Corruption and money laundering in Tether: protest campaign launched in the US

An advertisement in Times Square in New York accused Tether of corruption and aiding illegal activities.

Fox News journalist Eleanor Terrett twitted a photo of a massive billboard in the middle of Times Square. She noted that this action is part of a promotional campaign by the non-profit organization Consumers’ Research.

The organization’s executive director, Will Hild, compared Tether to the bankrupt FTX exchange. According to him, this is a huge “Ponzi scheme” that could result in significant losses for investors in the future.

Hield claims that Tether’s coin, USDT, was the most commonly used stablecoin for illicit activity in 2023. He also criticized the company for its lack of public auditing.

Does Tether help terrorists and human traffickers?

In its latest statement, Consumers’ Research accused Tether of facilitating illegal activities and circumventing international sanctions.

The organization has launched a public campaign against Tether, claiming that the company may be linked to terrorist organizations and human traffickers using USDT stablecoins.

In addition to accusations of using USDT to finance terrorism and circumvent international sanctions, Consumer’s Research claims that Tether refuses to undergo due diligence that would prove it has sufficient reserves for stablecoins.

“We are shining a light on Tether for their suspicious business practices, including a decade long refusal to perform an audit and the routine use of the product by terrorists and traffickers of drugs and humans.”

Will Hild, Consumers’ Research Executive Director

UN report on money laundering

In January, the United Nations Office on Drugs and Crime released a report showing that criminals in Southeast Asia are increasingly using USDT to launder illicit money.

An agency spokesman told the Financial Times that criminals had effectively created a banking system using new technologies, and the proliferation of wholly or poorly unregulated online casinos and crypto assets had strengthened the region’s criminal ecosystem.

The UN expressed concern about the pace of development of global regulation of the crypto-asset sector. Representatives of the organization believe they need to catch up to the speed of development and popularization of the segment.

Later, Tether representatives published an official response to the UN Office on Drugs and Crime’s report. The organization said it was disappointed with the agency’s approach and the selectivity of its analysis.

“We are disappointed in the UN’s assessment that singles out USDT highlighting its involvement in illicit activity while ignoring its role in helping developing economies in emerging markets.”

Tether representatives

The company emphasized cooperation with law enforcement agencies, including the FBI and the U.S. Secret Service. Tether also stated that the nature of the blockchain makes USDT an impractical choice for conducting illegal activities. This is emphasized by the numerous blocking of accounts carried out by the company.

In conclusion, Tether invited the UN to an active dialogue, noting that the company continues to advocate for financial transparency.

The questionable experience of tether founders and Wall Street control

In February 2023, The Wall Street Journal (WSJ), citing financial documents, reported that four people with scant financial experience managed Tether.

According to journalists, in 2018, Giancarlo Devasini, a former plastic surgeon, controlled the majority of shares.

Another 30% of the company’s shares were split equally between former electronics importer Jean-Louis van der Velde and gambler Stuart Hoegner. Due to the hacking of the Bitfinex crypto exchange, another 13% went to the largest client, Christopher Harborne. It is unknown who owned another 14% of the company.

That same month, the WSJ released another report. It said that U.S. Wall Street firm Cantor Fitzgerald has $39 billion in Tether bonds under management. The stablecoin issuer is said to have entrusted Cantor Fitzgerald with asset management back in 2021.

The report’s authors noted that the centralization of so much Tether reserves in the hands of one firm demonstrates Wall Street’s willingness to ignore cryptocurrency companies’ dubious pasts to manage billions of dollars of assets.

Questionable solvency

In May, the Deutsche Bank Expert Group published the results of a study of the stablecoin market. They named the weaknesses of this asset class and noted the lack of transparency of Tether.

After studying more than 330 different assets, experts concluded that 49% of stablecoins cease to exist within 8-10 years. Most are experiencing “turbulence” caused by speculative sentiment in the crypto market. Ultimately, they face losing their peg to the dollar, euro, or other currency.

Analysts also mentioned the collapse of the algorithmic stablecoin TerraUSD (TUSD) in 2022. It is known that as a result of the fraudulent scheme of Terraform Labs and its co-founder Do Kwon, investors lost more than $40 billion.

They called Tether’s solvency status questionable. Given the monopoly in the stablecoin market, if USDT collapses, its consequences will be more serious.

However, Tether criticized Deutsche Bank’s report. Representatives of the USDT issuer stated that it lacks clarity and substantial evidence. Additionally, according to Tether, the study relies on vague statements rather than rigorous analysis.

Company representatives said Deutsche Bank analysts had predicted several problems in the stablecoin sector but did not provide specific data to support their claims.

The issuer’s representative added that Deutsche Bank’s history of violations and fines raises doubts about the bank’s ability to criticize others in the industry.

Tether reports continue to shine

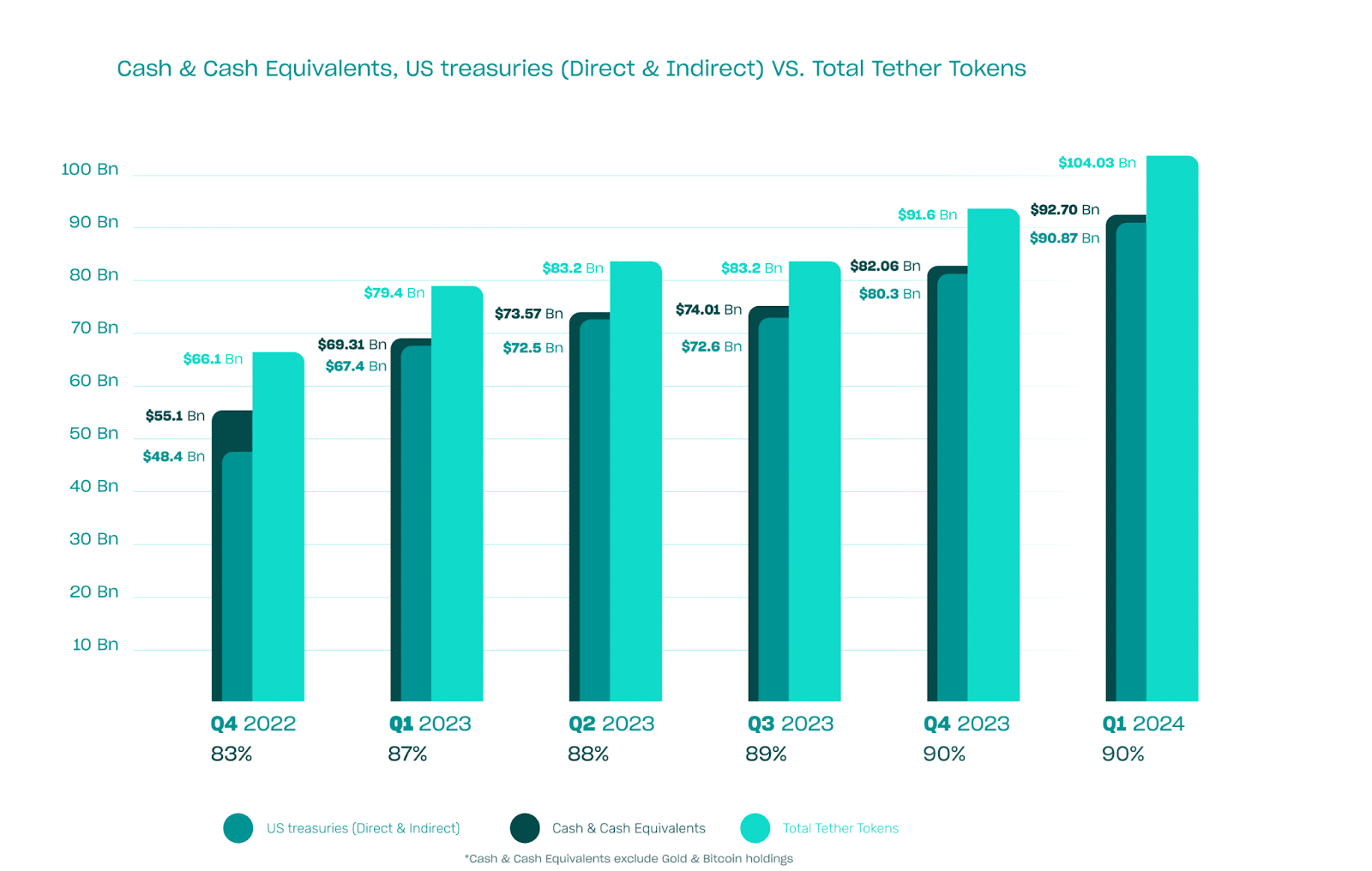

Despite many accusations, including a lack of reserve transparency, the firm’s latest report states that the USDT stablecoin is 90% backed by cash and cash equivalents. The asset’s supply volume increased by $12.5 billion in the first quarter of 2024.

Additionally, the firm reported record profits of $4.52 billion in the first quarter of 2024. About $1 billion came from income from the U.S. Treasury bonds. The report emphasized that in the first quarter, Tether also increased excess reserves by $1 billion. The total amount of this fund exceeded the company’s obligations by $6.3 billion.

Who to believe?

Throughout its existence, Tether has periodically faced accusations of opaque reserves, aiding money laundering and terrorist financing.

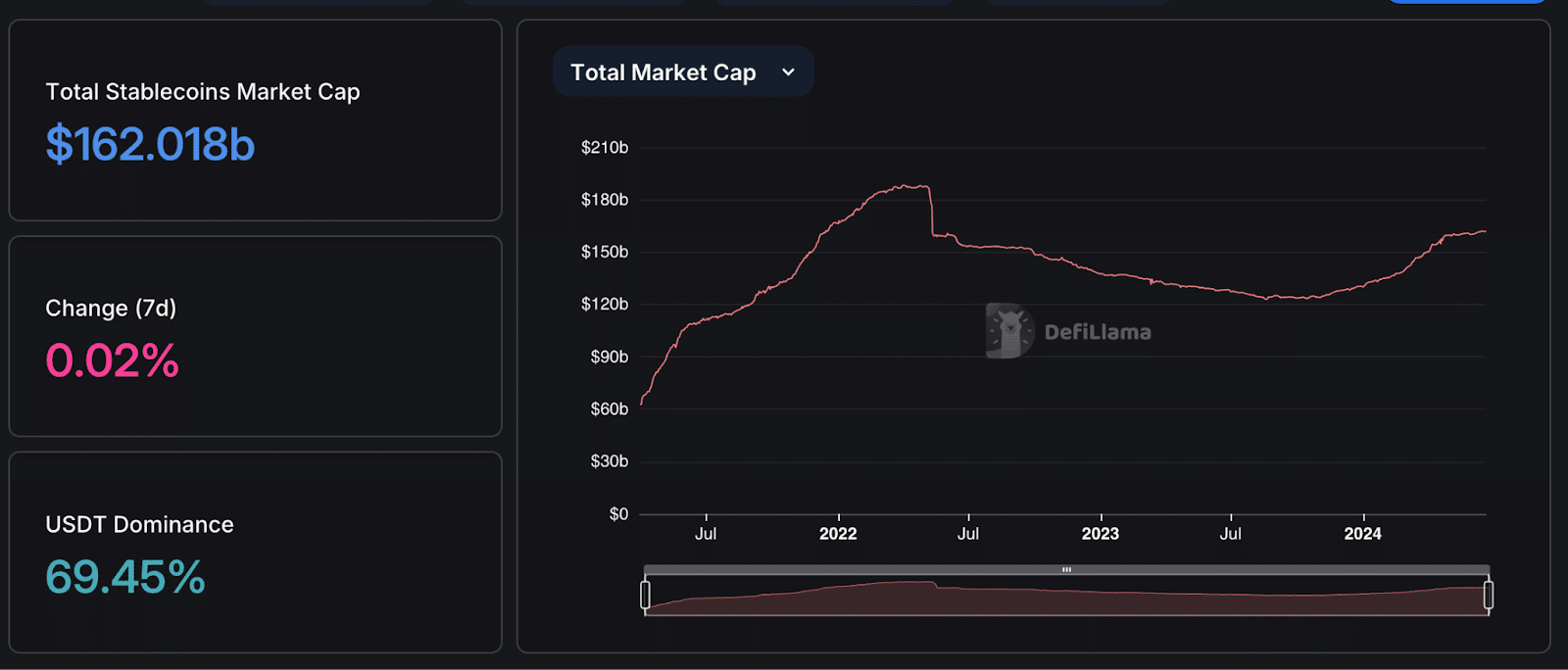

However, despite many accusations, USDT leads among stablecoins with over 69% market dominance with a total market capitalization of $162 billion.

In addition, the company’s profits continue to set records. Therefore, despite several accusations of the opacity of its activities, Tether continues to occupy a dominant position and remain afloat.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.