Crypto Lending: How to Earn Interest in the DeFi Markets

Crypto lending is one of the most popular investment activities in the burgeoning decentralized finance (DeFi) market. Read on to learn what crypto lending is and how you can earn yield in the DeFi markets.

What Is Crypto Lending?

Crypto lending refers to the act of handing your digital assets over to borrowers for a specific or flexible period of time in exchange for interest payments paid by the borrowers.

Digital asset lending in the DeFi market has gained popularity because anyone can lend crypto and earn a passive income. Also, lenders can typically achieve higher yields in the crypto interest markets than in the traditional fixed-income securities market.

Sign up today

Sign up today

How Does Crypto Lending Work?

Crypto lending involves three parties: the lender, the borrower, and the lending platform that brings them together.

The lender can lend their assets on centralized or decentralized lending platforms while the borrower puts up crypto assets as collateral to access a loan. They cannot access this collateral because it will be locked by the platform. If the borrower fails to repay the loan, the platform liquidates the collateral and gives it to the lender.

Although crypto lending generally works like this, the process differs depending on the platform used. Let’s take a look at how lending works on a decentralized and a centralized lending platform.

Lending on a Decentralized Platform

In the DeFi lending markets, the lender sends digital assets to a lending pool via a smart contract. These funds then become available to anyone who wants to borrow against them by taking out a loan. Next, the smart contract sends the funds to a borrower, who has to stake a certain amount of tokens as collateral.

The collateral in DeFi protocols is usually worth more than the loan itself. This is referred to as over-collateralization and is crucial because borrowers should ensure their collateral stays above the margin call to avoid liquidation.

Once the borrower receives the loan, the lender receives interest paid in the token they have deposited. For example, if you deposit ETH into a lending pool on Compound, you receive your interest payments in cETH. Lending protocols use a specific annual percentage yield (APY) to calculate the interest lenders will earn. However, extreme liquidity changes can alter a fixed APY.

Besides overcollateralized loans, some DeFi protocols also offer flash loans. These loans don’t require collateral but have to be repaid within the same transaction. If the borrower fails to pay the loan plus interest before the nodes validate the block transaction, the loan is reversed. Flash loans are ideal for arbitrage trading and portfolio refinancing and restructuring. Note that flash loans can only work on the same blockchain.

Lending on a Centralized Platform

Most centralized crypto platforms have similar regulations and infrastructure to traditional financial institutions. That means they observe know-your-customer (KYC) and anti-money laundering protocols, among other regulatory policies. They hold their users’ assets and keep them secure through cold storage and third-party insurance solutions.

In CeFi lending, all crypto lending transactions take place on the blockchain, but an intermediary facilitates the entire process.

Investors that want to earn interest on their crypto holdings will deposit assets on a platform like BlockFi or Nexo. The lending platform will then give a collateralized loan to a borrower for a certain period. The platform’s loan-to-value ratio (LTV) will determine how much the borrower will put up as collateral in relation to the loan amount. Also, the APY will vary from platform to platform. Therefore, you should research the platforms with the best rates before depositing your digital assets for lending purposes.

Lenders typically receive interest payments in their wallets daily or weekly. The lending platform ensures the borrower can’t access the collateral and run off with it during the loan period. This guarantees the lender will receive the collateral and will not incur a loss if the borrower fails to repay the amount.

How to Make Money Lending Crypto in the DeFi Markets

Investors can put their funds in DeFi protocols to earn investment income rather than HODLing their assets and waiting to cash out for a profit in the future.

DeFi lending requires connecting the supported wallet to a lending protocol and then selecting any of the assets available for lending. The asset will go to a lending pool, and the investor will start earning interest.

Besides earning interest on the asset lent, a lender can also earn governance tokens for supplying liquidity to a lending pool. The governance token is distributed by the protocol itself.

For instance, lending on Compound will earn you COMP, which gives you the right to debate, propose, and vote for protocol changes. However, most investors just sell it as it provides additional yield to Comp users.

How to Lend Crypto Using Compound: A Step by Step Guide

Compound is a DeFi lending protocol built on Ethereum. It’s one of the most popular decentralized lending platforms in the DeFi space.

As of June 8, 2022, USDT, DAI, and USDC recorded the largest supply rates on Compound, according to data from The Block.

Here is how you can lend on Compound:

- Visit the Compound website.

- Click “App.”

- Connect a wallet. If you’re using Metamask, get the web browser extension for Google Chrome.

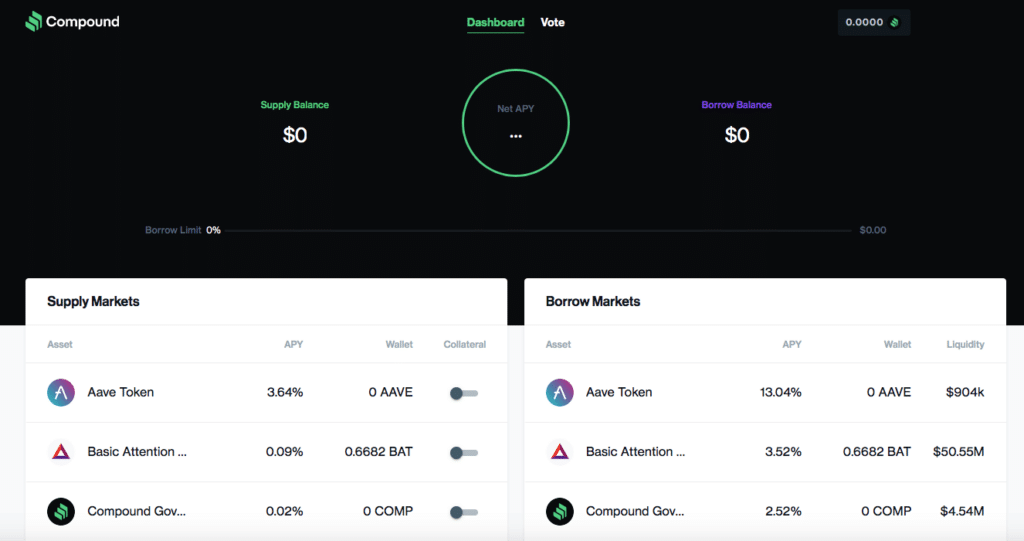

- Once you’ve unlocked and connected your wallet, the Compound dashboard will appear. It will reveal the supply and borrow balance, the net APY, and the supply and borrow markets. The supply markets are made up of assets you can lend to earn interest on stablecoins and other digital currencies. In contrast, the borrow markets refer to tokens you can borrow.

- Click an asset you’d like to lend from the supply list.

- Compound will display the supply and distribution APYs you’ll get for lending that asset. The former APY means the number of tokens you’ll earn per year, while the latter refers to the amount of COMP you’ll receive yearly.

- Next, enable the supply asset and confirm the transaction. In this example, let’s lend ETH.

- Enter the amount in ETH you want to supply and click “Supply” and submit the transaction.

- You’ll start earning interest immediately. The amount in the supply balance will increase over time.

- On the top-right side of the dashboard, you’ll see the COMP you’ve earned. You can click that tab to collect your COMP. You can also withdraw your balance to your Ethereum wallet.

- And that’s it!

While crypto lending in the DeFi markets offers an excellent opportunity to earn yield on the digital assets you are planning to HODL for the long-term, it doesn’t come without risks.

DeFi protocols are still very much a work in progress and an error in the code can lead to a loss of funds. Moreover, there is little to no recourse should you lose your funds in a DeFi lending pool. So, should you decide to dedicate funds towards lending pools, don’t invest more than you can afford to lose.

FAQs

What is Cryptocurrency Lending?

Cryptocurrency lending refers to depositing funds into a centralized or decentralized lending platform to earn interest (paid in cryptocurrency) from borrowers who are looking to access capital in the crypto markets.

What’s the Difference Between Centralized and Decentralized Crypto Lending?

Centralized crypto lending involves depositing funds in (and handing over your digital assets’ private keys to) a crypto finance company that matches lenders and borrowers in exchange for a fee.

Conversely, in decentralized crypto lending, lenders and borrowers are matched up using autonomous protocols powered by smart contracts to alleviate the need for a centralized authority. Moreover, both borrowers and lenders are not required to hand over the private keys to a third party as decentralized lending allows users to retain complete control over their funds.

Is Crypto Lending Risky?

Yes, lending crypto assets is widely considered a risky venture for investors. Centralized crypto lenders (as we have seen in recent months) can freeze user funds without notice if they run into financial difficulties. In the worst cases, users will not only lose access to their funds but all the money they placed with a lender entirely.

DeFi lending is not much safer despite the fact that users are able to retain control over their funds because vulnerabilities in smart contract code, operational errors, and fraud can lead to a loss of funds held in decentralized lending protocols.