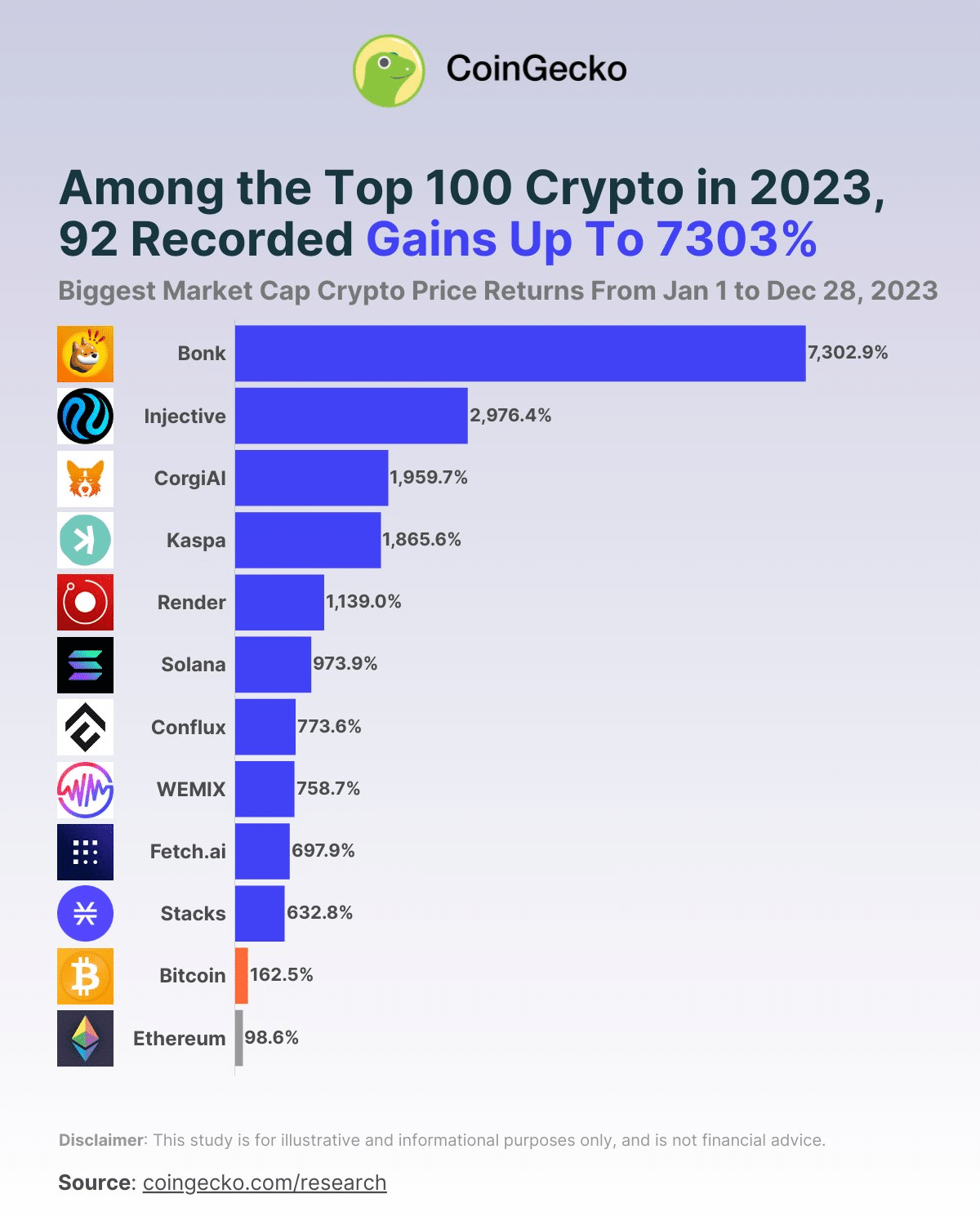

Bonk emerges as top crypto gainer in 2023 with staggering 7,302.9% gain

In a historic year marked by significant crypto market volatility, Bonk (BONK) emerged as 2023’s top gainer.

The meme coin skyrocketed by an astonishing 7,302.9% from $0.0000002 to $0.0000146.

Bonk’s remarkable surge was largely catalyzed by a strategic airdrop, according to CoinGecko, which captured the data in an end-year survey it shared on Dec. 29.

The airdrop drew widespread trader and investor attention, which also propelled Solana’s ecosystem back into the limelight.

Per CoinGecko’s data, Injective (INJ) followed closely, logging an impressive 2,976.4% increase, buoyed by the introduction of pre-launch token futures by its decentralized exchange, Helix.

Injective’s early-year establishment of a $150 million ecosystem fund aimed at accelerating the adoption of interoperable infrastructure and DeFi also played a crucial role in its success.

Meanwhile, CorgiAI (CORGIAI) emerged as the year’s third-largest crypto gainer, surging by 1,959.7%, driven primarily by its ascent as the main meme coin on the Cronos blockchain. The top 10 crypto gainers of 2023 all outperformed both Bitcoin (BTC) and Ethereum (ETH), often considered the industry’s gold standard.

Interestingly, these top performers were also strongly associated with the year’s most popular narratives, including meme coins, layer 1 protocols, artificial intelligence, and layer 2 solutions. According to analysts at CoinGecko, this indicates a correlation between market trends and their respective success.

Not all coins enjoyed such a bullish year, however. Eight out of the top 100 cryptocurrencies, including Tether (USDT), USD Coin (USDC), Dai (DAI), Binance USD (BUSD), TrueUSD (TUSD), Toncoin (TON), Chiliz (CHZ), and Sui (SUI), ended 2023 in the red.

Despite these laggards, Bitcoin still managed to outperform 65 tokens in the top 100, increasing by 162.5% from $16,540 to $43,418. Bitcoin’s growth was fueled by spot ETF applications from market giants like BlackRock and Fidelity, whose approval market observers believe could significantly boost its value in 2024.