BlackRock Bitcoin ETF hits record $788m daily net inflows

Bitcoin ETF investors parked a record amount of money into BlackRock’s fund on the day crypto’s leading token achieved a new all-time high before retracing up to 10%.

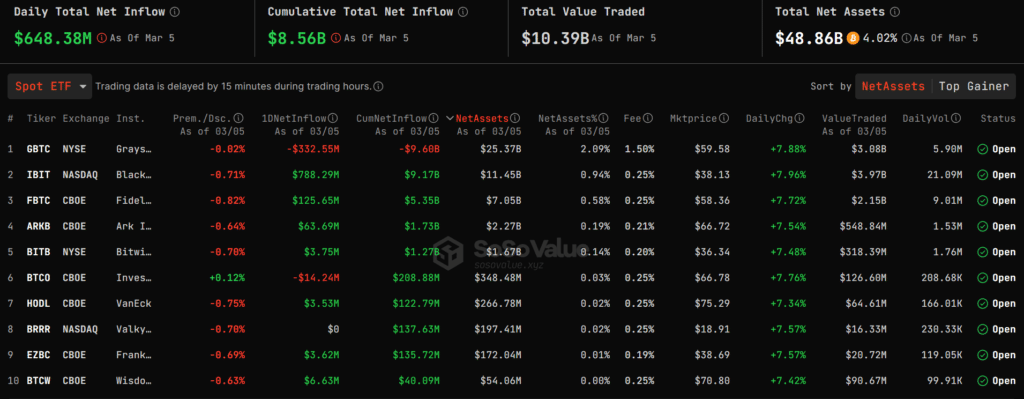

BlackRock’s iShares Bitcoin ETF (IBIT) received $788 million in net inflows on Mar. 5, setting a new historical high for daily influx into the investment vehicle as traders seemingly capitalized on a market dip.

According to SoSoValue, the IBIT ETF has seen over $9 billion in all-time inflows and commands nearly $12 billion in assets under management (AUM). The AUM is underpinned by over 183,000 Bitcoin (BTC) acquired by the asset manager since Jan. 11, when trading officially opened.

BlackRock’s largest daily inflow also signaled its biggest BTC scoop, acquiring nearly 12,600 Bitcoin in a single day. The previous highest purchase was on Feb. 28 when the Bitcoin ETF issuer bought over 10,140 BTC for its IBIT fund.

Per crypto.news, BlackRock plans to invest in more BTC ETFs through its Strategic Income Opportunities Fund. The Wall Street titan disclosed its intentions via a Mar. 4 filing with the U.S. SEC just days after announcing its Bitcoin ETF plans in Brazil.

Asset managers make U-turn on Bitcoin ETFs

As IBIT marked record inflows, Grayscale’s GBTC continued to experience outflows, as the converted ETF shed $332 million. All 10 spot BTC ETFs noted $648 million in net inflows, while investors have liquidated over $9 billion from GBTC.

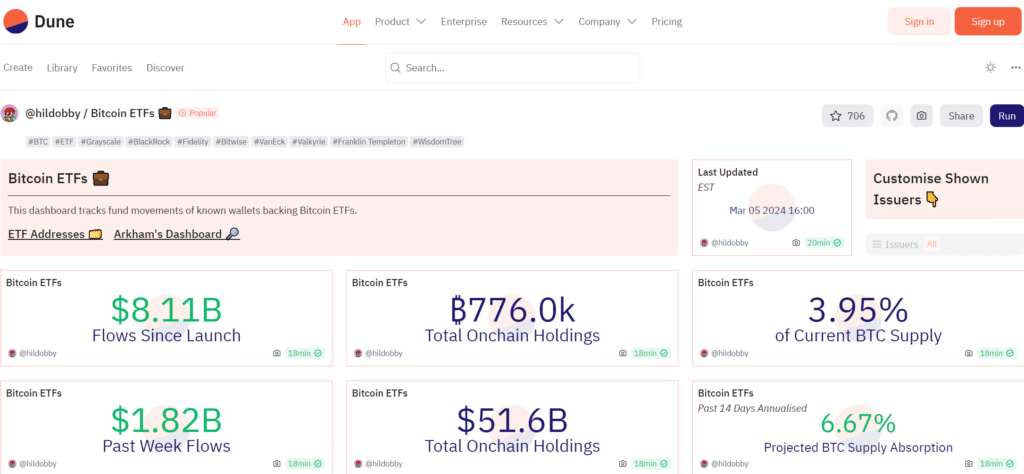

Other institutions have also started hopping on the BTC ETF bandwagon after the products have accumulated over $20 billion in AUM, excluding Grayscale’s GBTC. According to a Dune Analytics dashboard, spot Bitcoin ETFs account for almost 4% of BTC’s current supply.

Bank of America’s Merrill Lynch, Citi Bank, UBS, and Wells Fargo announced that, due to customer demand, select clients could purchase spot BTC ETFs. However, the legacy institutions initially shunned the product after the launch.