Coinbase Japan is subject to recent company layoffs

Coinbase’s Japan unit will reportedly be subject to layoffs as part of a larger global workforce reduction. Japanese workforce will be cut by 20% amid the extended crypto bear market.

Reducing their Japanese-branch staff numbers was confirmed by a Coinbase official in an interview with Bloomberg. Coinbase vice president of international and business development Nana Murugesan said in an interview:

“We’ve decided to wind down the majority of our operations in Japan, which led to eliminating most of the roles in our Japan entity.”

Nana Murugesan, Coinbase vice president of international and business development

This 20% slash is the second round of global layoffs in less than one year.

This new wave of layoffs comes just shortly after about 25% of the company’s US workforce was let go. Coinbase cited that the releases were to “weather downturns in the crypto market.” Before that, Coinbase let go of another 18% of its staff, comprising 1000 employees, in June 2022.

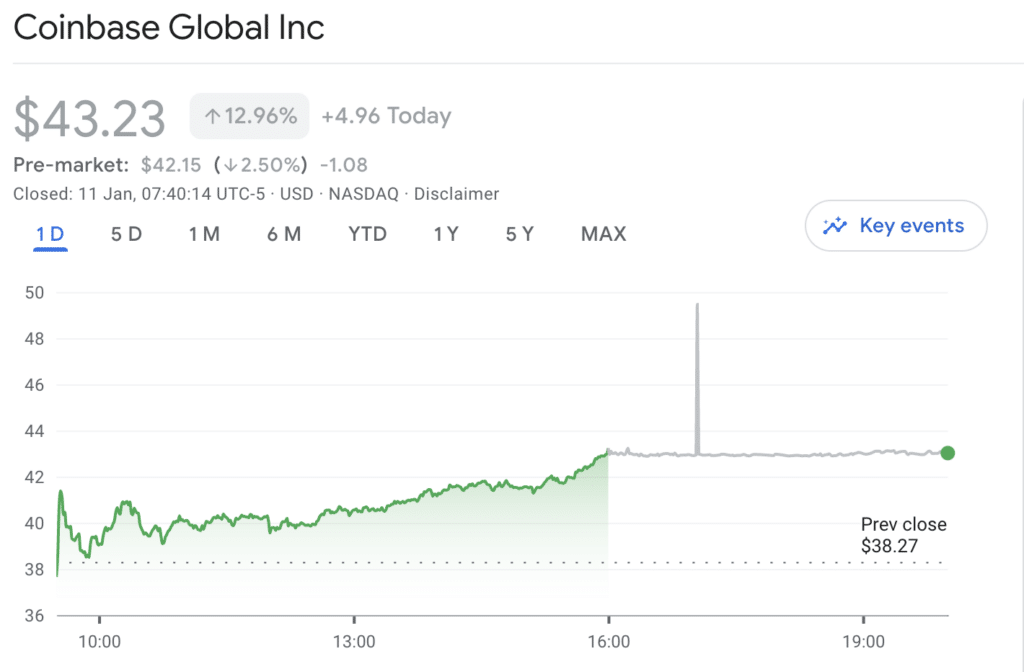

Coinbase’s share price experienced an increase of nearly 12% to reach $41.62 following the announcement of job cuts in the company. Additionally, multiple Wall Street banks maintained their optimistic outlook on the company in the long term despite the job cuts.

Analysts from Wall Street think this move from Coinbase is one to be commended, specifically those from Barclays who wrote:

“We are encouraged by this morning’s news, as it shows the company is taking financial discipline seriously in a very challenging crypto/macro environment.”

Bear market woes

Coinbase is not the only company battling with the bear market syndrome. Several crypto and traditional companies have laid off hundreds of staff. Apart from Coinbase, Goldman Sachs said they could lay off as many as 3200 employees in 2023.

Digital Currency Group’s subsidiary, Genesis Trading, laid off 30% of its workforce. This was the company’s second round of layoffs. Additionally, the company is reportedly facing bankruptcy.

According to Forbes, other giant companies, such as Amazon, Salesforce, Vimeo, Stitch Fix, and Scale AI, have reported that they will lay off 10-20% of their employees this year.