Crypto market rebounds, lifting crypto-related stocks: what’s next?

What impact are Bitcoin and Ethereum rallies having on crypto-related stocks, and will this bullish trend continue?

Table of Contents

After weeks of bearish sentiment and market consolidation, the crypto market has made a comeback in the last 24 hours.

Bitcoin (BTC) has surged past the $70,000 mark, trading at $71,000 as of May 21. Ethereum (ETH) has experienced an even more dramatic rise, jumping over 20% to trade above $3,700.

This rally follows a key announcement by Eric Balchunas, a senior analyst at Bloomberg, who increased the odds of an Ethereum exchange-traded fund (ETF) approval from 25% to 75%.

Balchunas noted that the U.S. Securities and Exchange Commission (SEC) appears to be accelerating its approval process, possibly due to political pressure and its previously cautious stance on ETFs.

The bullish sentiment is further evidenced by the optimism among hashrate futures contract traders. Analysts at Hashrate Index predict a rise in hashprice over the next six months. They expect Bitcoin’s transaction fees to increase and the price to continue its growth.

This sentiment is supported by their recent post on X (formerly Twitter), where they mentioned that Bitcoin’s price rally to $70,000 is positively impacting hashprice, despite it being relatively low compared to previous halving epochs.

In response to the positive momentum in the crypto market, crypto-related stocks have also seen substantial gains.

Coinbase (COIN) surged 9% on May 20, reaching $225. Similarly, MicroStrategy (MSTR) also rose by 9%, trading at $1,727, suggesting that the bullishness in the crypto market is spilling over into stocks linked to the crypto sector.

In the light of these developments, let’s analyze how these stocks have performed recently and what we can expect next.

What’s happening with Coinbase?

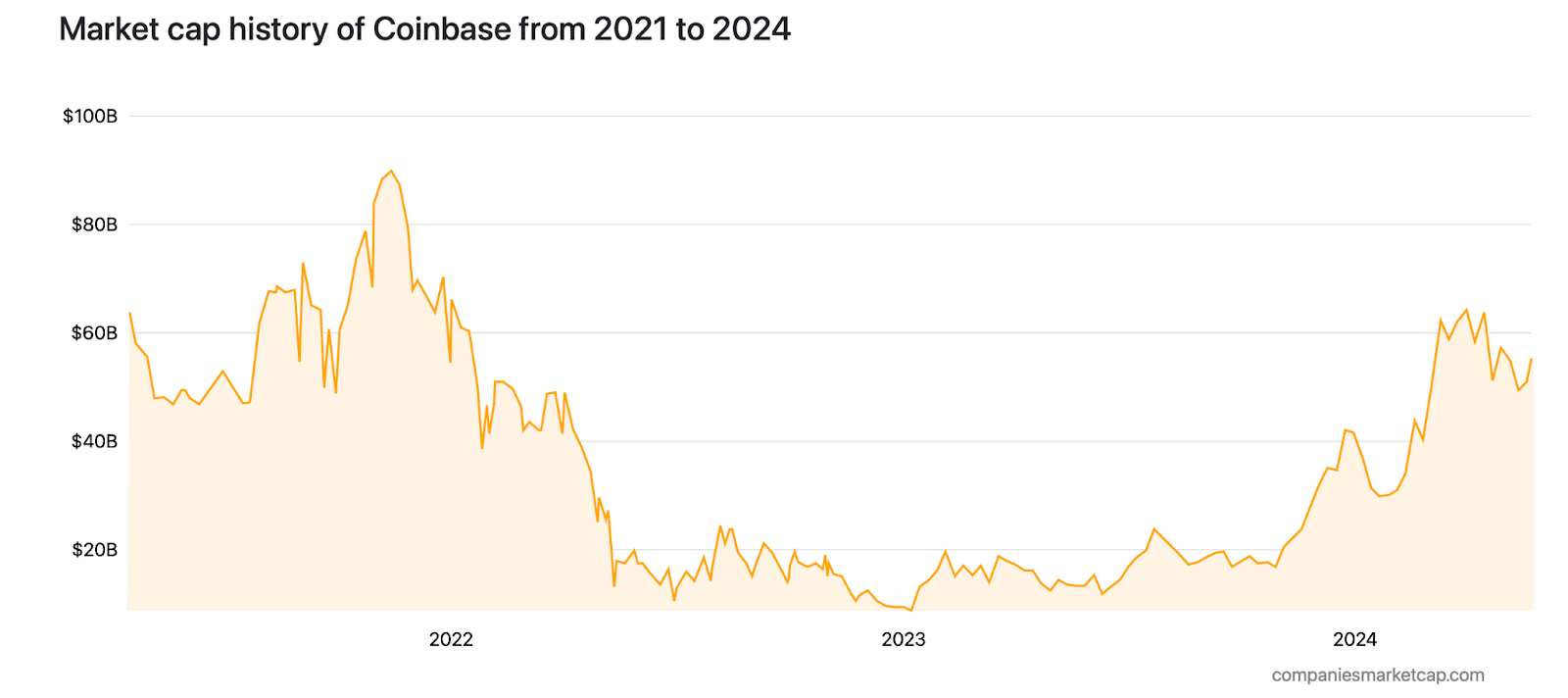

Despite experiencing a revenue decrease in 2022 compared to 2021, Coinbase has become the world’s 340th most valuable company, with a market cap of over $55 billion as of May 2024.

After bottoming out at $47 per share in June 2022, Coinbase’s share price surged to $225 on May 20, representing a 378% increase. Over the past year, the stock has risen more than 268% and climbed over 113% in the last six months.

In 2023, Coinbase reported a revenue of $3.97 billion, a decrease from the $7.83 billion reported in 2021. However, the company’s first-quarter revenue for 2024 soared to $1.6 billion, marking a 72% increase from the previous quarter.

This surge in revenue and stock price is primarily driven by a boost in transactions, thanks to the wider crypto market’s upswing and a favorable change to crypto accounting rules.

The company’s net income for the first quarter of 2024 was $1.18 billion, or $4.40 per share, a turnaround from a year-ago loss of $78.9 million, or 34 cents per share.

Coinbase’s revenue drivers include consumer transaction revenue, which stood at $935 million for the quarter, and total transaction revenue, which almost tripled to $1.08 billion. Additionally, subscription and services revenue contributed $511 million for the quarter.

The company also benefited from the surge in BTC and ETH prices during the first quarter. Bitcoin reached a new all-time high above $73,000 in March, while ETH underwent its first major upgrade in over a year. These events led to increased trading volumes and demand for Coinbase’s services.

Furthermore, Coinbase has positioned itself as a key player in the institutional investor space, particularly since the approval of the spot BTC ETF by the SEC in the U.S. Many of these funds have partnered with Coinbase as their custody partner, collectively boosting demand for Coinbase and its services.

Microstrategy’s Bitcoin bet

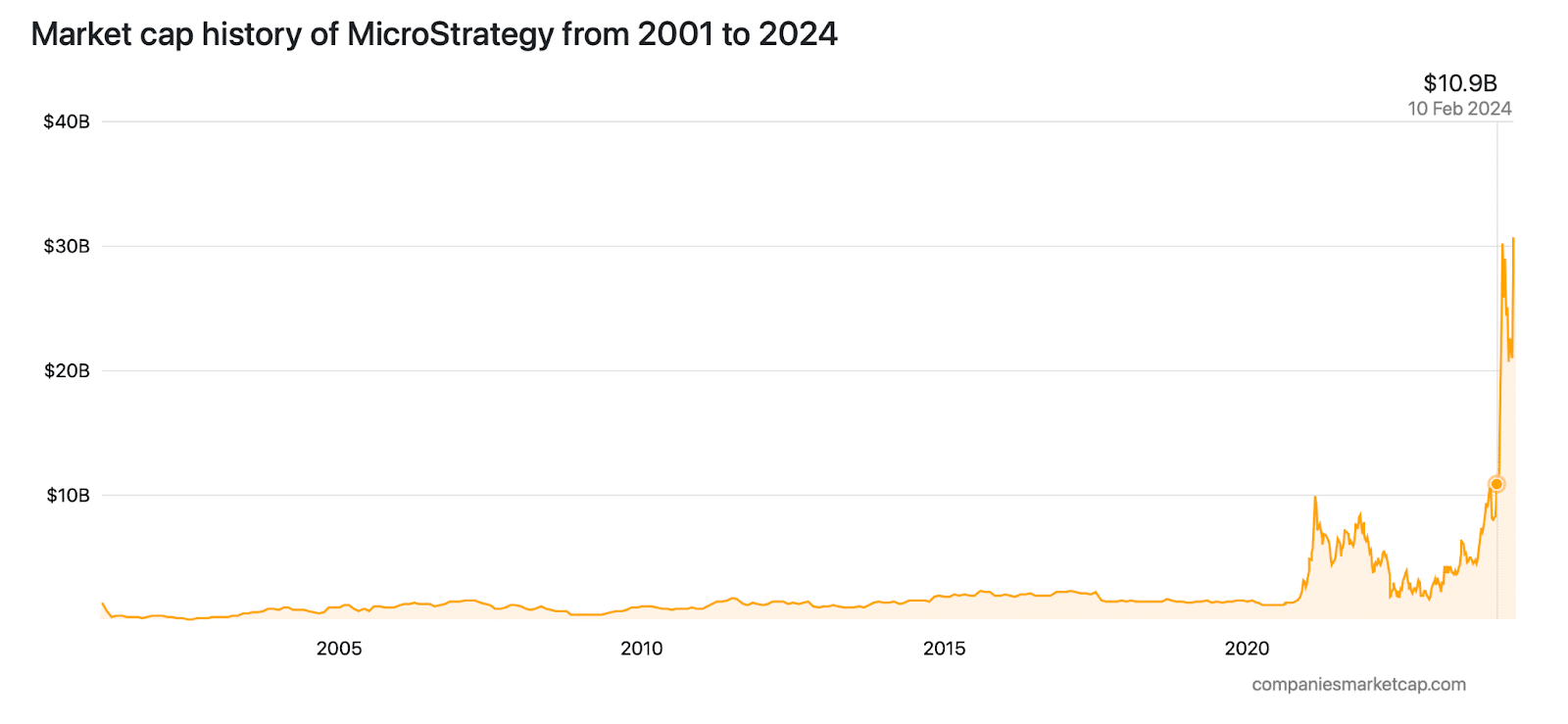

MicroStrategy, ranked as the world’s 654th most valuable company by market cap as of May 2024, has experienced notable fluctuations in its market cap over the years.

Between 2020 and 2024, the company’s market cap surged from $3.60 billion to $30.63 billion, marking a 750% increase. This surge is particularly impressive considering the company’s market cap declined by 73.42% to $1.63 billion by the end of 2022.

The company’s share price also tells an interesting story. Between 2000 and 2020, MSTR’s share price remained relatively stagnant, hovering between $100 and $150 with no major upswing.

However, since 2020, the share price has been on a steady rally, gaining over 1180% in the last five years and nearly 500% in the last year alone, trading at $1,727 as of May 20.

Despite these positive trends, MicroStrategy’s revenue has seen some fluctuations. In 2023, the company reported a revenue of $0.48 billion, a decrease from the $0.51 billion reported in 2021. Similarly, the company’s revenue in 2022 decreased to $0.49 billion from $0.51 billion in 2021.

MicroStrategy’s price-to-earnings ratio (P/E ratio) is another metric worth noting. As of the latest financial reports, the company’s P/E ratio stands at 200.144, a stark increase from -1.09 at the end of 2022.

The high P/E ratio indicates that investors are willing to pay a premium for MicroStrategy’s earnings, possibly due to the company’s strong performance and growth potential. However, high P/E stocks usually carry substantial risks.

One key factor contributing to MicroStrategy’s recent success is its substantial bitcoin holdings. As of Q1 2024, the company holds 214,400 bitcoins, valued at approximately $15.26 billion as of May 21.

These holdings, acquired at an average cost of $35,180 per bitcoin, have generated a paper profit of around $7.76 billion for MicroStrategy.

Meanwhile, MicroStrategy’s addition to the MSCI World Index further validates its position as a key player in the stock market.

The MSCI World Index is a broad global equity-market index comprising nearly 3,000 companies from 23 developed countries and 24 emerging markets. MicroStrategy’s inclusion in this index suggests growing BTC exposure in traditional portfolios.

What’s the largest BTC miner up to?

Marathon Digital Holdings (MARA), the world’s 2,379th most valuable company by market cap as of May 2024, has experienced extreme volatility in its market cap over the years.

Between 2020 and 2024, the company’s market cap surged from $0.85 billion to $6.09 billion, marking a 616% increase. This surge followed a sharp decline in 2022, where the market cap dropped by 88.15%.

The company’s revenue trends also reveal an interesting narrative. Marathon’s 2023 revenue stands at $0.38 billion, an increase from $0.11 billion in 2022 and $0.15 billion in 2021.

Despite these improvements, Marathon has faced challenges, as evidenced by its current P/E ratio of -5.16667. At the end of 2022, the P/E ratio was -0.5516.

The negative P/E ratio can be attributed to various factors, including operational challenges, unexpected equipment failures, transmission line maintenance, and weather-related curtailments at its mining sites.

Meanwhile, Marathon’s stock performance over the years has been strong, with the share price rallying nearly 617% over the past five years and approximately 121% in the last year.

In the first week of May, Marathon’s stock was listed by S&P Global, a crucial milestone for the company. Despite this positive development, Marathon faced operational challenges in the first quarter of 2024, mining only 2,811 Bitcoins, a 34% decrease from the previous quarter.

As a result, Marathon reported first-quarter earnings per share (EPS) of $1.26, well above Wall Street estimates of $0.02. However, this figure included a favorable mark-to-market adjustment due to newly approved FASB fair value accounting rules and the recent increase in bitcoin prices, making the comparison to forecasts complex.

Amid these challenges, the company remains bullish on its future, maintaining its 2024 guidance of ramping up to 50 exahash per second (EH/s) and anticipating additional growth in 2025.

What to expect next?

The future of the crypto market largely hinges on its performance in the coming months.

Should the market continue its upward trajectory, we can expect a ripple effect benefiting crypto-related stocks. Conversely, any downturns will likely have an adverse impact on these stocks.

Currently, the momentum is positive, with Bitcoin Trading well above $70,000 and Ethereum experiencing a wild surge, reaching around $3,700.

A critical factor to watch is the potential approval of an Ethereum ETF. If approved, it would be a strong bullish signal, likely driving up prices further and driving more investment in both crypto and related stocks.

Despite the optimistic outlook, you should exercise caution. The crypto market is notoriously volatile, and sudden shifts can lead to substantial losses.

Diversifying investments and having a clear risk management strategy are essential to navigate the uncertainties in this space. Never forget the golden rule of investing: never invest more than you can afford to lose.