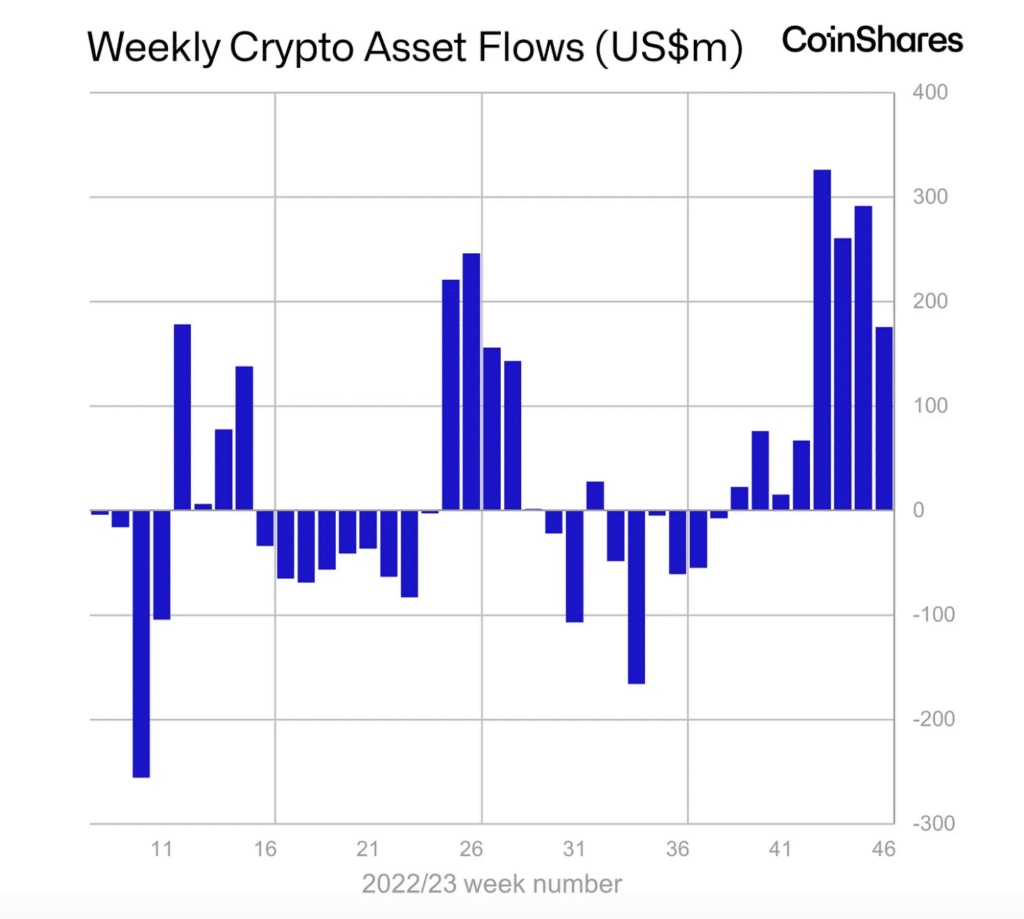

Digital asset investment inflows totaled $176m last week

ETP inflows continued last week, reaching $176 million, a much larger share of the cryptocurrency’s total volume.

According to the CoinShares report, the positive dynamics of capital inflows have continued for eight weeks in a row. Meanwhile, ETP’s share of total cryptocurrency volumes is growing, averaging 11% compared to the long-term historical average of 3.4% and well above the 2020-2021 bull market averages.

However, inflows still lag significantly behind 2021 and 2020 figures of $10.7 billion and $6.6 billion, respectively.

Trading volumes grew to an average of $3 billion per week, double this year’s average of $1.5 billion.

Bitcoin (BTC) remains dominant, with inflows of $155 million over the past week. Moreover, over the past eight weeks, the inflow amounted to 3.4% of the total assets under management.

“We believe this continued positive sentiment is related to the imminent approval of a spot-based Bitcoin ETF in the US.”

CoinShares report

The inflows came from a wide range of altcoins, with the most notable being Solana (SOL), Ethereum (ETH), and Avalanche (AVAX), which received $13.6 million, $3.3 million, and $1.8 million, respectively. Uniswap (UNI) and Polygon (MATIC) noted minor outflows of $0.55 million and $0.86 million respectively.

Prior to this, in the period from Nov. 6 to Nov. 10, the inflow of funds into cryptocurrency-based exchange products reached $293 million. Since the beginning of 2023, the volume of infusions has exceeded $1.14 billion. This makes the current influx the third largest in the history of monitoring by CoinShares analysts of the movement of funds on the specified products.