Compound DAI (CDAI): An Autonomous Protocol for Investors

Compound DAI, an autonomous protocol for investors, enables its holders to integrate financial apps and community-built interfaces.

What is Compound DAI (CDAI)?

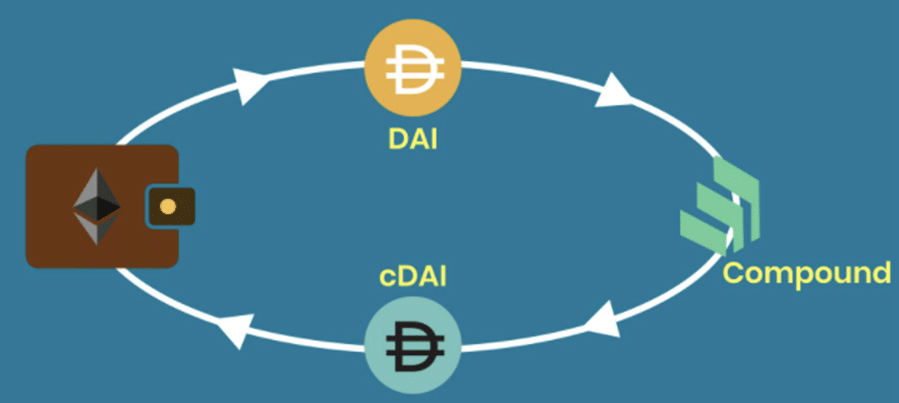

The major function of CDAI is allowing investors to receive passive income by supplying their assets to liquidity pools. In this manner, financial intermediaries receive access to the desired amount of funds, while investors can receive comparatively high returns without incurring considerable risks. In contrast with traditional interest instruments, CDAI utilizes complex algorithms to integrate a number of relevant factors that may affect the market interest rate. In this way, it is automatically adjusted, thus providing the maximum convenience for traders and investors. The following institutions offer their services for integrating the protocol of CDAI: Ledger, Bitgo, Fireblocks, Anchorage, etc. Thus, investors may receive the maximum flexibility in terms of allocating their funds and utilizing the functionality provided by other services, while also receiving satisfactory interest in their liquidity provision services.

The Compound DAI project was launched in 2020, and CDAI’s current market price is $0.02187, and the circulating supply is 25.2 billion CDAI. Its current market capitalization is $551.3 million, making it the 2836th largest cryptocurrency in the market. CDAI does not have a maximum supply, and its available supply will depend on the demand for such tokens, and the application of the developed algorithms. The growing utilization of decentralized exchanges and holders’ interest in obtaining the maximum passive income should contribute to reaching CDAI’s maximum long-term capitalization. The growing interdependence between all crypto projects contributes to the higher demand for such crypto assets as CDAI.

Figure 1. CDAI’s System of Operations; Data source – BlockchainSimplified

Investing in CDAI: Pros and Cons

The long-term demand for CDAI will depend on the spread of algorithmic solutions in reflecting the value of stable coins and other crypto projects. Moreover, the preferences toward obtaining the passive income may also be important in affecting the reliance on CDAI. By increasing the integration with other services and decentralized exchanges, CDAI may contribute to strengthening its overall positions in the market. The short-term price dynamics of the analyzed token can be forecasted with the help of technical analysis tools.

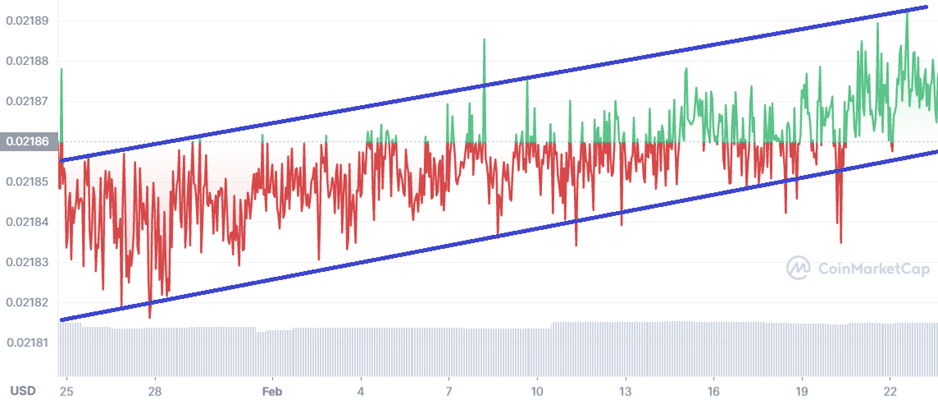

Figure 2. CDAI/USD Price Dynamics (1-Month); Data source – CoinMarketCap

The short-term price dynamics indicates the channel with a positive slope that properly approximates CDAI’s price dynamics. Despite the token’s price fluctuations within this channel, the positive price dynamics appears to be sustainable. Therefore, investors can reliably purchase CDAI as long as the price does not break the lower boundary of the constructed channel.