Electricity demand to double in 3 years. How AI and mining play a part

Electricity demand worldwide could double over the next three years, mainly due to cryptocurrency mining and artificial intelligence. How will crypto keep up?

AI and cryptocurrencies accounted for almost 2% of global electricity demand in 2022, which illustrates the scale of their energy impact. This increase is mainly due to the growing complexity and volume of computing operations for artificial intelligence and the ever-increasing number of cryptographic transactions.

According to a recent report from Bloomberg, which cites the International Energy Agency, global demand for electricity from data centers, cryptocurrencies, and artificial intelligence could more than double over the next three years, amounting to the equivalent of Germany’s entire electricity demand.

AI’s appetite to grow

Artificial intelligence (AI) has become an integral part of modern life, streamlining various aspects. However, its extensive integration raises concerns about a substantial surge in energy consumption. According to Alex de Vries, a graduate student at the University of Amsterdam Free University, the global AI infrastructure might demand an energy equivalent to that of an entire country.

It’s been nearly a year since the AI industry entered a phase of rapid expansion triggered by the introduction of the OpenAI ChatGPT AI chatbot. The training and operation of neural networks, such as the one powering this service, involve a notably energy-intensive process. Hugging Face, an AI-developing company and a key contributor to large language models, disclosed that training its platform demanded 433 megawatt-hours (MWh) of electricity – roughly equivalent to the energy needs of 40 average American households for a year. In comparison, ChatGPT, being a more extensive project, consumes approximately 564 MWh daily.

And there seems to be no way out of this situation. Companies worldwide are working to improve AI systems’ efficiency in hardware and software, making them less energy-intensive. However, increasing the efficiency of these machines will inevitably increase the demand for AI services, causing resource use to increase even further—a phenomenon in economics known as Jevons’ Paradox.

How AI will change electricity demand

Amid these developments, the most substantial projects raise concerns. According to the paper by Alex de Vries, Google currently handles a staggering 9 billion search queries daily. Using this information, the researcher calculated that if AI were employed for every Google search, it would demand approximately 29.2 terawatt-hours (TWh) of energy annually – a figure on par with Ireland’s total consumption. While de Vries acknowledges that this extreme scenario may not materialize in the near future, he does concede that the expansion of AI servers will contribute to an overall rise in energy consumption. By 2027, the cumulative volume could range between 85 and 134 TWh annually.

This volume is comparable to the needs of larger countries, such as Argentina, the Netherlands, and Sweden. Increasing the efficiency of AI accelerators will allow developers to repurpose processors to solve problems associated with AI algorithms, which will additionally lead to an increase in the related energy consumption.

The future of artificial intelligence, where everyone has a personal assistant, relies heavily on having access to affordable energy. Without it, the pace of AI progress could slow down considerably. There’s hope for cost-effective energy sources through innovations like new energy solutions or advancements in thermonuclear fusion. Currently, creating robust neural networks, exemplified by projects like ChatGPT, is a privilege limited to a handful of major players with hefty investments, such as OpenAI.

Is it profitable to mine cryptocurrencies?

There are over 8,000 data centers scattered worldwide, with approximately 33% located in the U.S., 16% in Europe, and 10% in China. The numbers are rising, with more centers in the planning stages. In Ireland, where the data center landscape is expanding, the International Energy Agency (IEA) anticipates the sector to devour 32% of the country’s electricity by 2026, a significant jump from 17% in 2022. Currently, there are 82 centers in Ireland, with 14 under construction and another 40 awaiting approval.

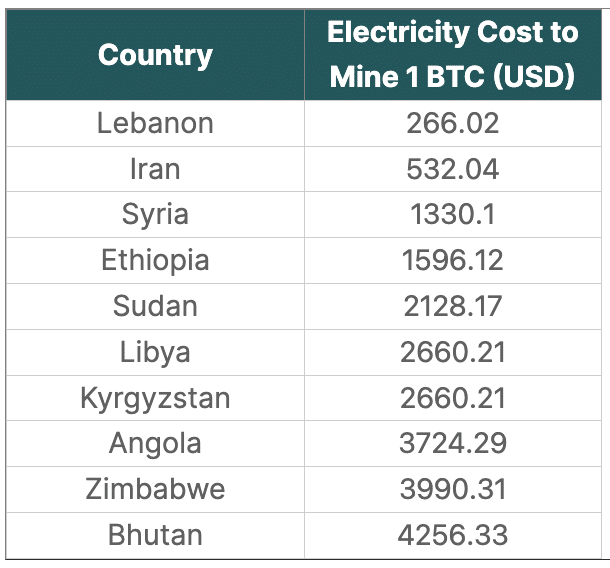

However, as of July 2023, analysts at CoinGecko pointed out that Europe remains the least profitable region for mining. By mid-2023, only 65 countries were deemed profitable for individual Bitcoin mining, according to electricity cost data. Europe contributed five countries to this list, while the Americas, particularly South America and the Caribbean, offered opportunities in eight countries. In Africa, 18 regions were profitable for mining, and in Asia, 34 countries presented favorable conditions for mining endeavors.

At the same time, mining Bitcoin is unprofitable in 82 countries. The top 10 most expensive countries with the highest electricity costs for households when mining one BTC were Italy ($208,560.33), Austria ($184,352.44), Belgium ($172,381.50), Denmark ($166,795.06 ), Germany ($163,336.79), Ireland ($159,612.50), Lithuania ($152,163.92), Netherlands ($137,798.79), United Kingdom ($130,616.23) and Cayman Islands ($128,222.04).

Electricity demand after halving

The upcoming Bitcoin (BTC) halving in the spring of 2024 is poised to bring about a noteworthy shift in mining dynamics.

Halving directly impacts the profitability of mining operations, as miners receive fewer Bitcoins for their efforts when the reward is halved. This can particularly affect miners facing high energy and equipment costs, potentially leading some to suspend their operations if they can’t recover their expenses.

A substantial increase in the price of Bitcoin could offset the decrease in block rewards by enhancing the value of the mined Bitcoins. To put it formally, if the price of Bitcoin doubles, individuals may be more willing to invest in electricity costs to enhance the returns from their mining efforts. Consequently, there’s a possibility that the demand for electricity in mining could see an increase.

Will the predictions come true?

As new technologies emerge, they naturally demand more resources, and electricity is no different. Consequently, predictions about heightened consumption by both AI and miners appear quite plausible.

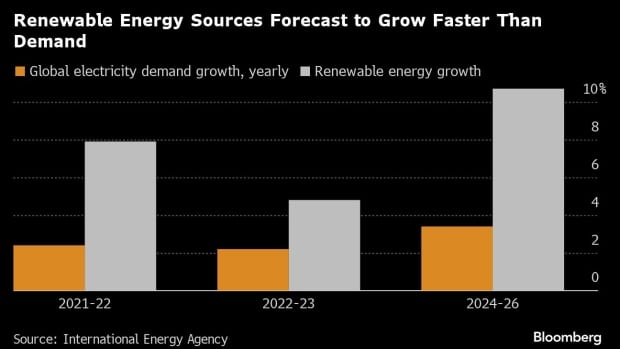

However, there is a catch. Meeting the increased demand for electricity will require exploring new energy sources, particularly renewables.

If successful in finding and implementing these new sources, there’s a strong likelihood that AI and cryptocurrency miners could emerge as significant players in the energy consumption sector.