Chart of the week: Solana could end crypto market limbo with 10% rally, SOL eyes $150 target

Crypto market uncertainty results in negative year-to-date returns for altcoins in the top 10, including Solana. Amid traders’ fearful sentiment and the economic fallout from President Donald Trump’s tariff announcements, Solana bucks the market-wide decline with a steady climb in the past 10 days.

Solana (SOL) price could receive a boost from the U.S. Federal Reserve’s decision to start reducing interest rates again soon. Traders expect three to four quarter percentage point cuts in 2025.

Table of Contents

Solana price forecast

Solana ended its downward trend on March 10 and has been consolidating around $135, a key level for the Ethereum alternative token.

At the time of writing, SOL trades at $138.75.

SOL rallied nearly 20% in the past week and nearly 8% in the past month. With $125.82 being the support level for the altcoin, it coincides with the upper boundary of an imbalance zone on the SOL/USDT daily price chart.

Two key momentum indicators, RSI and MACD support a bullish thesis in Solana. The green histogram bars above the neutral line and RSI sloping upwards with a reading of 56 suggest an underlying positive momentum in SOL price uptrend.

Solana could rally 13.33% and test the $152.90 level, a key resistance and previously a key support for the altcoin. If Solana successfully flips the $152.90 level from resistance to support, a rally towards resistance at $180, a sticky resistance for the altcoin throughout March and the first two weeks of April 2025.

SOL on-chain analysis

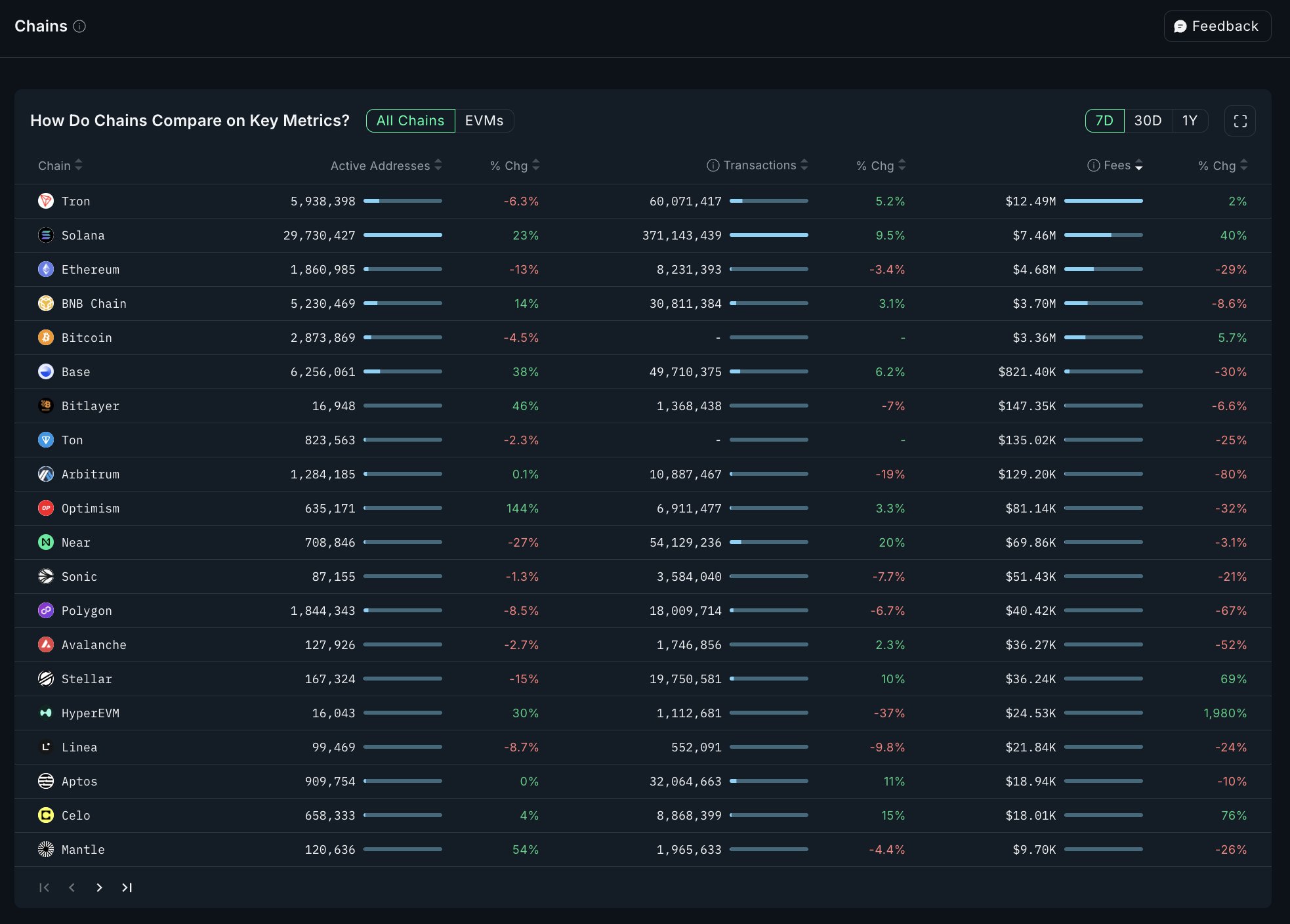

On-chain data from Nansen compares activity across Solana, Base and Ethereum. SOL leads with over 4 million active addresses in the past seven days. Base is second and Ethereum ranks lowest.

Higher count of active addresses shows the token’s relevance and demand among market participants.

Comparing DEX volume across the three chains, Solana leads with over $5.48 billion, while Ethereum ranks second at $975 million and Base follows with $465 million.

In terms of transactions, Solana leads with 52 million transactions in the past seven days, while Ethereum and Base lag behind, according to Nansen data. This is consistent with data for active addresses.

In terms of fees generated by the top 5 chains, Solana is second best with a 17% increase in active addresses, nearly 9% increase in transactions and 42% gain in fees generated in the last seven days, per Nansen data.

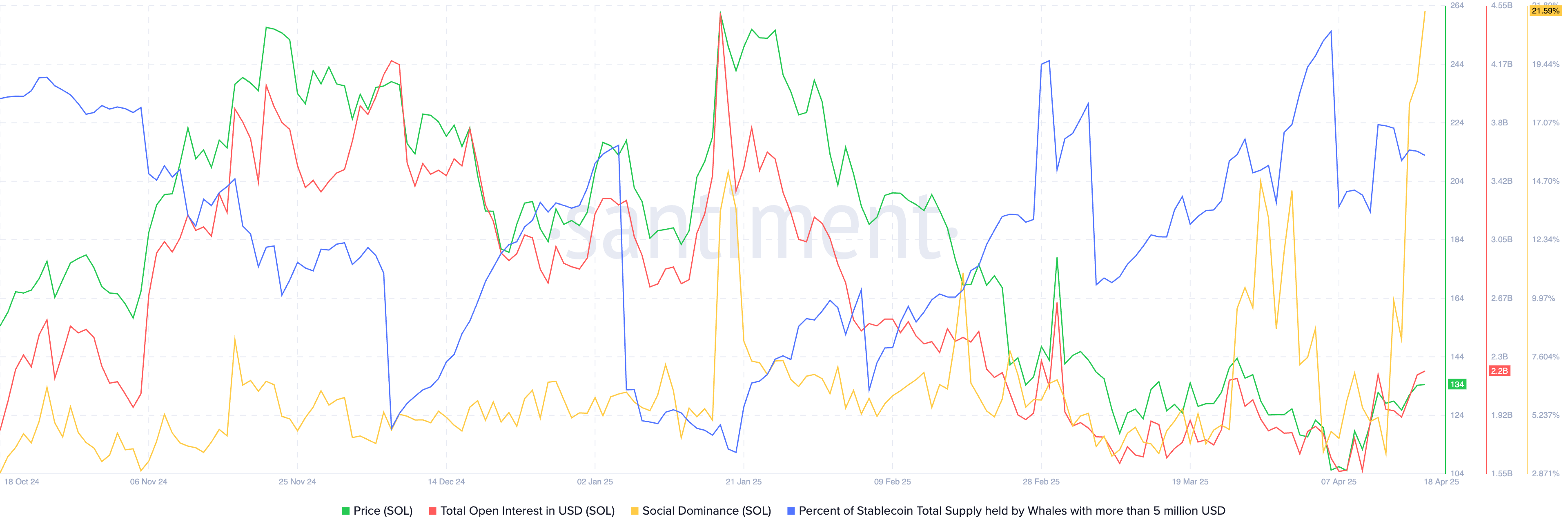

Santiment data shows a large spike in social dominance on Friday, up from 8.30% on April 15 to 21.59% on April 18. Alongside a rise in social dominance, total open interest in Solana climbed, in terms of USD.

This implies that the total value of open long and short positions in Solana has increased in the same timeframe, supporting a thesis for a rally in Solana price.

SOL weekly price performance

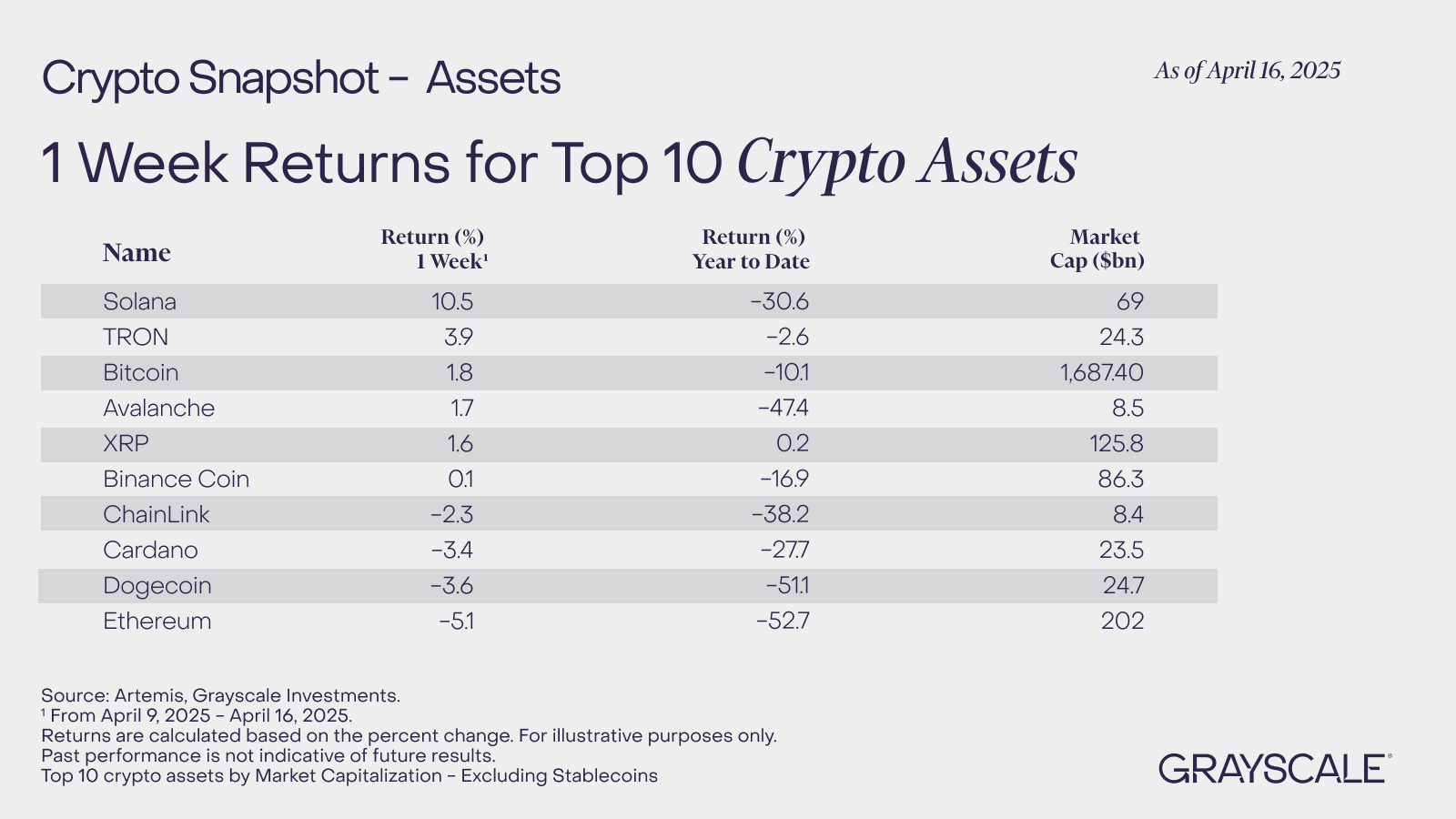

Grayscale, one of the largest alternative asset fund managers compared the returns for top 10 cryptocurrencies for a week. Data shows Solana climbed 10.5% while year-to-date returns are a negative 30.6%, at a market capitalization of $69 billion.

Solana leads the top 10 cryptocurrencies its its weekly gains, XRP leads in year-to-date returns where SOL lags. The flashcrashes in Bitcoin price and the market correction in crypto dragged down Solana price, wiping gains from 2024 and contributing to negative year-to-date returns.

Solana vs. Layer 1 and Layer 2 chains

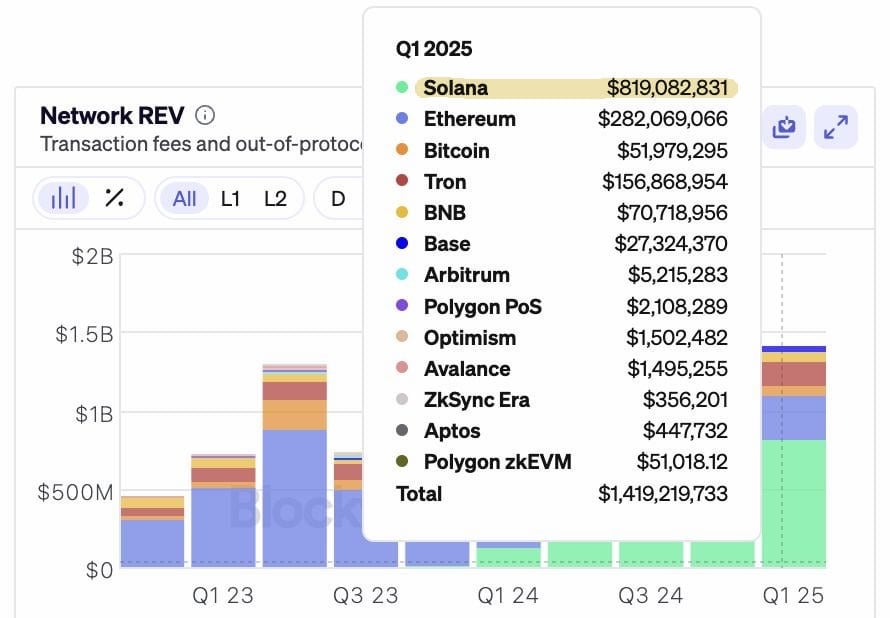

When Solana’s network revenue is compared with Layer 1 and Layer 2 chains like Ethereum (ETH), Bitcoin (BTC), TRON (TRON), it shows SOL outperformed its competitors.

SOL’s network revenue for the first quarter of 2025 is $819 million, Ethereum and TRON are the within the top three while Bitcoin lags with $51.97 million revenue in Q1.

When Solana’s revenue generated in the past seven days is compared, it shows that the Ethereum competitor continues to lead and ranks among the top 5 chains, per Nansen data.

SOL continues to dominate among competitors with the highest revenue generation. If SOL value is equated to its revenue generation, the token is likely undervalued and could yield further gains next week and in the second quarter of 2025.

Catalysts driving gains in Solana

Solana’s network developers are not alone in their efforts to scale the SOL infrastructure to make it faster, more resilient, and scalable.

Coinbase, one of the largest centralized exchanges, announced its system upgrade to process Solana transactions in a manner that boosts processing throughput, improves performance, and optimizes operational controls.

Coinbase shared the update on X and informed the community of traders of their commitment to boosting the Solana network infrastructure to increase reliability for end-users as well.

The exchange unveiled plans to continue investing in the Solana network and its development in the future.

Solana ETF filings and their progress in H1 2025 are another key market mover. An approval from the U.S. SEC could catalyze a rally in Solana in the second quarter of the year.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.