Compound (COMP): A Lending Protocol for Interest Generation from the Platform’s Pools

Compound (COMP), an innovative DeFi lending protocol, allows users to effectively maximize their interest by lending their crypto assets to pools supported by the platform.

What is COMP?

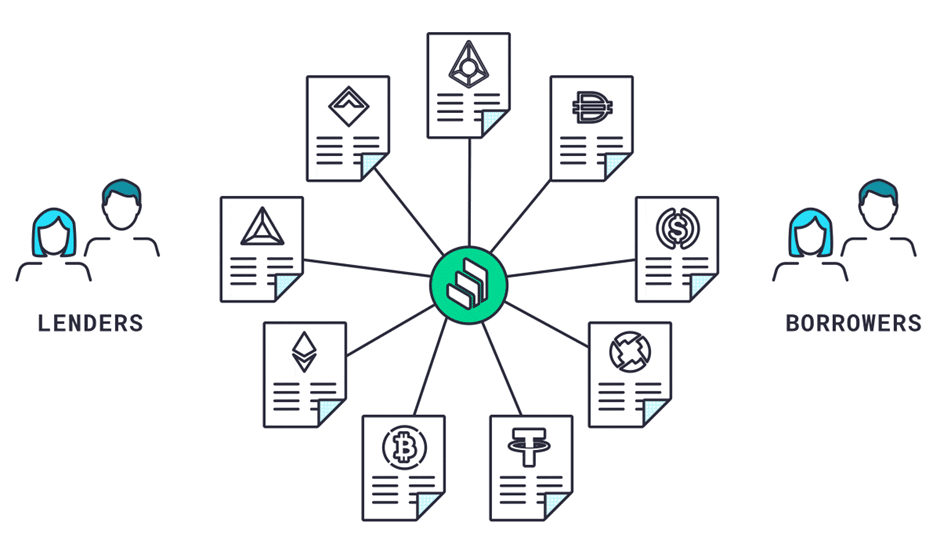

One of the major functions of DeFi apps is achieving the most effective system of crypto resources’ allocation. Lenders should receive the maximum interest for their services, while borrowers should have access to the required liquidity at any moment. COMP addresses this challenge by offering cTokens to users when they provide respective tokens (for instance, cETH for ETH). The exchange rate to the deposited assets increases over time, thus enabling users to receive extra income. The secured loan is also always available for borrowers in case they have provided the proportional collateral. The loan-to-value-ratio typically varies in the range of 50-75%. In this manner, the interests of all major parties involved are properly balanced with one another.

COMP’s current price is $145.48 with the circulating supply of 6.715 million tokens. COMP’s maximum supply is 10 million tokens, and it has a potential for further supply increase in the following years. However, it cannot increase more than by 33% as compared with the current level. COMP’s market capitalization is $977.7 million, making it the 83rd largest cryptocurrency in the market. COMP reached the historically maximum price of above $800 in May of 2021. The token experienced a rapid decline in the following months due to the high dependence on the overall market conditions and DeFi trends. The development of crypto exchanges in the following months and the restoration of higher rates of the DeFi segment’s growth can contribute to the proportional appreciation of COMP.

Investing in COMP: Pros and Cons

The long-term demand for COMP will largely depend on the following factors: the availability of liquid funds in the DeFi segment; the structure of potential risks and profits offered to lenders and borrowers; competitors’ offerings; technological innovations developed by Compound, etc. Although COMP has a high potential for the future growth, the risks and growing competition in the segment are also considerable. The evaluation of the major support and resistance levels based on technical analysis may be helpful for making better-supported short-term investment decisions. The close risk control and management are also obligatory when trading this asset.

COMP has the major support level at the price of $98 that corresponds to the local minimum reached in the past few months. Currently, COMP is approaching the first major resistance level of $152 that is historically significant for determining the token’s short-term price dynamics. In case COMP successfully exceeds this level, the major target is the local maximum of $172 that represents the second resistance level. COMP’s ability to exceed the first resistance level can encourage investors to open long positions. At the same time, they should closely monitor the overall tendencies in the DeFi segment due to the high crypto market’s volatility that is currently observed.