Convex Finance (CVX): Boosted Staking Opportunities

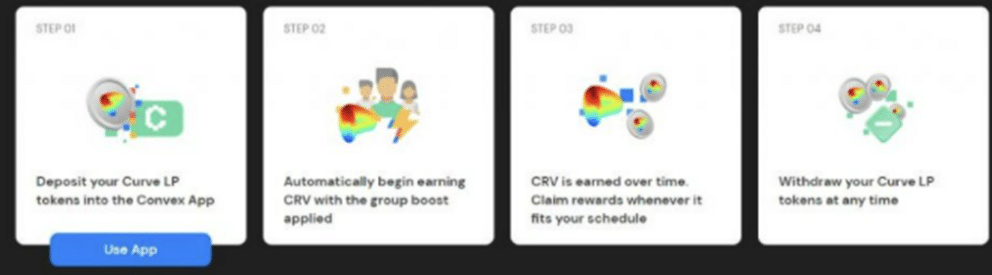

Convex Finance (CVX) provides boosted staking functionality by introducing an innovative DeFi protocol on the basis of the stablecoin exchange Curve Finance, thus providing additional liquidity and yield reward opportunities for its holders.

Convex Finance Functionality

Convex Finance is a platform used for offering additional interest rewards to CVX token holders. Boosted curve staking constitutes an innovative product in the DeFi segment that allows holders to receive higher passive income. As a result, their demand for CVX tokens may tend to increase even further in the following months. Curve Finance is highly effective in preventing people from incurring impermanent losses. Convex Finance mostly targets the following two categories of customers: CVX holders and liquidity providers. CRV holders can stake their tokens and receive additional passive income. Staking and boosting options are also available for liquidity providers. Overall, the effectiveness of stablecoins’ allocation may be considerably promoted.

The current price of the CVX token equals $31.13 with the circulating supply of 55.36 million tokens. Its maximum supply is 100 million tokens, thus its supply will continue to increase in the following years. Convex Finance’s total market capitalization equals $1.7 billion, making it the 66th largest cryptocurrency at the moment. The token’s price has reached the maximum level of above $57 at the very beginning of 2022 year. Despite the rapid decline in the following months, the price tends to restore recently. Convex Finance demonstrates only the moderate dependence on the overall tendencies in the crypto market, making it reasonable to use CVX for diversifying one’s portfolio and reducing the general market risks.

Reasonability of Investing in CVX

The demand for CVX is expected to increase in the long term because stablecoins are more actively used by modern investors. Moreover, they are interested in obtaining additional passive income. Therefore, Convex Finance may strengthen its competitive positions as compared with the major rivals in the industry. Thus, the CVX token has a high potential for market appreciation in the following months. However, the short-term dynamics is more uncertain and depends on various industry factors, including the adoption of stablecoins, tendencies in the DeFi segment, and investors’ access to financial resources and credit programs.

CVX has the major support level at the price of $15 that was tested several times within the past several weeks. Moreover, CVX has just successfully exceeded another support level of $30, making it reasonable for Convex Finance’s investors to open long positions. The target price level that corresponds to the resistance level of $50 may be the major investment objective for the following weeks. Overall, the investment in CVX is associated with comparatively low risks, while the expected market returns and financial gains may be considerable. However, the most reasonable approach is monitoring the overall evolution of the DeFi segment with the specification of potential implications for Convex Finance. Although the situation in the crypto industry is subject to change, CVX remains one of the most profitable investments from a long-term perspective.