China’s crypto investors triumph despite restrictions, net about $1.2b

In 2023, investors in China’s cryptocurrency market saw impressive gains, accumulating approximately $1.15 billion, according to Chainalysis.

This achievement placed them fourth globally, trailing behind the U.S., the United Kingdom, and Vietnam.

Chainalysis, a blockchain research firm in New York, highlighted a significant rebound in the crypto space, showing strong continued interest within China despite the government’s restrictions.

Notably, the total gains by crypto investors worldwide in 2023 amounted to $37.6 billion, a considerable recovery from the previous year’s losses.

However, the amount still contrasts with the explosive $159.7 billion gains made in 2021 during the crypto market’s last major bull run before it succumbed to a long-drawn winter.

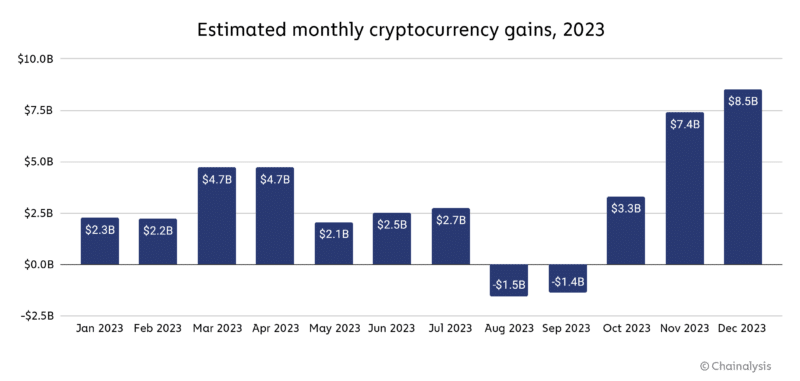

Per the analysis, crypto earnings in 2023 were steady all year until they dropped in August and September.

After that, earnings quickly went up, with November and December having much higher numbers than any other months before.

Earnings by American crypto investors easily surpassed those of the rest of the world, with Chainalysis estimating they made approximately $9.36 billion in 2023. In comparison, investors in the second-highest-earning nation, the United Kingdom, collectively made about $1.39 billion.

Although about eight times less than the U.S., mainland China’s performance is particularly remarkable given the stringent ban imposed by Beijing on cryptocurrency-related activities.

The persistence and success of cryptocurrency enthusiasts in the country underscore a resilient interest in virtual assets, even as the government maintains a tight grip on the sector.

Meanwhile, in Hong Kong, investors managed to secure $250 million in gains, indicating a lively market despite fluctuating fortunes since 2021.

Despite China’s general skepticism towards cryptocurrencies, the special administrative region has taken steps to attract crypto businesses and financial giants to its shores, aiming to be a leading center for the future of digital finances.

Globally, the continued strength of cryptocurrency adoption, especially in Asia, signals a promising horizon for the digital asset class, despite regulatory challenges and market volatility.

The early months of 2024 have shown promising trends that might herald gains comparable to the peak of 2021, with significant cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) experiencing notable price surges, with BTC even breaking its all-time high price record.

This optimism is met with cautionary advice from Chinese authorities, reminding investors of the inherent risks despite recent successes.