Demand appears to have outpaced issuance as Bitcoin halving nears

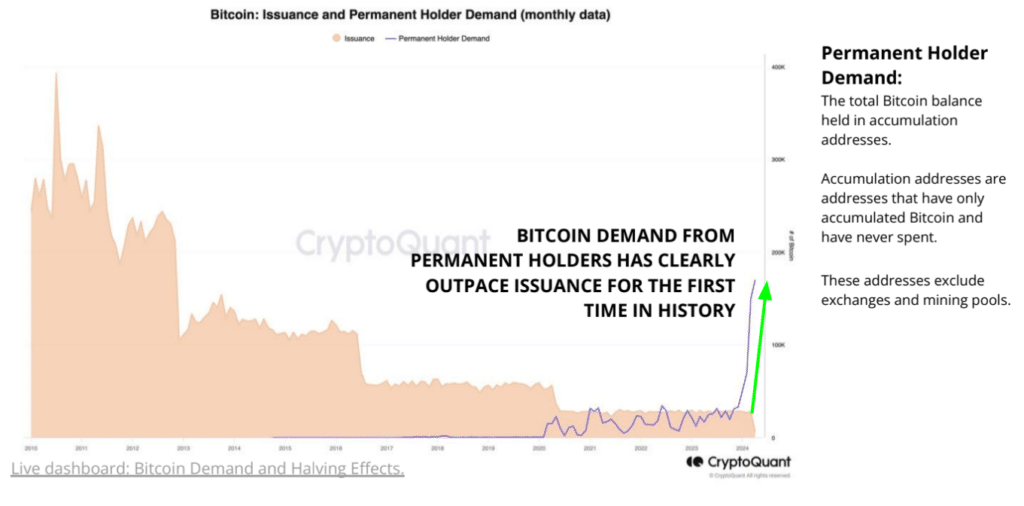

Analysts at CryptoQuant found that Bitcoin demand from “permanent holders” has outpaced BTC issuance for the first time in history, adding fuel for the potential price rally.

Bitcoin‘s demand from long-term holders has surged past issuance levels for the first time in the cryptocurrency’s history, according to a recent research report from CryptoQuant.

The cohort of long-term holders is now adding around 200,000 BTCs per month, analysts say, adding that the figure is far exceeding the monthly issuance of approximately 28,000 BTC.

Analysts at CryptoQuant noted that with the upcoming halving set to reduce monthly issuance to about 14,000 BTC, such a demand marks a significant shift in Bitcoin’s supply-demand dynamics.

Commenting on the upcoming halving, Tezos co-founder Arthur Breitman described the event as a “reduction in security budget,” suggesting that while the reward change for miners could benefit the Bitcoin ecosystem in the short term by potentially addressing overpayment for security, underscoring the need for future adjustments to emission policies to maintain security.

“Today, this is a good thing because Bitcoin likely overpays for security at the moment, but it’s also a reminder that, in the long run, the emission policy will have to change to maintain security. Financial projections based on the halving are unserious.”

Arthur Breitman

Despite Breitman’s caution, crypto executives hold differing views. Arthur Hayes, former head of BitMEX, anticipates BTC price declines before and after the halving, attributing it to limited dollar liquidity during this period. Meanwhile, Marathon CEO Fred Thiel suggests that the halving’s impact may already be priced in, citing successful spot exchange-traded fund (ETF) approvals.

As Bitcoin miners prepare for reduced rewards, the upcoming halving in mid-April will cut mining rewards from 6.25 to 3.125 BTC per block. This process occurs automatically, with the Bitcoin network protocol adjusting itself upon reaching a programmed block height. The milestone of mining all 21 million BTCs is projected around 2140, after which miners will rely solely on transaction fees for rewards.