Chinese traders prosper despite crypto ban. Here is how they evade it

Chinese crypto traders thrive despite the country’s strict measures against mining and digital currency transactions.

In 2020, China was an active player in the cryptocurrency market, accounting for more than 75% of the global Bitcoin (BTC) mining hashrate. That all changed after the government cracked down on all cryptocurrencies. Recently, though, regulations seem to be slightly relaxed as investors seek promising new assets.

Chinese Bitcoin traders remain a significant force in Bitcoin trading. Their participation in the latest cryptocurrency sell-off is motivated by market price fluctuations rather than new constraints imposed by Chinese regulators.

Chinese trade for billions of dollars despite the ban

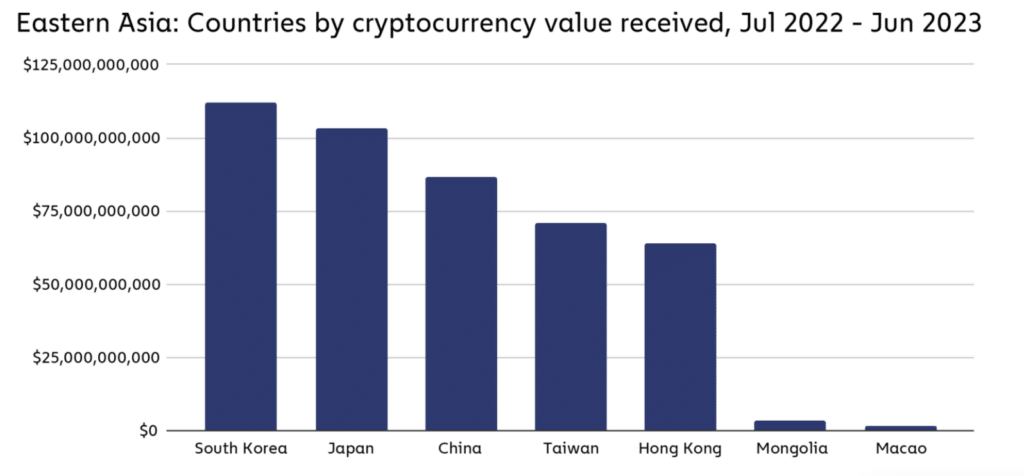

According to Chainalysis, between July 2022 and June 2023, the Chinese cryptocurrency market processed $86.4 billion in crypto transaction volume. Large retail transactions ranging from $10,000 to $1 million make up 3.6% of the total, nearly double the global average.

Chainalysis experts say that recent events in Hong Kong have fueled speculation that the Chinese government may be warming up to cryptocurrencies and that Hong Kong could become a testing ground for these efforts.

How to bypass restrictions

Despite a ban on cryptocurrency trading in China since 2021, Reuters reports that losses in the Chinese stock market over the last three years have driven investors back to cryptocurrencies. Dylan Run, a financial executive in Shanghai, refers to Bitcoin as “a safe haven, like gold.”

In early 2023, noticing the downturn in China’s economy and stock market, Run started shifting some of his funds into cryptocurrencies.

Though officially banned, cryptocurrency trading remains accessible in China. Citizens continue to trade digital tokens like Bitcoin on platforms such as OKX and Binance or through over-the-counter methods. Another option is using foreign bank accounts to buy cryptocurrencies.

Variety of payment methods

With China’s cryptocurrency ban, investors have become more creative in managing their funds. As Reuters reports, Dylan Run, for instance, used bank cards from small rural banks to purchase cryptocurrencies through unofficial dealers. He kept transactions under 50,000 yuan ($6,978) to avoid drawing attention from authorities.

Traders have found various ways to transfer cryptocurrencies, including cash or bank transfers. Cities like Chengdu and Yunnan have become hubs for these traders, offering a respite from the central government’s scrutiny, which is focused elsewhere.

According to the Wall Street Journal, Chinese investors also turn to social networks like WeChat and Telegram for cryptocurrency trading. They use these platforms to connect with others in specialized groups, bypassing the need for centralized exchanges.

In rural areas, where enforcement is less strict, the physical trading of digital assets is prevalent. Traders often meet in public places such as cafes or laundromats to exchange wallet addresses or conduct transactions in cash or through banks.

Hong Kong

Hong Kong also offers savings opportunities as Chinese citizens are given an annual foreign currency purchase of $50,000, which some use to buy cryptocurrencies in the Hong Kong market.

As China’s $135.7 trillion real estate market continues to struggle, more citizens may soon turn to cryptocurrencies to catch up. The country’s property market ended 2023 with the steepest fall in new home prices in nearly nine years, despite government efforts to prop up a sector once a critical driver of the world’s second-largest economy.

One anonymous Hong Kong crypto exchange executive told Reuters they see mainland investors entering the cryptocurrency market almost daily. China’s economic downturn “has made investment on the mainland risky, uncertain and disappointing, so people are looking to allocate assets offshore.”

And it’s not just retail investors. Chinese brokers and other financial institutions have also begun to enter the cryptocurrency market. The need for growth opportunities on the mainland has pushed them to explore the cryptocurrency business in Hong Kong.

“If you’re a Chinese broker facing a weak stock market, weak IPO demand, and shrinking other businesses, you need a growth story to tell your shareholders and board of directors.”

Anonymous Hong Kong crypto exchange executive

Fintech platforms such as Ant Group’s Alipay and Tencent’s WeChat Pay have also made it easier for citizens to invest in cryptocurrencies. They allow users to convert yuan into stable digital coins at dealers, which can then be used to trade cryptocurrencies on various exchanges.

According to Chainalysis, the increasingly closer relationship between China and Hong Kong has some speculating that Hong Kong’s growing status as a crypto hub could signal that the Chinese government is changing course on digital assets or at least becoming more open to crypto initiatives.

False geolocation

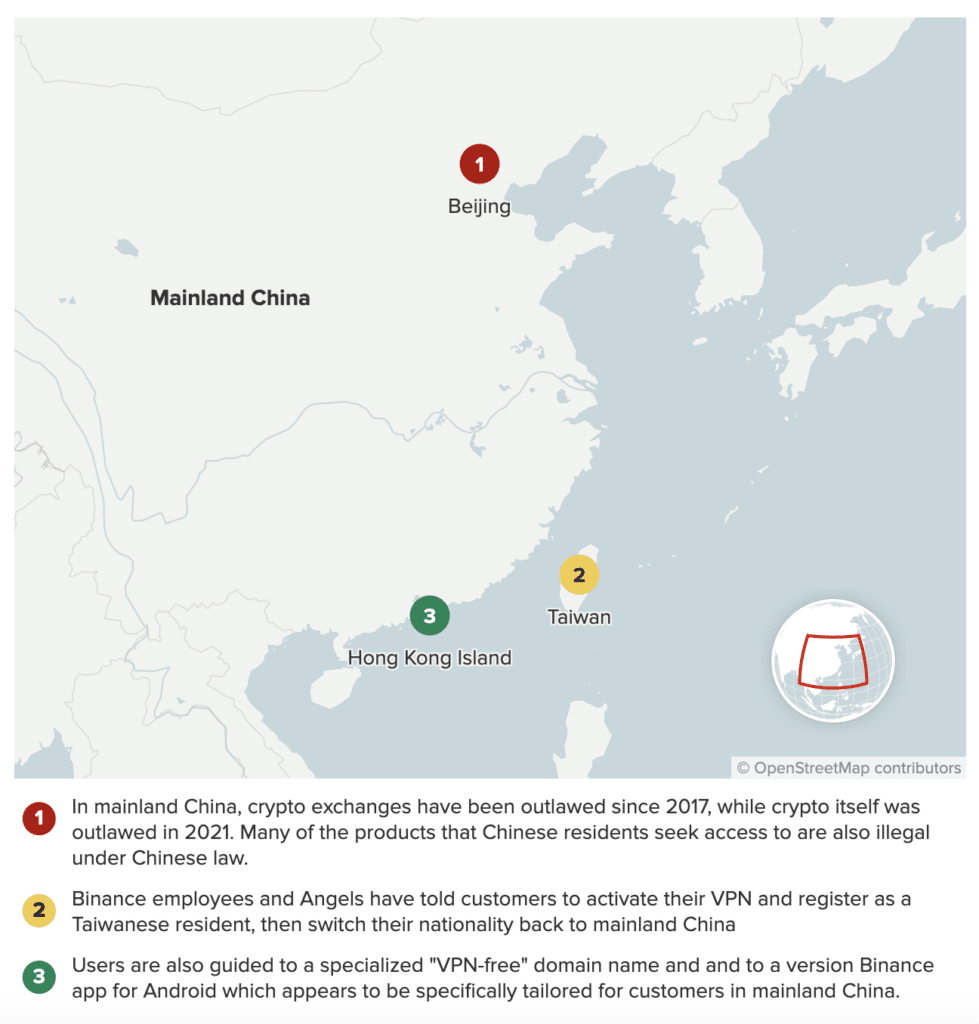

Some users saved their accounts on trading platforms and continued to use them after the ban, bypassing geo-restrictions using a VPN. In May 2023 alone, the turnover of Chinese traders on Binance reached $90 billion – approximately 20% of the total. According to CNBC, exchange employees advised users from China to evade KYC checks.

Last year’s report highlighted that some traders opened crypto accounts with fake documents, including citizenship.

By providing false residence and bank details, these traders seek to circumvent Know Your Customer (KYC) protocols and register accounts violating regulatory measures. This unconventional approach to cryptocurrency trading starkly contrasts the country’s strict regulatory environment.

China is looking for salvation in crypto

The surge in Bitcoin and other cryptocurrencies comes from underperforming traditional Chinese investments. The crackdown on the real estate sector and the ongoing economic transition have made conventional investment avenues such as stocks and real estate less attractive. Indeed, a dominant state-owned enterprise sector, opaque governance, regulatory uncertainty, and a weak credit rating system pose significant economic challenges.

Current conditions have accelerated the stock market crash and raised concerns about the future of China’s economic environment. Cryptocurrencies are, therefore, emerging as a viable alternative, offering a semblance of stability and growth potential amid the turbulence of the Chinese economy. Chinese traders’ rise in cryptocurrency investment is a telling sign of the times, reflecting a strategic shift in response to a changing economic and regulatory environment.