Celsius demands billions of dollars from Tether: What’s going on

Bankrupt lending platform Celsius has filed a lawsuit against Tether seeking 39,542 BTC.

Table of Contents

According to the lawsuit, the amount was collateral for a loan from the issuer of the Tether (USDT) stablecoin. Tether requested more collateral after the price of Bitcoin (BTC) dropped in early 2022.

Celsius granted Tether‘s request, but the collateral was again threatened. The lawsuit says that while the lending platform was raising funds during the period specified in the contract, the USDT issuer liquidated the entire collateral within hours.

According to the lawsuit, “amidst the chaos,” on June 13, 2022, then-former Celsius CEO Alex Mashinsky allegedly permitted Tether to liquidate the collateral in an orderly manner. However, the platform noted that the lender never received written consent:

Tether’s efforts, of course, are now subject to intervening federal bankruptcy law. Thus, these preferential and fraudulent transfers of Bitcoin should be avoided, and the Bitcoin or its value should be recovered for the benefit of Celsius’s estate.

The company said that instead of providing additional collateral, Celsius instructed Tether to liquidate its Bitcoin collateral to close a position of approximately $815 million.

In addition to 39,542 BTC, Celsius demanded 15,658 BTC and 2,228 BTC, which it allegedly provided as additional collateral, for a total of 57,428 BTC.

Tether’s response

Commenting on the situation with Celsius, Tether CEO Paolo Ardoino noted that the entire process, from over-collateralization to margin call and liquidation, was carried out properly, as instructed by Celsius management.

According to him, in 2022, Tether provided USDT to some of its clients, including Celsius. Tether’s agreements with its customers are simple: Tether provides USDT to select customers who provide excess collateral in Bitcoin.

This complaint shows a lack of basic understanding of the concepts of market slippage, block liquidation and risk management. Very poor arguments made. Also the liquidation was directed by Celsius management team and agreed each step in the way.

He also reminded that Tether’s top priority remains the safety of USDT users. According to Ardoino, the company’s capital is $12 billion, so stablecoin holders will not be affected even in a worst-case scenario.

We, at Tether, have proven our resilience uncountable numbers of times in recent years. Bullying never scares us. We are very confident in being able to demonstrate the correctness of our actions in court.

What happened to the loan?

In 2020, Celsius entered into an agreement with Tether to borrow stablecoins USDT and EURT at low interest rates. At its peak, Celsius had over $2 billion in loans from Tether, secured by a significant amount of Bitcoin as collateral.

Amid the Bitcoin crash in mid-2022, the crypto lender’s collateral was at liquidation risk. According to the agreement, the company was required to provide additional collateral.

Celsius claims that Tether acted in bad faith by hastily liquidating a significant amount of cryptocurrency and breaching the terms of the agreement.

The document says this ultimately led to financial difficulties and bankruptcy for the company. Celsius’s lawsuit’s main goal is to return the Bitcoin assets, which the crypto lender claims were sold below market value and with numerous violations.

How did Celsius go bankrupt?

Celsius froze the withdrawal of client assets in June 2022. A month later, the company went bankrupt. According to several analysts, the crypto broker was experiencing liquidity problems. However, the company stated the opposite—allegedly, this measure was supposed to help “stabilize liquidity.”

At the end of January 2023, a forensic expert found that Celsius Network faced a shortage of stablecoins worth a billion U.S. dollars in May 2021. At the same time, the company did not notify clients or regulators about this until the bankruptcy itself but continued to advertise its services.

Celsius Network’s creditors revealed a reorganization plan for the company, which most account holders approved. In November 2023, the court approved Celsius’ restructuring plan. A few months later, the crypto lender announced that it had completed bankruptcy proceedings and intended to pay creditors $3 billion.

Celsius CEO blames prosecutors for collapse

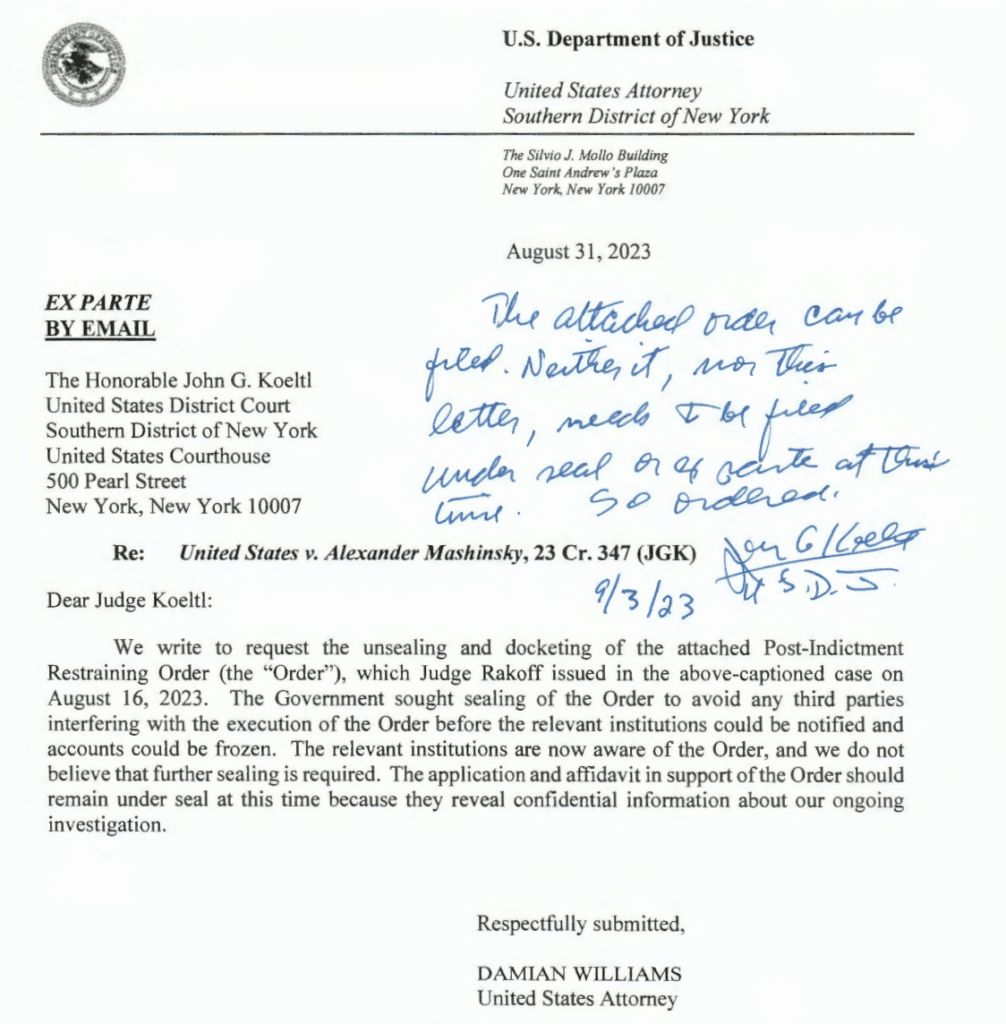

In July 2023, Mashinsky was arrested after the Securities and Exchange Commission filed a lawsuit against the company. He is accused of fraud and market manipulation, and the company’s token is recognized as security. He was soon released on bail of $40 million. Prosecutors said they would need six to eight weeks to collect evidence, including Mashinsky’s videos on the Internet, in which he allegedly misled investors.

He pleaded not guilty, and his lawyers called the charges “baseless.” Moreover, Mashinsky himself previously accused the New York Attorney General’s Office of the collapse of his business.

In September 2023, Mashinsky’s bank accounts and real estate were frozen by a court decision as part of a criminal case against the company and its top management.

What’s next?

The lawsuit is no guarantee that Celsius will get what it wants. For now, the platform is likely to face another lawsuit after a two-year bankruptcy battle. Either way, the lawsuit further illuminates how Tether has sidestepped the financial difficulties other crypto firms have faced during the 2022 bear market.