Crypto trading volume jumps 19% for first time in four months: CCData

Crypto trading volume surged 19% in July, hitting $4.94 trillion, marking its first increase in four months, according to CCData.

In July, global crypto trading volumes on centralized exchanges rose 19% to $4.94 trillion, marking the first increase in four months, per CCData latest research report. The firm attributes the surge in volume to the launch of spot Ethereum exchange-traded funds in the U.S. and positive sentiment expressed by U.S. political figures at the Bitcoin conference in Nashville, Texas.

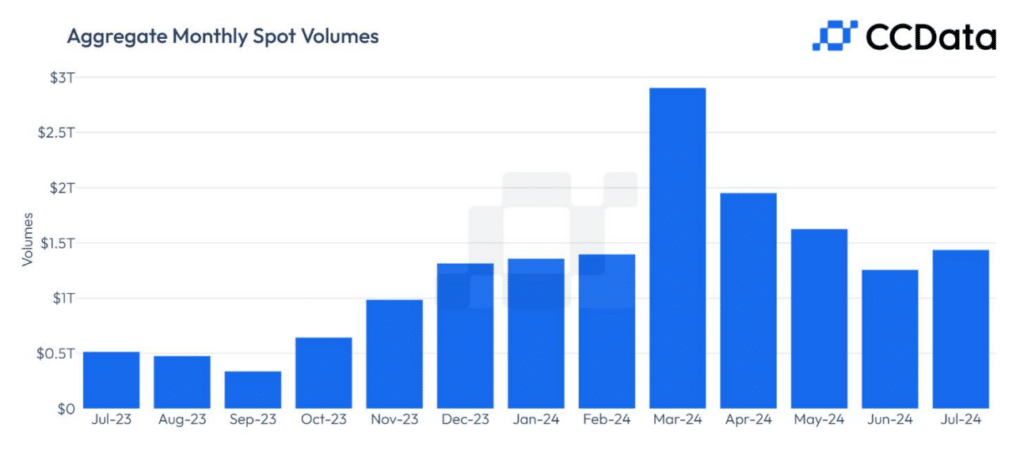

The report indicates that both spot and derivatives trading volumes on centralized exchanges saw significant growth, with spot trading volumes rising 14.3% to $1.44 trillion and derivatives trading volumes increasing by 21% to $3.50 trillion. The share of the derivatives market climbed to 70.9%, the highest level since December 2023.

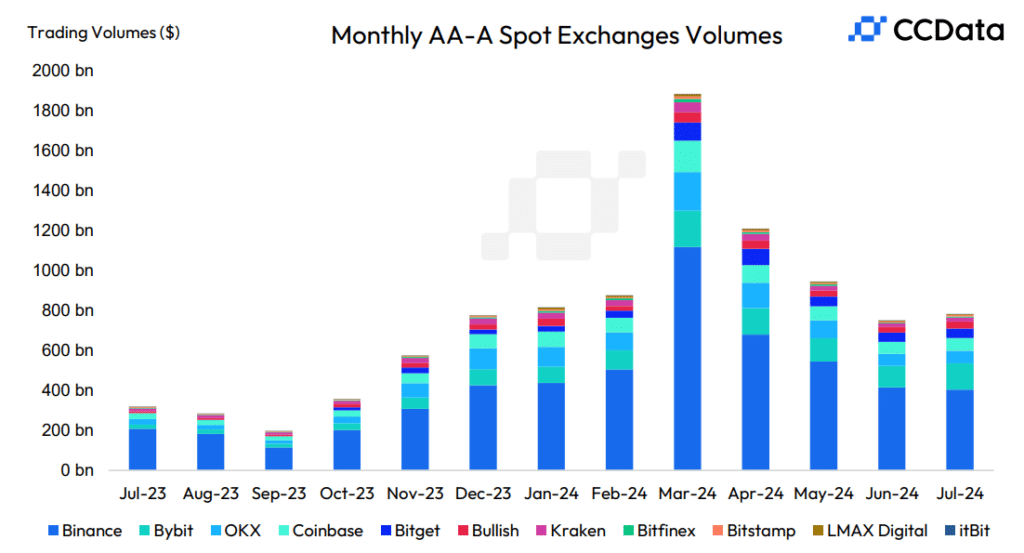

CCData says Bybit emerged as a top performer in July, with its spot trading volume increasing by nearly 23% to $132 billion, the third-highest monthly volume in the exchange’s history. This boost in trading activity helped Bybit achieve a record market share of 9.18%, cementing its position as the second-largest spot exchange.

Despite this, Binance retained its position as the largest spot exchange with a market share of 28.1%, though this represents a decline of 4.9% from the previous month, the report reads.

In the derivatives market, Binance also maintained its dominance with a 43.5% market share, followed by OKX at 19% and Bybit at 15.1%. The report also highlights a significant spike in volatility in early August, which led to the second-highest daily spot trading volume since May 2021, a time when China’s ban on Bitcoin (BTC) mining disrupted global markets.