajectory, this trend might reverse, adding to the approximately $2.2 billion of short covering observed in the sector this year.

“Investors looking for crypto exposure can now pick between the actual crypto-currencies or crypto stocks – if the recent momentum continues, both look to outperform the market.”

Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners