BNB overtakes Solana, traders betting against the surge

BNB’s recent surge helped it gain the fourth spot again, flipping Solana (SOL). However, traders are betting against BNB’s rally.

BNB is up by 10.4% in the past 24 hours and is trading at $322.75 at the time of writing. The asset’s market cap surged to $48.9 billion, making a $4.6 billion gap with Solana. BNB’s daily trading volume, however, recorded a 4% decline, dropping to $2 billion.

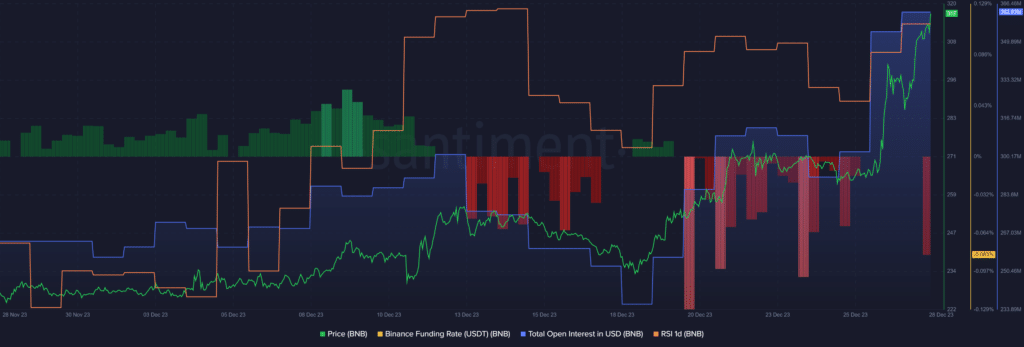

According to data provided by the market intelligence platform Santiment, BNB’s total open interest (OI) surged from $354 million to $362 million over the past 24 hours.

However, data shows that short-position holders are currently dominating BNB’s total OI. Per Santiment, BNB’s Binance funding rate stands at negative 0.08% at the time of writing.

This indicator suggests that a dominant number of traders are betting against BNB’s price hike, expecting a downward momentum again.

Moreover, data from Santiment shows that BNB’s Relative Strength Index (RSI) surged from 66 to 78.4 over the past three days. When the RSI rises, the indicator usually suggests the possibility of a price drop.

For BNB to stay bullish, the RSI indicator would need to stay below the 65 mark.

One of the major elements in BNB’s bearish expectations is Binance’s lawsuit in the United States.