The Blockchain Meets the Energy Industry (Analysis of POWR, MWAT, WPR, and SLR)

Cryptocurrencies and the underlying blockchain technology have infiltrated the majority of businesses and industries. While we are still in the infancy stages of the blockchains implementation, clear niche markets in the sector are already beginning to develop. The energy industry is emerging as one of these markets waiting to reap the innovation’s benefits. The cryptocurrencies that will be highlighted in this report are Power Ledger (POWR), Restart Energy Democracy (MWAT), We Power (WPR), and SolarCoin (SLR). According to the author, MWAT stood out among the rest as the top cryptocurrency in this field.

Cryptocurrencies, the Blockchain, and the Power Industry

Blockchain technology allows individuals and businesses to transparently and securely track transactions on a public (or private) ledger. Bitcoin (BTC) was the first to reveal the power of the technology and intended on disrupting financial markets and centralized nature of global banking.

Since BTC’s arrival, there have been over 1,500 cryptocurrencies offering a multitude of different objectives. The purpose of blockchain technology in the power industry is to create a world where there is no reliance on sizeable centralized utility companies.

Many of the coins this report focuses on thus intend to revolutionize how the world consumes energy. The end goal is for creators of power, whether solar or any other form, to be able to transfer that energy to a neighbor without a go-between.

Last week the author wrote a report on how cryptocurrencies, and the technology behind them, can be invested in without actually buying cryptocurrency while also highlighting supply chain cryptocurrencies. The supply chain sector, for example, already has coins valued in the multiple billions of dollars.

The energy and power industry, on the other hand, has very few early entrants and boasts a cumulative market cap under $1 billion. The power industry similar to the supply chain sector can benefit from the transparency, security, ease of transferring, and minimal transaction costs associated with the blockchain.

Cryptocurrencies like POWR, MWAT, WPR, and SLR all intend to capitalize on the benefits the blockchain can bring to this industry. Further, it is likely each of these currencies has a strong 2018 as all have suffered significant losses in the last two months.

However, the author’s favorite Power Industry cryptocurrency when predicting future returns is MWAT.

POWR – Power Ledger

Power Ledger (POWR) is one of the largest cryptocurrencies in the energy sector. Their crypto is currently priced at $0.78, with a market cap $284 million. They were founded in May 2016 which makes them relatively old compared to many of the other cryptocurrencies on this list. When POWR began, they attempted to help solve three significant issues facing the global energy system.

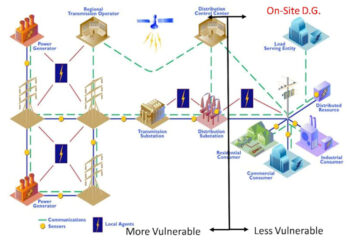

The first objective aimed to provide alternative energy to individuals living in high-density areas. Their second goal was to change electricity networks to create an incentive for the Decentralized Energy Resources (DERs).

(Source: US Department of Energy)

Their final goal was to mitigate the risk of connecting billions of dollars in network assets by using a secure decentralized blockchain. The last two years provided POWR the perfect opportunity to begin solving the problems plaguing the energy sector.

An Ambitious First Few Years

August 2016 was when POWR’s first major milestone was accomplished. It should also be noted that a significant advantage for Power Ledger is that the Australian government backs the firm. As such, they were able to develop and trial the country’s first energy trading blockchain.

Almost immediately after, POWR made headlines again by deploying a peer-to-peer blockchain energy trading platform in New Zealand. These two accomplishments put the energy company on the map as an active player in the energy sector with the support of a government that is continually dealing with power related difficulties.

The achievements did not cease there, and by the end of the second quarter of 2017, POWR had deployed a commercial energy management system. It explicitly allowed for the transparent distribution of locally generated renewable energy to tenants in multi-unit dwellings.

Instead of being required to purchase power from the monopolized electric companies, an individual now can buy their electricity from someone generating it locally. POWR specializes in renewable energies, so the voltage you are purchasing is guaranteed to be from wind, solar, etc. (renewable sources).

#Renewable #energy developers BCPG & Power Ledger have announced plans to introduce peer-to-peer renewable energy trading in Thailand. https://t.co/lx01LZMHs0#Blockchain #POWR #POWRtoken #btc pic.twitter.com/M86866ey0w

— Powerledger (@PowerLedger_io) December 23, 2017

POWR’s latest achievement is to enable vehicle charging stations across Australia. These charging stations would use solar power to charge themselves, and the user pays for the ability to access the charging station temporarily. With more and more individuals purchasing electric vehicles but not wanting to pay for the expensive charging aparati that are required, pay to use charging stations should continue to increase in popularity.

POWR – Mass Adoption in Australia and A Great Safe Play

POWR is a unique cryptocurrency as very few have the adoption and public approval of major governments. Australia fully supports energy platform and hopes it will alleviate many of their ongoing power shortages.

Currently, POWR has person to person trading of renewable energies in Australia and New Zealand. They have charging stations popping up across Australia and have plans to expand further. With fully developed applications and many on the horizon, POWR looks to be the safest play in the long term for mass adoption as an entire country is already rallied behind it.

MWAT – ReStart Energy RED Platform

MWAT is a token design by ReStart Energy for the RED platform. ReStart Energy is the fastest growing private energy provider in the European Union. The firm is also officially licensed as an energy supplier for the continent.

2017 saw more than $20 million in revenue with 2018 expected to surpass $100 million. Across the European Union ReStart currently has 30,000 paying customers and a 400 percent yearly growth rate. ReStart Energy created the RED platform to trade the MWAT token.

Their ICO hit the hard cap very quickly on January 15, 2018, but since then their price has been pummeled by the market correction. MWAT currency is valued at $.06 per token with a market cap of $24 million. This cap is exceptionally low for what the MWAT token represents.

The MWAT token enables the trading and storage of energy in a virtual network. Each token is “backed” by an initial charge of 0.11kWh/token. Over time tokens accumulate more value as energy from producers drives their initial “charge.”

The capacity per token is set at one MWh/token once fully charged. This idea is fascinating and revolutionary to ponder. MWAT is attempting to create a system where you can bypass your local energy supplier and buy a cryptocurrency in exchange for power for your home or business. However, to be able to use the MWAT and trade it person to person a blockchain platform had to be created.

#Renewable #energy developers BCPG & Power Ledger have announced plans to introduce peer-to-peer renewable energy trading in Thailand. https://t.co/lx01LZMHs0#Blockchain #POWR #POWRtoken #btc pic.twitter.com/M86866ey0w

— Powerledger (@PowerLedger_io) December 23, 2017

The RED Platform

ReStart Energy decided to name their blockchain the RED Platform. What RED accomplishes is a global decentralized energy supply platform with p2p capabilities. This network enables consumers to buy energy from each other or directly from producers like ReStart.

The blockchain implements another level of transparency and security. By not having to transport that individual atom of energy through multiple middlemen and intermediaries the RED platform can save consumers well over 30 percent on energy costs. The savings the MWAT token provides the consumer will lead to mass adoption and the driving of the token’s value North.

ReStart Partners

Having a customer base of 30,000 individuals is impressive enough, but the fact that ReStart already has partnerships with one of Romania’s biggest grocer’s as their energy partner is an added benefit. The list of partners for ReStart include Profi, Valeo, and EuroGSM.

ReStart has developed 500 Megawatt (MW) renewable energy projects and, through their ICO, intends to tokenize the use of energy on the blockchain. An enormous customer base and fantastic partners in the European Union will lead MWAT well above their ICO price.

Real Energy and a Franchise

MWAT has two final points that not only make it unique but make it a long-term hold. Each token as mentioned earlier is backed by real energy which flies in the face of critics claims that most tokens have no value. BTC, for instance, has a base cost determined by how much electricity and computing power it takes to produce one.

MWAT currently holds the equivalent of 0.11 kWh peaking by 2023 (predicts ReStart). The tokens act like virtual batteries that can be sold on an exchange or transferred to your home to provide electricity.

Most coins have staking, or masternodes, or some form of adding value to long-term holders who purchase in mass quantities. MWAT is no different but once again adds a unique spin to holding large amounts of tokens.

10,000 tokens earns the holder a RED City Franchise, allowing them to sell energy in their city of residence. 100,000 tokens grants the holder a Red Regional Franchise, allowing them to sell energy in an entire region of their country of residence. 1,000,000 tokens allows the holder a Red Country Franchise, allowing them to sell energy in their whole country of residence.

10,000,000 tokens allows the holder a RED Master Franchise, allowing the token holder the exclusive rights to his or her country of residency and the option to create sub-franchises in that country.

The more MWAT you hold, the higher your geographic influence can be along with your ability to sell power to the masses.

MWAT Conclusion – The Highest Yielding Energy Cryptocurrency for 2018 is Here!

The RED platform needed to use the MWAT token, in your home or business, launches in April 2018 with the countrywide launch in Romania coming by August. Currently, MWAT is priced under their ICO price even though they are backed by a profiting, rapidly growing, private, European Union based energy supply company with many partners and customers.

Every aspect is there for MWAT to be as big if not bigger than POWR over the next year. If MWAT is 50 percent of POWR’s market cap by the year-end it will provide a 500 percent return. If MWAT rivals POWR, they will yield over 1,000 percent in 2018.

ReStart Energy has tokenized electricity in the MWAT cryptocurrency and can legally distribute power it in the European Union. Their platform is going live for individuals to use MWATs by the end of quarter three with major partnerships and revenue streams already in place. Expect MWAT to be one of the few real moon potentials for 2018.

WPR – WePower

Similarly, to MWAT, WePower (WPR) also recently finished their ICO. Their token, the WPR, is trading at $0.15 with a market cap $53 million. WPR is a green energy trading platform on the Ethereum Network. This means the tokens are ERC-20 which is convenient for transferring between wallets. The WPR platform helps green energy project developers to raise funds by allowing them to sell their energy directly to consumers by bypassing centralized energy companies.

By bypassing centralized energy companies, the consumer can pay a drastically reduced rate. This is beneficial for both producers of green energy and the consumers. The producer of the energy succeeds by not having to seek funding from venture capitalists or institutions at outlandish debt rates.

The consumer wins by having electricity in their home at a fraction of their previous cost. All these energy cryptocurrencies have many similarities but determining which one will have mass adoption is very important.

WPR intends to allow consumers to buy energy directly from renewable producers on a one kWh basis through smart contracts. This will enable global investment opportunities when green energy projects are presented while also increasing the existing market for consuming green energy.

22,933 people contributed to help us deliver our #mission of accelerating #RenewableEnergy #development and shifting the world towards a more #sustainable living. It is our time to now work even harder and deliver. #WePower #Blockchain #Tech #Energyhttps://t.co/iX2vC3rZu7

— WePower (@WePowerN) February 2, 2018

WePower’s Structure

WePower intends to act as an energy intermediary or an energy supplier of sorts. The firm’s platform connects to the energy grid and a local energy exchange market. The energy user also connects to this market, and all links in the chain are completed. When a renewable energy producer joins, future energy is tokenized based on kWh units.

Each internal energy token represents one kWh to be produced at a certain time in the future. This concept is fantastic as the consumer would not need additional equipment to pay energy bills besides being able to connect to the WePower market.

WPR tokens specifically allow for priority access to their holders for auctions of tokenized energy of future green energy plants. This allows token holders to purchase energy at the lowest initial price set by the producer. WPR is not used to pay for energy tokens.

WPR tokens are also rewarded in the form of dividends donated from producers at a 0.9 percent rate of total sales. This results in the WPR tokens accruing green energy over time and allowing them to sell or use the green energy once it’s produced and provided in a dividend. The idea seems solid, but who is the team behind the project?

An Impressive List of Team Members and Advisors

Although MWAT has more market traction, partnerships, and customers, the WePower team is definitely competing to be number one on this list.

Arturas Askavicius, the COO, has a legal background in crowdfunding and specializes in Fintech. Nikolaj Martyniuk, the CEO, has over ten years of experience in energy development and projects. David Allen Cohen, an award-winning energy advisor. Eyal Hertzog, an advisor, but also the co-founder of Bancor. Jon Matonis, an advisor and chairman of Globitex.

Liraz Siri, founder of SIRI for Apple (I’m just kidding, just checking to see if you were paying attention). Liraz is a security expert and co-founder of Turnkey Linux. This list of advisors and team members would be pleasing to see on any ICO page, especially one linked to energy production.

More Government Support from Australia and Lithuania

It seems POWR is not the only ICO in the energy world directly or indirectly supported by the Australian government. WPR joined Australia’s Startupbootcamp Energy Australia Accelerator (SBC). By investing in WPR, SBC was the first accelerator program to invest in a company doing an ICO.

#Startupbootcamp #Accelerator (SBC) chose us as one of 10 #energy companies for a prestigious #Australian energy track program! It is both a huge honour & achievement!

Thank you, @trevortownsend, @ruudhendrikstv, @Sbootcamp! #ICO #Blockchain #GreenEnergy https://t.co/zzjaPyHPaM— WePower (@WePowerN) December 13, 2017

WPR also has partnerships with Australian energy giant, Energy Australia.

The WPR project is sponsored by The Ministry of Energy of the Republic of Lithuania because of its likely positive impact on climate change. WPR is an innovative token that when clarified to the European regulator highlighted how it is structured as a reward based crowdfunding, where contributors are rewarded free energy to be used or sold in the future.

There are currently three partnerships to connect 1,000 MW capacity projects to the WPR network from Conquista Solar, Civitas, and Novocorex.

WPR Conclusion: Good but Not Great

WPR has a lot of potential, but their hiccup with European regulators and the token being a crowdfunding device seems to be a manipulative way around whatever it is they’re trying to accomplish. A major positive for WPR is their team as it is truly outstanding.

WPR’s government connections in Australia and Lithuania make it a very strong play as it is a rare find to see two governments actively interested in a single cryptocurrency.

Due to significant partnerships, an exceptional team and government support WPR should have an above average 2018. The author believes MWAT will outperform WPR and the other coins on this list, but if a second-place award were to be given, WPR would get the silver.

SLR – SolarCoin

SolarCoin (SLR) was launched in 2014 making it the oldest cryptocurrency on this list. A lack of market adoption and a shaky business model has, however, resulted in severe price fluctuations without ever gaining substantial traction. Currently, SLR is traded for$0.76 per token with a market cap of approximately $30 million. The concept was based on the idea of rewarding solar energy producers.

The basic idea indicates that If you have solar panels, you receive SLR as a “thank you” for being a good Samaritan. Think of it like miles for an airline company. By traveling you acquire them at no added cost to yourself. SLR provides tokens for free based on the amount of photovoltaic energy generated by the producer.

SolarCoin’s primary goal is to work as an incentive to reward the owner of solar photovoltaic systems in tokens. This stimulates the implementation of solar panels worldwide, accomplishing the introduction of renewable energy systems on a mass scale. Any owner of a solar installation may apply to claim their free SLR.

The form to sign up can be found on the company’s website. One SLR is provided per MWh of solar electricity generated. SLR coins are sent every six months based on solar energy produced.

SLR Conclusion – The Sun Faded on This One

An incentive to use solar panels? Paying the “dividend” once every six months? Initially very interesting, but If the market adoption has not taken place in the prior three years, it is unlikely to happen now. The other energy cryptocurrencies do everything from actually tokenizing power to having partnerships with governments and major energy producers.

SLR’s selling point is that they are an incentive for solar producers paid semi-annually? The energy cryptocurrency market is already beginning to be filled with great options, and SLR does not seem to be one of the better choices.

The Top Cryptocurrency for the Energy Sector: MWAT

MWAT has already tokenized electricity which creates an actual value associated with each token. This pegged amount increases over time ensuring the value is not diluted but similarly increases over time.

MWAT is supported by a functioning, profitable, rapidly growing, private energy firm in Europe with their network going live by the end of quarter three. MWAT’s shallow market cap along with a six-month roadmap makes it a moon candidate for 2018.

POWR has a market cap that is almost ten times the other coins on this list. Yes, it may yield high returns as the market rebounds. However, cryptocurrencies with smaller market caps and better business models should far exceed the profits of POWR from a percentage perspective.

Second place goes to WPR as their team is fantastic and they have the support of two government bodies. If their market cap was not 100 percent higher than MWAT and they were further along in their roadmap, they would have been a competitor for the number one spot on this list.

SLR has no business even competing with the other coins on this list as it is solely an “incentive” for solar producers. The author loves the idea of green energy and rewarding those that are genuinely using it.

However, few people are actually signed up to be rewarded with SLR. If the individuals that are supposed to be incentivized with SLR are using solar panels but do not care about the cryptocurrency, why should we? In three years the market adoption has been minimal, the author does not foresee 2018 changing SLR’s path much.

MWAT should be the top gainer for 2018 with WPR being a close second.

To read the King’s prior articles, to find out which ICOs he currently recommends, or to get in contact directly with the King, you can on Twitter (@JbtheCryptoKing) or Reddit (ICO updates and Daily Reports).