Bitcoin’s SOPR ratio suggests strong interest as price recovers

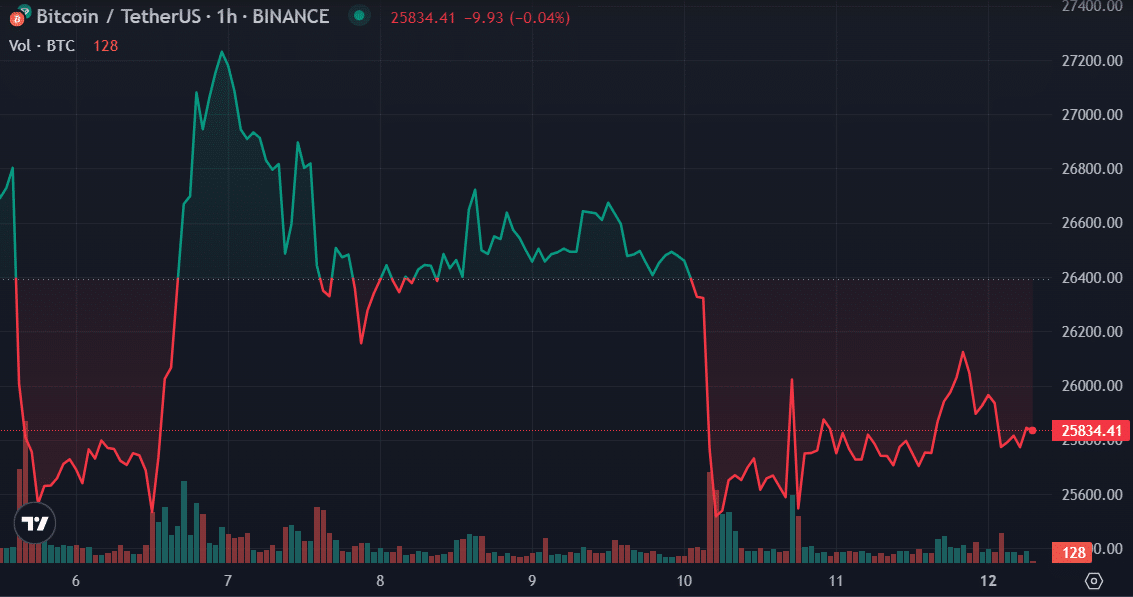

Bitcoin’s (BTC) price witnessed an instant fall on June 5, as the US Securities and Exchange Commission (SEC) decided to take legal action against Binance and Coinbase.

The asset’s price fell from around $26,800 to $25,500 within 18 hours after the SEC’s legal case against the exchanges.

A day after, however, the broader crypto market witnessed a recovery, and bitcoin consolidated over the $26,000 mark until June 10. As the bearish sentiment grew, the asset’s price dropped to a local bottom of $25,675 yesterday.

BTC’s spent output profit ratio (SOPR) suggests that the market might still be gaining profitability as the ratio has been staying above the 1 mark since late March. According to an analysis by CryptoQuant, the current SOPR position is almost the same as the strong bull runs in 2015 and 2019 — when the SOPR ratio stayed above 1 for at least 3 consecutive months.

Moreover, the analysis suggests that another steady bull run might be on the way as there hasn’t been strong selling pressure at this price point.

Furthermore, on-chain data shows that investors have been trying to hold their bitcoins as the number of lost and HODLed coins just surpassed 7,749,322 BTC, worth more than $200 billion, marking a five-year high.

Bitcoin is up by 0.3% in the past 24 hours and currently trading at $25,850 at the time of writing. Its 24-hour trading volume, however, plunged by 21.6% and currently stands at $11.4 billion, showing lesser activity on the network.