Crypto markets react to Binance’s battle with CFTC

The US Commodity Futures Trading Commission (CFTC) took legal action against the largest crypto exchange, Binance, on March 27. Consequently, the digital asset market has been showing bearish signs.

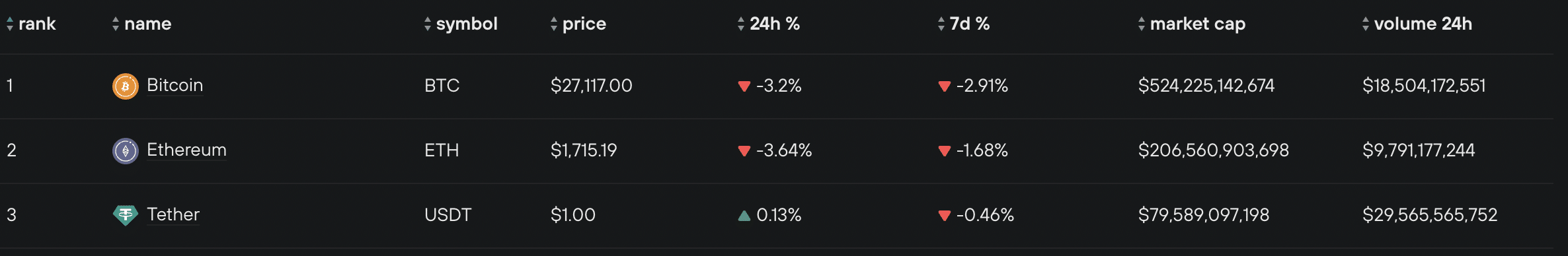

As the debate gets more sizzling among the crypto community, the top three cryptocurrencies have witnessed notable price drops. For instance, bitcoin (BTC) has dropped 3.2% in the past 24 hours and is trading at $27,133 when writing.

The BTC price drop comes while the number of its holders has regularly increased over the last three months. According to Glassnode, wallets holding 0.01 or more bitcoins have reached 11,718,623, marking a new all-time high (ATH).

The second-largest crypto asset, ethereum (ETH), however, has dropped less than bitcoin. ETH is down by 0.8% in the past 24 hours and currently trading at roughly $1,750. Per Glassnode data, the number of receiving ethereum wallets, with a seven-day median average, has reached the 10,271.375 mark, a five-month-high level.

Moreover, Binance’s native asset, BNB, has not been safe either amid the skirmish with the US regulator. BNB dropped by 6.29% in the past 24 hours, trading at around $308 at the time of writing.

You might also like: Binance’s CZ responds to ‘unexpected’ CFTC accusations

CFTC’s regulatory effort comes a few hours after Binance announced the opening of a web3 hub in Georgia, a country at the intersection of Europe and Asia.

Binance’s CEO, Changpeng Zhao (CZ) stated the exchange’s global regulatory compliance in response to the CFTC. He pointed out the platform’s know-your-customer (KYC) and anti-money laundering (AML) policies.

Read more: CNBC report shows how Chinese Binance customers bypass crypto bans