Compound DAO faces class action lawsuit for allegedly selling unlicensed securities

A new lawsuit claims that investors experienced damages after purchasing COMP tokens. Compound DAO is suspected of selling unlicensed securities.

Eight defendants named in the lawsuit

The San Francisco-based DeFi lending platform was named in the suit alongside its co-founders, Robert Leshner and Geoffrey Hayes, as well as investment firms Andreesen Horowitz, Paradigm Operations, Gauntlet Networks, Polychain, and Bain Capital. Together, these firms have put more than $33 million into Compound since its founding in 2017.

The three complainants, Susan Franklin, Charles Douglas, and Amanda Houghton claimed they incurred financial losses from buying COMP tokens, which they described as unregistered and unqualified. They also stated that the DAO and its stakeholders are in charge of selling COMP tokens as unlicensed securities.

COMP failed to live up to its promise

According to the three, the defendants made false and misleading claims about the possibility of profiting from COMP token holdings, whereas in truth, retail COMP buyers have generally fared poorly.

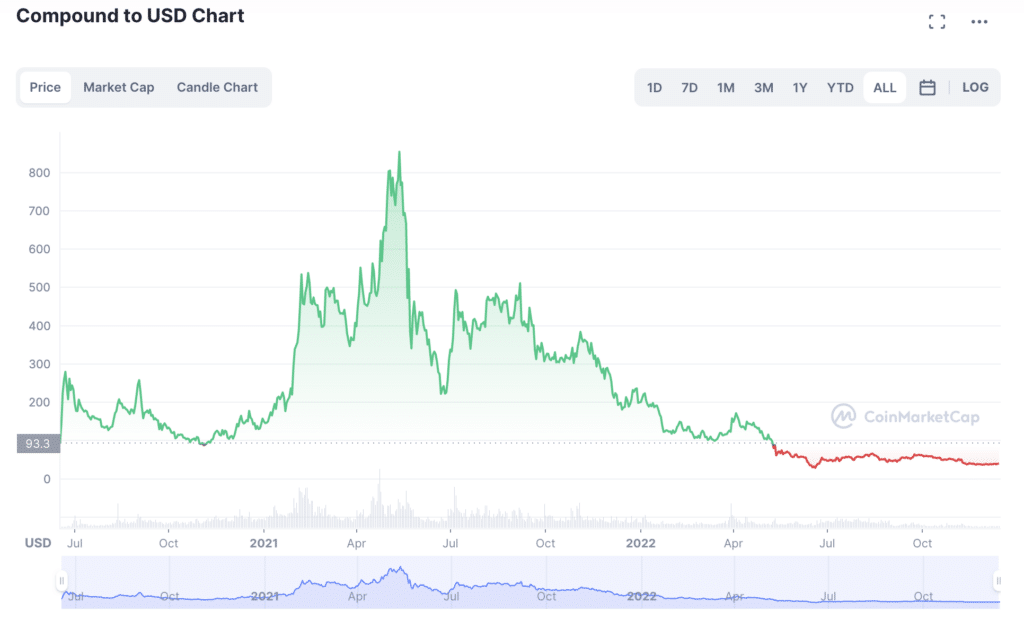

COMP’s value peaked in May 2021 at nearly $500 per token, resulting in a total market capitalization of around $4 billion. However, its value quickly diminished, and by the fall of 2021, COMP’s market capitalization was just over $2 billion.

The plaintiffs stated that COMP’s value had dropped by 90% in the year preceding the filing of the class action suit, and it currently has a market capitalization of about $278 million.

According to the suit, Susan Franklin bought $2 worth of COMP in 2021, when the token was priced at $230. Charles Douglas, for his part, purchased $75 worth of COMP in early 2022 when it was around $130. He claims to have sold part of his holding at a loss while retaining a small fraction. The third plaintiff, Amanda Houghton, bought $3 worth of COMP in November 2022, when the token went for $42. She also received a further $9 worth of COMP from a Coinbase Earn promotion, bringing the total COMP holdings of the three to about $89.

Compound DAO controlled by few insiders

Compound DAO, alongside the other listed defendants, holds 51.56% of the COMP currently in circulation. The lawsuit claimed that Compound DAO’s assertion of “community governance” via COMP tokens was a sham since the system was skewed to “ensure insiders kept control of the business into the distant future.”

According to the plaintiffs, the COMP token’s initial supply schedule was the genesis of the unfair distribution system. They allege the system was designed to ensure “founders and team,” “shareholders,” and “future team members” will altogether hold more than 57% of outstanding COMP supply when the token is fully distributed. According to the lawsuit, holding that many governance tokens will give the insiders effective control of the DAO indefinitely.