CFTC: Uniswap allowed illegal digital asset derivatives trading

Decentralized exchange Uniswap has settled with the Commodity Futures Trading Commission over illegal digital asset derivatives trading.

Per a CFTC notice on Sept. 4, Uniswap Labs, the entity behind Ethereum’s (ETH) largest DEX, was accused of unlawfully offering leveraged and margined retail commodity transactions.

The order acknowledged Uniswap’s “substantial cooperation” with the CFTC’s investigation, which led to a reduced civil penalty. As a result, Uniswap Labs agreed to pay $175,000 in fines.

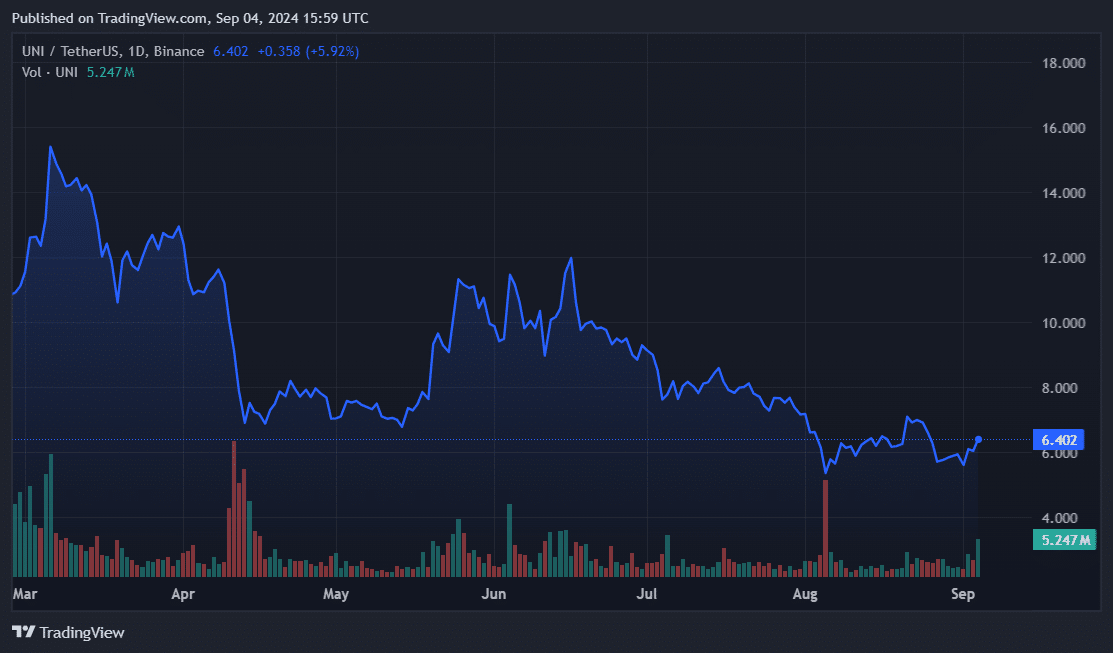

The company will also cease and desist from breaking the Commodity Exchange Act, meaning it can no longer facilitate commodity futures contracts. Despite the news, Uniswap’s native token (UNI) was up over 5% at press time.

Uniswap hit with second enforcement action

The CFTC’s settlement is the second enforcement action to rock Uniswap’s legal department this year. In April, the web3 startup was served a Wells Notice by the U.S. Securities and Exchange Commission alleging federal violations.

Both crackdowns may be part of a broader inquiry by American watchdogs into decentralized finance and cryptocurrencies, a sector that SEC chair Gary Gensler has accused of non-compliance and widespread fraud.

Indeed, the CFTC confirmed in its complaint that its action against Uniswap continued a regulatory focus on DeFi activity.

Industry voices have also pointed to Operation Choke Point 2.0, which is designed to remove crypto from the U.S. financial system and business economy.

In related news, the SEC slammed Ethereum-based NFT marketplace OpenSea with a Wells Notice. The document typically costs a lawsuit, but it does not guarantee the agency will take action. SEC prosecutors also accused crypto firm Galois of custody lapses and misleading investors.