Dorsey’s Block stock plummets after alarming report

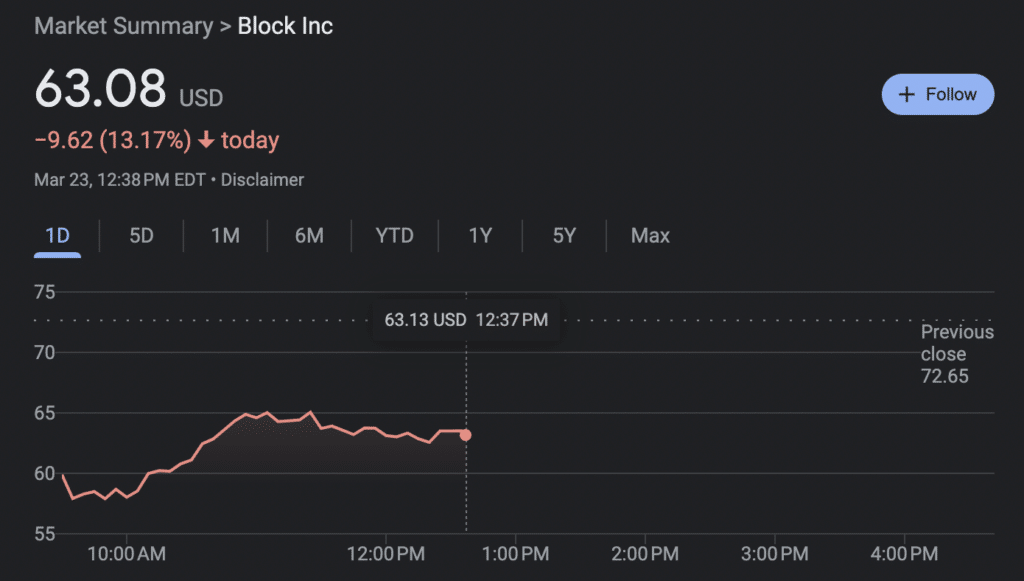

Block Inc.’s stock currently trades at $62.66, experiencing a loss of 13% today and 12% over the past month. This significant fall in price followed the release of an alarming report by Hindenburg Research.

On March 23, Hindenburg Research revealed short positions in Block Inc. (SQ.N) and accused the Jack Dorsey-led payments company of overstating user numbers and understating customer acquisition costs. In response, Block’s shares dropped 20% to $57.85 in premarket trading. If the decline continues, this could be the steepest percentage fall since March 2020.

Hindenburg Research stated on its website that its two-year investigation concluded that Block “has systematically taken advantage of the demographics it claims to be helping.” The US short-seller, which instigated a market rout of over $100 billion in India’s Adani Group, reported that former Block employees estimated 40%-75% of accounts they reviewed were fake, involved in fraud, or were additional accounts tied to a single individual.

According to Hindenburg, Block obscures the number of individuals using the Cash App platform by reporting misleading “transacting active” metrics filled with fake and duplicate accounts.

The firm also highlighted that co-founders Jack Dorsey and James McKelvey collectively sold over $1 billion worth of stock during the pandemic as the company’s share price surged. Additionally, other executives, such as finance chief Amrita Ahuja and Cash App lead manager Brian Grassadonia reportedly sold millions of dollars in stock, as mentioned in the report.

Despite the recent decline, Block shares are up 15% from six months ago and 0.63% since the start of the year. However, the stock price remains significantly lower than its early August 2021 price of over $275.

The findings follow recent reports that Block Inc. exceeded the expectations of industry analysts and experienced a rise in its share price through after-hours trading — despite the firm’s bitcoin revenue falling due to the price drops.