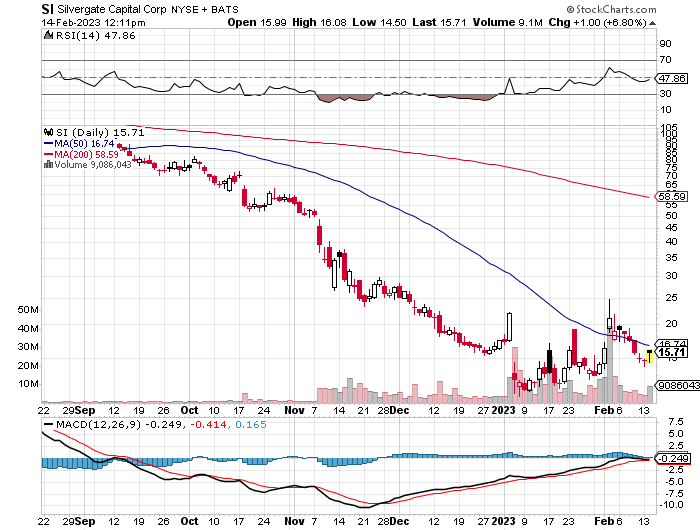

Citadel Securities buys 5.5% stake in Silvergate bank for market making

Citadel Securities disclosed that it owns 5.5% of Silvergate bank, which has been negatively impacted by the crypto downturn. The shares were bought for options market making, not as an investment in the bank.

The announcement of the interest by Citadel Securities helped Silvergate stock to rise in New York trading. While the stock was up by at least 5% in trade on Feb. 14, it has been under pressure since FTX collapsed in 2022.

Citadel Securities was founded by Kenneth C. Griffin, and is a market maker in U.S. financial markets. It remains an influential financial firm in the U.S. While the disclosure was positive for the shares of the bank, it was not a direct investment by Citadel, which has extensive options market-making activities.

Big investors looking for a bargain

Citadel Securities isn’t looking for distressed crypto assets, at least this SEC filing doesn’t suggest it. But Cathie Wood’s ARK has been scooping up crypto-linked assets, like shares of Coinbase. While the crypto winter bites asset prices in the crypto space, large investors see value, based on their purchases.

Cathie Wood also sees value in some of the major tokens. In recent interviews, Wood expands on why public blockchains, like ethereum, are likely to rise in value over the coming years. According to Wood, blockchain assets are attractive, and by 2030, bitcoin could be worth as much as $1.4 million.

Does deflation matter?

One of the factors that Wood sees as attractive is the deflationary nature of ethereum. In a post-merge market, the amount of ethereum is falling while the volume of fiat currency is rising. Ethereum provides value to it users and can be used for numerous digital applications.

While a basic economic relationship like supply and demand falls short in many applications, in the case of ethereum, Wood sees it driving ETH prices much higher.

Another factor to consider is faith in fiat currency, as a lack of faith in central bank issues money could act as a tailwind for cryptos in nations where the population loses faith in fiat currency.

In countries like Argentina and Venezuela, the value of cryptos has risen substantially more than in developed nations, as the local currency is seen as less desirable. In addition, cryptos allow people from abroad to remit funds with cryptos, and avoid any capital controls that exist.

A dot-com collapse all over again

On April 21, 2003, the New York Times ran an article about Wall St. analyst coverage of dot-com stocks. At the time, spirits in the world of tech investment were low.

“With a handful of exceptions like AOL Time Warner, eBay and Amazon.com, online companies were shunned by investment analysts after the bottom fell out of the dot-com market in 2000. And who could blame them? Investors hardly needed analysts to tell them that Internet companies were circling the drain.”

Bob Tedeschi, New York Times.

Nine days later, on April 30, 2003, shares in Apple Computer closed at $0.25 per share. Times in the tech world were dark, and the deals to be had were once-in-a-lifetime.

At the time of writing, shares of AAPL are trading at $151.41 per share.

In addition, according to the company, “The stock split on a 4-for-1 basis on August 28, 2020, a 7-for-1 basis on June 9, 2014, and split on a 2-for-1 basis on February 28, 2005.”

Today, the mood in crypto is dour, and institutional investors like Citadel Securities and ARK are stepping in to buy up companies and assets for pennies of what they traded for just a few months ago.