BlackRock’s IBIT leads spot Bitcoin ETFs with $14.7b in AUM

BlackRock spearheads proceedings with 203,754 BTC accumulated for investors in under three months as the Bitcoin ETF market expands.

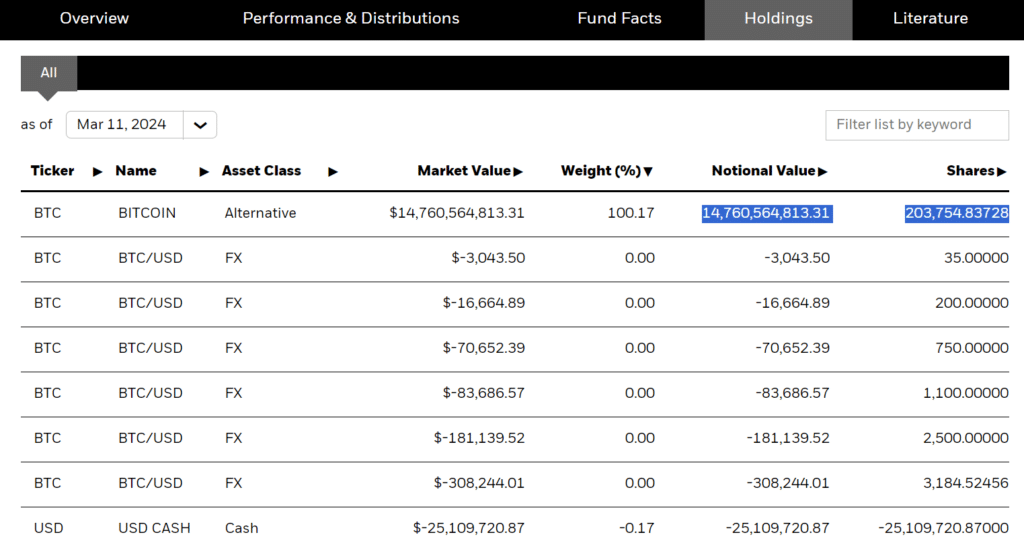

BlackRock’s iShares Bitcoin ETF (IBIT) boasts a notional value of $14.7 billion as of March 11, according to the asset manager’s official data updated on March 12. Excluding Grayscale’s converted GBTC ETF, this makes IBIT the largest Bitcoin (BTC) ETF among the nine new funds approved on Jan. 10 by the U.S. SEC.

The closest issuer to BlackRock was Fidelity’s FBTC, with $9.2 billion in assets under management (AUM) per SoSoValue analytics. Both issuers stand head and shoulders above the pack after amassing over $17 billion in cumulative net inflows from eligible investors.

BlackRock may hold the largest BTC stash of any new ETF issuer, but Michael Saylor’s MicroStrategy, which recently received a scoop, inched ahead of the company. The software maker owns 205,000 BTC.

Meanwhile, IBIT’s initial success has catalysized interest in more Bitcoin ETFs from the Larry Fink-led Wall Street stalwart. As crypto.news reported, the asset management giant sought SEC approval to purchase more spot BTC ETFs and include such investment vehicles in its Global Allocation Fund.

The company also expanded its BTC ETF footprint outside the U.S. to emerging markets in Latin America. BlackRock launched the iShares Bitcoin Trust ETF’s Depositary Receipts in conjunction with Brazil’s B3 stock exchange.

BlackRock’s spot Ethereum ETF uncertain

While IBIT’s issuer holds an impeccable record for successful applications with the SEC, analysts have surmised that its latest crypto venture may be subject to stiff opposition from the securities regulator.

Fink’s company and several other issuers filed for spot Ethereum (ETH) ETF shortly after making progress with the BTC counterpart. However, the SEC delayed approving or denying these filings until May.

Experts like Bloomberg’s Eric Balchunas and Variant Fund’s Jake Chervinsky predicted slim chances that the SEC will approve these products by the May deadline. A lack of dialogue between the SEC and issuers like BlackRock was highlighted as a major signal for this skepticism, although reports have suggested meetings should be held this month.