Game on: Coinbase files two new FOIA requests against crypto regulators

Coinbase has submitted two Freedom of Information Act (FOIA) requests against American regulators.

The crypto exchange is demanding the disclosure of documents related to the prosecution of crypto companies by U.S. banks. This was reported by Coinbase CLO Paul Grewal.

“We filed two new sets of FOIA requests in our continued effort to get any sort of clarity on how regulatory agencies are approaching digital assets. In short, so long as the government will not relent, neither will Coinbase.”

The Federal Deposit Insurance Corporation (FDIC) has recommended banks limit deposits from crypto firms to 15% of total deposits. Coinbase has also filed another FOIA request to determine how regulators have responded to similar requests.

The FDIC reportedly set these limits without seeking public input in advance, contrary to the usual practice for banking regulators in the U.S. Grewal noted that the new FOIA requests are unrelated to previous requests filed more than a year ago, which are currently in federal litigation.

“Each is separate from our FOIA filings from over a year ago that are now the subject of federal lawsuits.”

FOIA in the U.S. gives the right to request access to records and information held by federal agencies. This includes government records related to financial transactions and cryptocurrency regulation.

What is known about the Coinbase lawsuit string

Coinbase has been pushing the U.S. Securities and Exchange Commission (SEC) to develop explicit rules for the industry for the past few years. In July 2022, the company filed a petition to the Commission to this effect, and in April 2023, it went to court.

The SEC’s head, Gary Gensler, rejected Coinbase’s claims, saying that existing laws apply to the industry. In March, the platform asked the appellate court to compel the regulator to develop rules.

In June 2023, the SEC brought charges against Coinbase, alleging that the company violated securities laws through its staking Ethereum (ETH) offering. Coinbase then requested documents from the regulator regarding the classification of ETH to determine whether the agency considers it a security or a commodity.

“We allege that Coinbase, despite being subject to the securities laws, commingled and unlawfully offered exchange, broker-dealer, and clearinghouse functions.”

Gary Gensler, SEC Chair

Following this issue, Coinbase also filed a lawsuit against the SEC and the FDIC for refusing to clarify the situation with the regulation of the cryptocurrency sector.

The company filed a FOIA request with the authorities. Specifically, the exchange was interested in materials on the Ethereum 2.0 investigation and two already closed SEC cases: Enigma MPC and Ether Delta.

However, Coinbase was unsuccessful, prompting it to seek a court order to overturn the SEC’s decision. The form argued that the regulator lacks clear guidance, making it difficult to comply with existing laws in the U.S.

Eugene Scalia, a lawyer for Coinbase, worried that the SEC’s lack of clarity in its conduct left the exchange “without a clear path to compliance”.

“I leave this court understanding the SEC’s views on this topic even less than when I entered.”

Eugene Scalia, Coinbase’s lawyer

The judging panel acknowledged that the SEC could prioritize its rulemaking but questioned why crypto regulation had not received the attention it deserves. The case is part of a broader tension between the SEC and the crypto industry, where the regulator insists on classifying most crypto tokens as securities that fall under its oversight.

Coinbase and other crypto companies are challenging this position, arguing that the sector is in a legal gray area and calling for new legislation to regulate digital currencies.

Crypto’s growing influence in the U.S.

As part of its push for better crypto regulation, Coinbase has launched a new initiative, Stand With Crypto, which includes a political action committee (PAC).

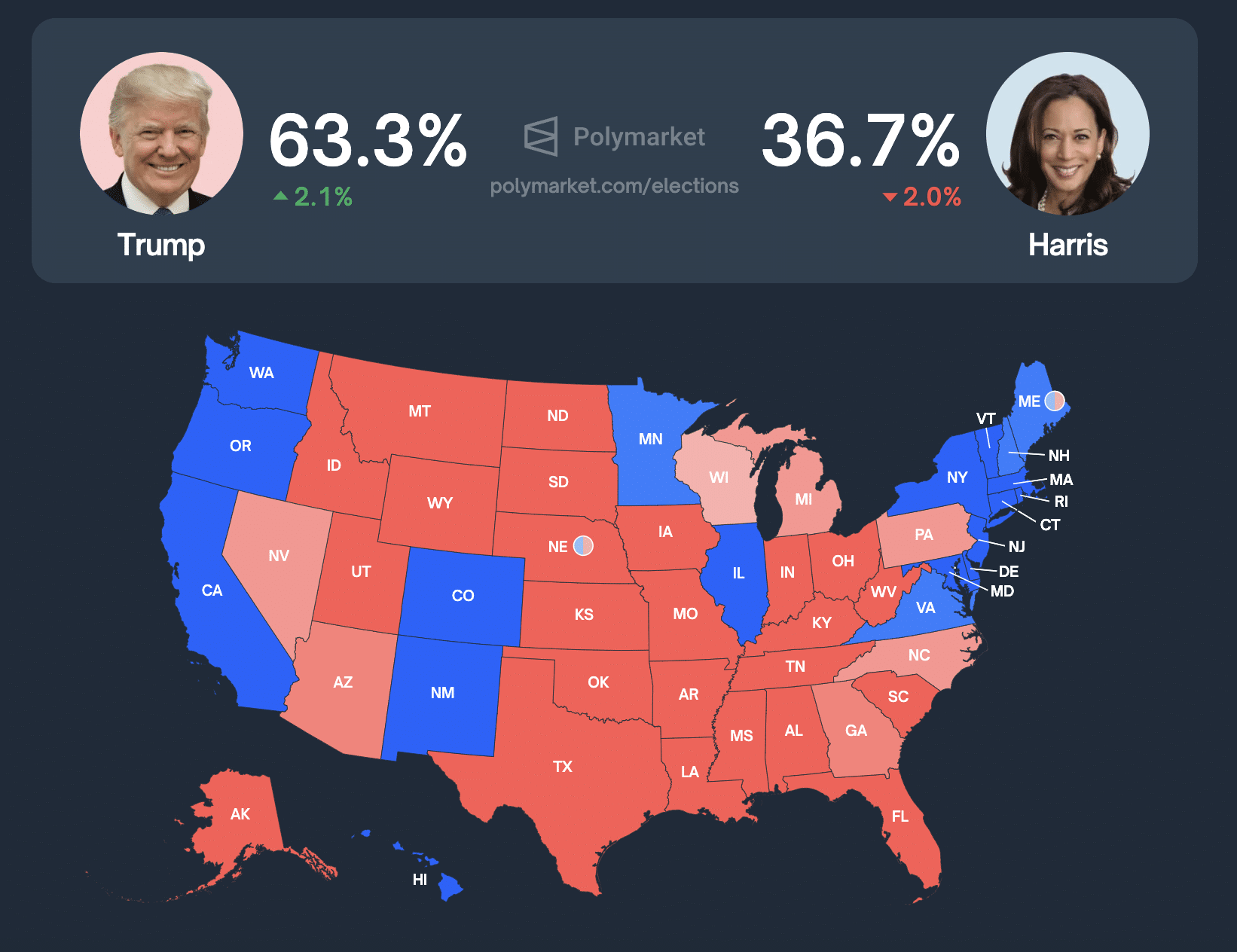

The upcoming U.S. elections in November will see a battle between Republican Donald Trump, who wants to make crypto great again, and Democrat Kamala Harris, whose views on cryptocurrency are more favorable than those of current President Joe Biden but still less progressive than Trump’s. Many crypto supporters believe this election could be a defining moment for the industry, and they are ready to financially support their candidates.

According to CNBC, crypto firms have provided almost half of all corporate contributions in this election cycle. The volume of crypto donations for the U.S. presidential election has reached nearly $200 million.

Crypto analyst James Delmore emphasized that California remains the center of the crypto industry thanks to its many blockchain companies, and the political situation in the state will be necessary for the further development of legislation in this area.