Coinbase-supported motion counters Tornado Cash sanctions

The filing asserts that the Treasury does not possess the necessary jurisdiction to ban Tornado Cash and its associated transactions.

In a recent filing on May 24, six individuals presented four key arguments to overturn the United States Treasury’s decision to impose sanctions on the popular crypto mixer, Tornado Cash.

The plaintiffs argue that the case is not about granting special rules to new technology but rather about government overreach and a violation of First Amendment rights.

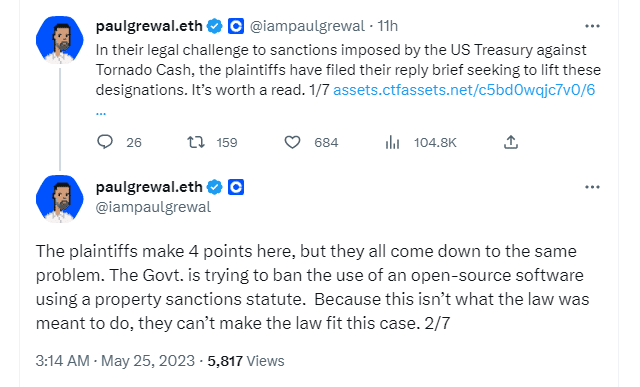

The arguments were summarized by Coinbase’s chief legal officer, Paul Grewal, in a Twitter thread, where he contended that the government is attempting to employ a property sanctions statute to ban open-source software, which contradicts the original intentions of the law.

Crypto exchange Coinbase has expressed support for the lawsuit against the US Department of Treasury, initially filed on September 8, 2022.

The plaintiffs involved in the filing include Joseph Van Loon, Tyler Almeida, Alexander Fisher, Preston Van Loon, Kevin Vitale, and Nate Welch, most of whom have had prior interactions with Tornado Cash.

Questioning the Treasury’s categorization of Tornado Cash

The plaintiffs’ first argument questions the Treasury’s attempt to categorize Tornado Cash as a foreign “national” to justify its actions.

The plaintiffs highlight that the Treasury’s definition of Tornado Cash includes all holders of the TORN token, regardless of any shared purpose. Consequently, the plaintiffs argue that Tornado Cash cannot be classified as an unincorporated association based on the Treasury’s own criteria.

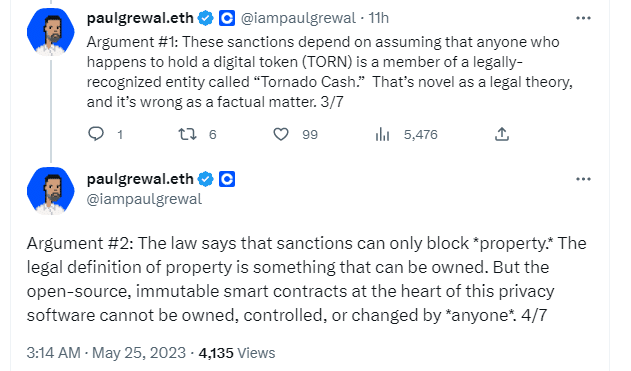

The second argument revolves around considering open-source smart contracts, which provide functionality to Tornado Cash. The plaintiffs assert that these smart contracts cannot be deemed as property since any property is generally defined as something that can be owned.

Even if the smart contracts were considered property, the third argument made by the plaintiffs contests the absence of any “interest” held by a Tornado Cash entity in these contracts. Thus, according to the plaintiffs, the Treasury lacks the authority to impose sanctions.

The final argument centers on the violation of the First Amendment. The plaintiffs argue that even if the Treasury possesses the authority to sanction Tornado Cash, such an action infringes on the right to free speech. They contend that the Treasury cannot justify this imposition by suggesting that Tornado Cash users should exercise their free speech rights elsewhere.

Upholding privacy in the crypto space

The US Treasury initially imposed sanctions on several addresses associated with Tornado Cash on August 8, 2022, merely a month after the open-sourcing of the user interface code.

Tornado Cash, a decentralized Ethereum mixer, offers users enhanced transactional privacy by obscuring the origin of their funds. The regulatory concerns surrounding privacy-focused tools have led to sanctions on such services.

Coinbase aims to address these concerns through its motion arguments in support of lifting sanctions on Tornado Cash.

The outcome of Coinbase’s motion to lift the sanctions on Tornado Cash could have far-reaching implications for privacy-enhancing tools and innovation in the cryptocurrency industry. It may establish a precedent for treating similar privacy-focused projects and shape the regulatory landscape concerning cryptocurrency privacy.

Additionally, this decision could influence how exchanges, regulators, and users perceive and engage with privacy tools moving forward.