Cameron Winklevoss says US may be left behind in next bull run

Gemini co-founder Cameron Winklevoss has said the United States risks being left behind in the next bull run if it doesn’t embrace crypto.

In a series of tweets he published on Feb. 19, Cameron Winklevoss predicted the next crypto bull run would start in the East and prove that digital assets are a global phenomenon.

Winklevoss lamented the United States’ inability to offer clear regulatory guidelines for the digital asset industry in the tweets. The crypto investor claimed governments that did not offer “clear rules and sincere guidelines” for the crypto sector could miss out on what he believes will be the most significant economic growth the world has witnessed since “the rise of the commercial internet.”

Winklevoss also suggested that the United States dithering stance on crypto regulations means that it is likely to miss out on being a “foundational part” of shaping and shepherding the future financial infrastructure, which he believes will be centered around crypto.

BTC records 50% hike to signal upcoming bull run

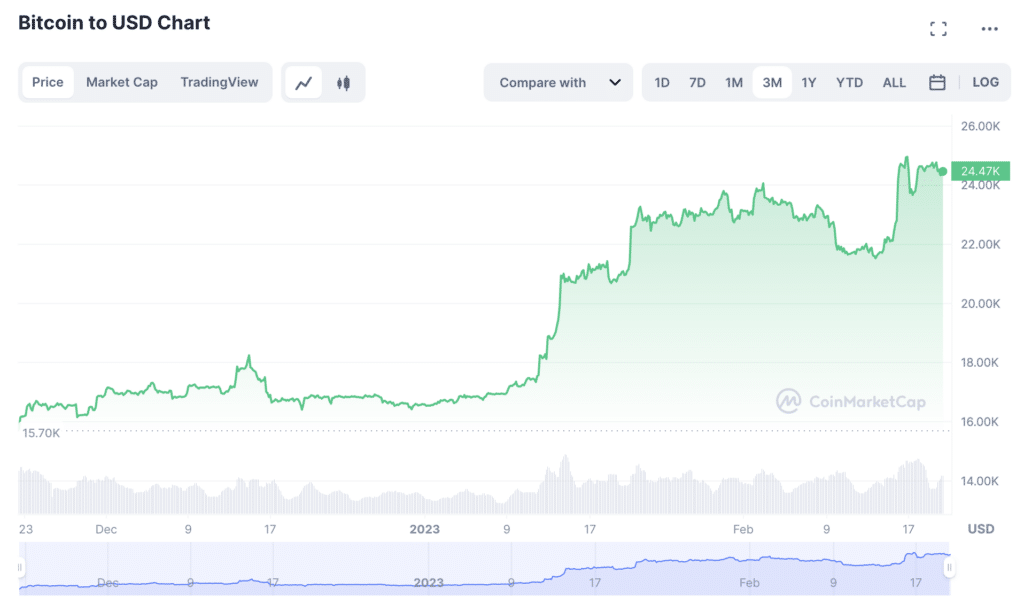

Winklevoss’s comments come in the wake of a dramatic rise in bitcoin to above $25,000. Analysts have argued that the cryptocurrency’s recent show of strength could indicate the market is preparing for a bull run in the foreseeable future. BTC hit a low of $15,599 in November 2022, but it has increased by about 50% since then.

However, crypto was going through a slight downturn at the time of this writing. As per CoinMarketCap, BTC’s value had dropped by 3.28% in the last 24 hours to trade at $23,930.25 after briefly surging past the $25,000 mark. Nonetheless, many market analysts have suggested that the bull market has started.

According to Cameron Winklevoss, the recent BTC price increase, especially following the FTX debacle that destabilized the industry, clearly shows that the sector was recovering and moving past that chapter.

Gemini in the clear

Cameron’s twin brother and fellow Gemini co-founder, Tyler Winklevoss, has suggested that if a proposed Securities and Exchange Commission (SEC) rule is approved, Gemini would be regarded as a qualified fiduciary custodian.

On Feb. 15, SEC chair Gary Gensler suggested including cryptocurrency exchanges in the federal custody laws. If Gensler’s proposal were to become law, crypto exchanges would need to separate their money from their customers’ funds and undergo more rigorous registration procedures to be recognized as qualified custodians. Per Tyler Winklevoss, Gemini already complies with capital requirements, anti-money laundering, and cybersecurity regulations.