Crypto firms paid $5.8b in fines in 2023, more than entire traditional finance system

According to data, crypto and digital payments companies paid nearly $6 billion in fines in 2023 for shortcomings in customer checks and anti-money laundering controls violations.

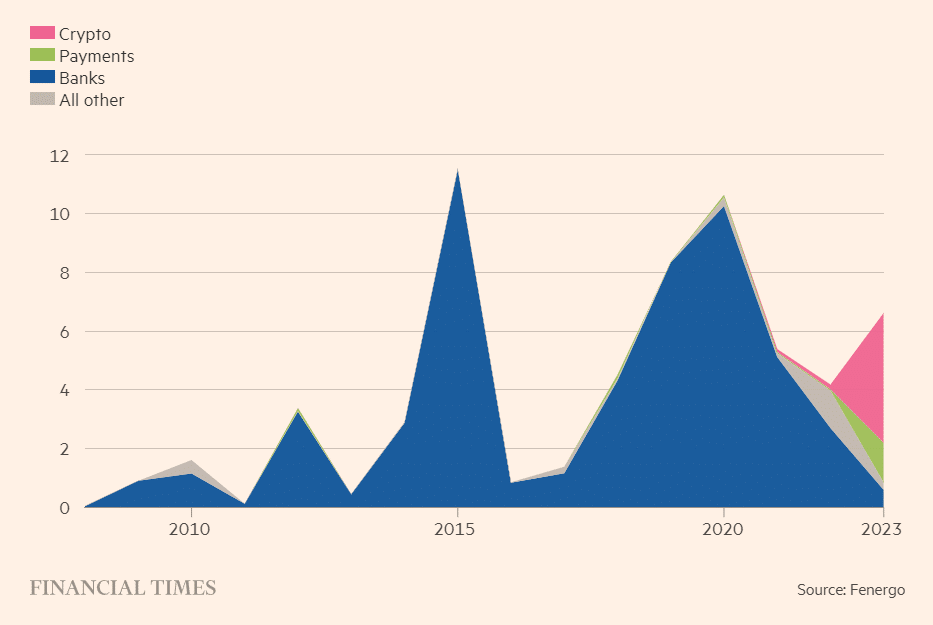

Crypto and fintech groups faced fines exceeding those of the entire traditional financial system in 2023, the Financial Times reports, citing data compiled by software provider Fenergo. Data revealed that the crypto industry paid a staggering $5.8 billion in fines last year, due to security shortcomings, anti-money laundering controls, and failures to uphold sanctions to address financial crime issues.

The majority of the sum included a $4.3 billion penalty imposed on Binance, described by U.S. prosecutors as “one of the largest corporate penalties in U.S. history.” As noted by the report, the figure far surpassed the $835 million paid by traditional financial services groups, marking the lowest level in a decade.

Data also indicated that total fines for money laundering and financial crime violations rose over 30% to $6.6 billion in 2023, although the figure remains below the 2015 peak of $11.3 billion. According to the Financial Times, the number of fines against crypto firms increased significantly last year, as crypto businesses faced 11 fines, compared to an average of less than two a year over the past five years.

In late November 2023, U.S. Commodity Futures Trading Commission (CFTC) Commissioner Christy Goldsmith Romero said the regulator would continue to pursue cryptocurrency exchanges that break the law, emphasizing the agency’s efforts to crack down on services that help users circumvent KYC rules.

Romero’s statement came shortly after Binance CEO Changpeng Zhao joined the other disgraced crypto entrepreneur Sam Bankman-Fried in making headlines, admitting to charges against him and his cryptocurrency exchange that included violating U.S. anti-money laundering laws.