Coinbase says Bitcoin, Ethereum current cycles resemble 2018-2022

Bitcoin and Ethereum are seemingly following the pattern of previous years, when their prices jumped by 500% and 1,000% respectively, Coinbase research says.

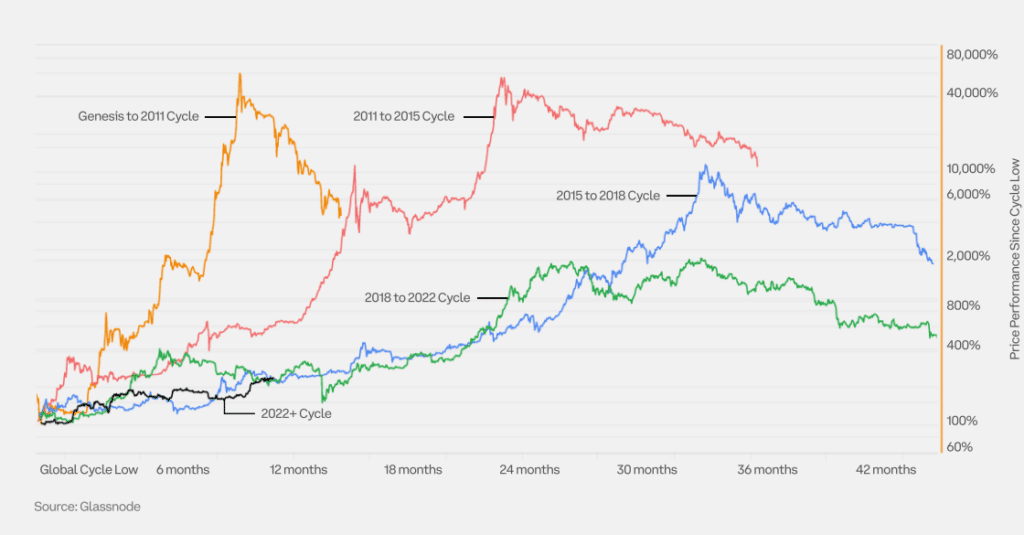

The current crypto market cycle for Bitcoin (BTC) and Ethereum (ETH) closely echoes the period between 2018 and 2022, when both cryptocurrencies witnessed a significant surge in their prices, according to the latest research report conducted by Coinbase Research and Glassnode.

As noted by analysts, various metrics of cyclicality, including net unrealized profit/loss and supply in profit, follow the previous trends and indicate that the current state of the crypto markets does not reflect the euphoric conditions witnessed during the maximum of 2023, suggesting the market still has room to surge.

While acknowledging the potential positive impact of the upcoming Bitcoin halving, Coinbase Research remains cautious, noting limited supporting evidence and characterizing the relationship as somewhat speculative.

“With only three halving events historically, we have yet to see a clear pattern fully emerge, particularly as previous events were contaminated by factors like global liquidity measures.”

Coinbase Research

The next Bitcoin halving is expected to take place in April 2024 based on current mining rates. The block reward will decrease from 6.25 to 3.125 BTC.

Regarding Ethereum, analysts spotlight the forthcoming upgrade named Cancun. Anticipated to enhance scalability and security, the upgrade aims to make layer-2 transactions as cost-effective as possible, potentially leading to a significant increase in the number of processed transactions on the Ethereum network.

Coinbase also notes that both Bitcoin and Ethereum have undergone two cycles, encompassing both bull and bear markets, with the ongoing cycle, which initiated in 2022, closely mirrors the patterns observed in the preceding cycles.