Chainlink price targets $20 as exchange outflows surge

Chainlink price may be on the verge of a breakout to $20 as exchange outflows rise and ecosystem growth continues.

Chainlink (LINK), the largest provider of oracle services, was trading at $16 on Wednesday — up 60% from its lowest point this year.

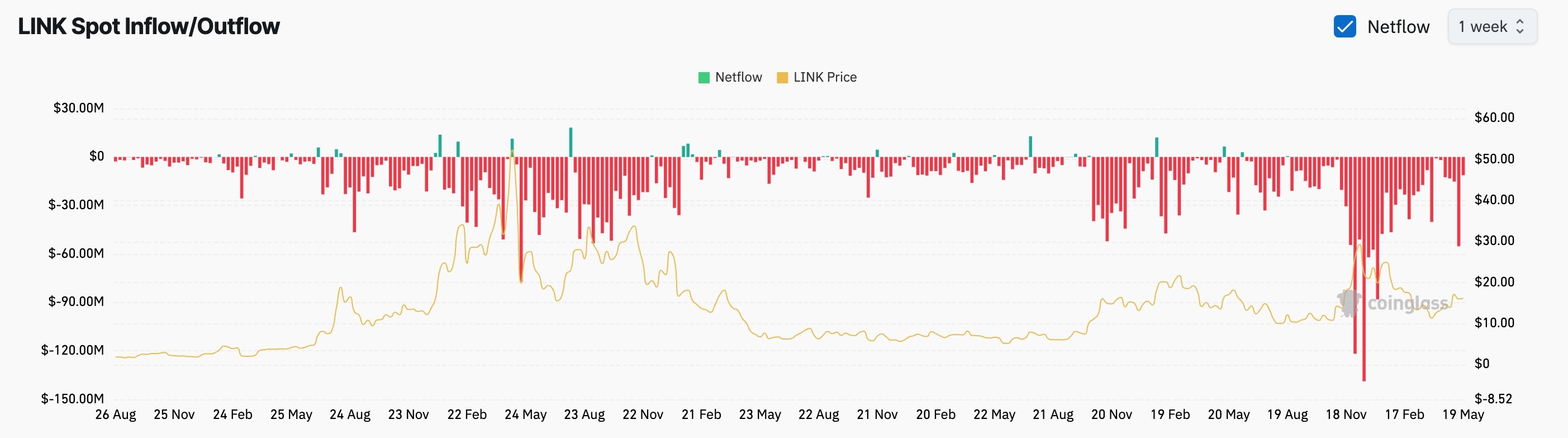

CoinGlass data shows that investors have continued accumulating the coin in anticipation of a rebound. As shown below, exchange balance netflow has remained negative every week since June of last year. So far this week, $11.27 million worth of LINK has exited exchanges, following $55.2 million in outflows last week.

Falling exchange balances typically occur when investors move their tokens into self-custody wallets. Rising balances, on the other hand, suggest selling pressure as investors deposit coins onto exchanges.

Chainlink’s technology is gaining more traction as the decentralized finance (DeFi) sector expands and as the outlook for real-world asset tokenization improves. For instance, Chainlink recently facilitated a transaction between JPMorgan and Ondo Finance (ONDO).

Chainlink’s cross-chain interoperability protocol went live on Solana (SOL) mainnet, a move that unlocked over $18 billion in assets. CCIP has also helped Solv Protocol, a Bitcoin staking platform, boost its assets to $2.5 billion, with $1.16 billion of them being powered by CCIP.

Analysts believe the RWA industry is still in its early stages and has substantial room for growth, a trend that could benefit Chainlink. Asset manager VanEck estimates the market for tokenized securities has already reached $50 billion and may exceed $30 trillion by 2030.

LINK price is also expected to benefit from Chainlink’s partnership with Swift, the global financial messaging network that processes trillions of dollars annually. The collaboration focuses on integrating blockchain infrastructure with traditional finance to enhance efficiency.

Chainlink price technical analysis

The daily chart shows that LINK formed a double bottom at $10.20 in November last year and again in April, a bullish reversal pattern that often signals strong upside momentum. LINK has also formed an ascending channel over the past three weeks and is currently supported by the 50-day weighted moving average.

The most likely scenario is a continuation toward the psychological resistance level at $20, a 27% gain from current levels. A drop below the lower boundary of the ascending channel would invalidate the bullish outlook.