ETFs set for record 2024 — but how are Bitcoin funds doing?

Exchange-traded funds have bucked the trend with higher-than-average volumes in August — yet Bitcoin ETFs suffered extensive outflows towards the end of the month.

New figures show that there was an insatiable appetite for exchange-traded funds in August — despite the summer being a traditionally sleepy month in the financial world.

According to BlackRock, net inflows rocketed to $129.7 billion last month, meaning the bustling sector is well on track to exceed the annual record of $1.3 trillion set back in 2021.

The launch of Bitcoin ETFs back in January has been something of a success story, with the latest figures showing that major U.S. funds now hold 4.58% of BTC’s total market cap.

And BlackRock’s iShares Bitcoin Trust is the leader of the pack here, with $20.56 billion in assets under management.

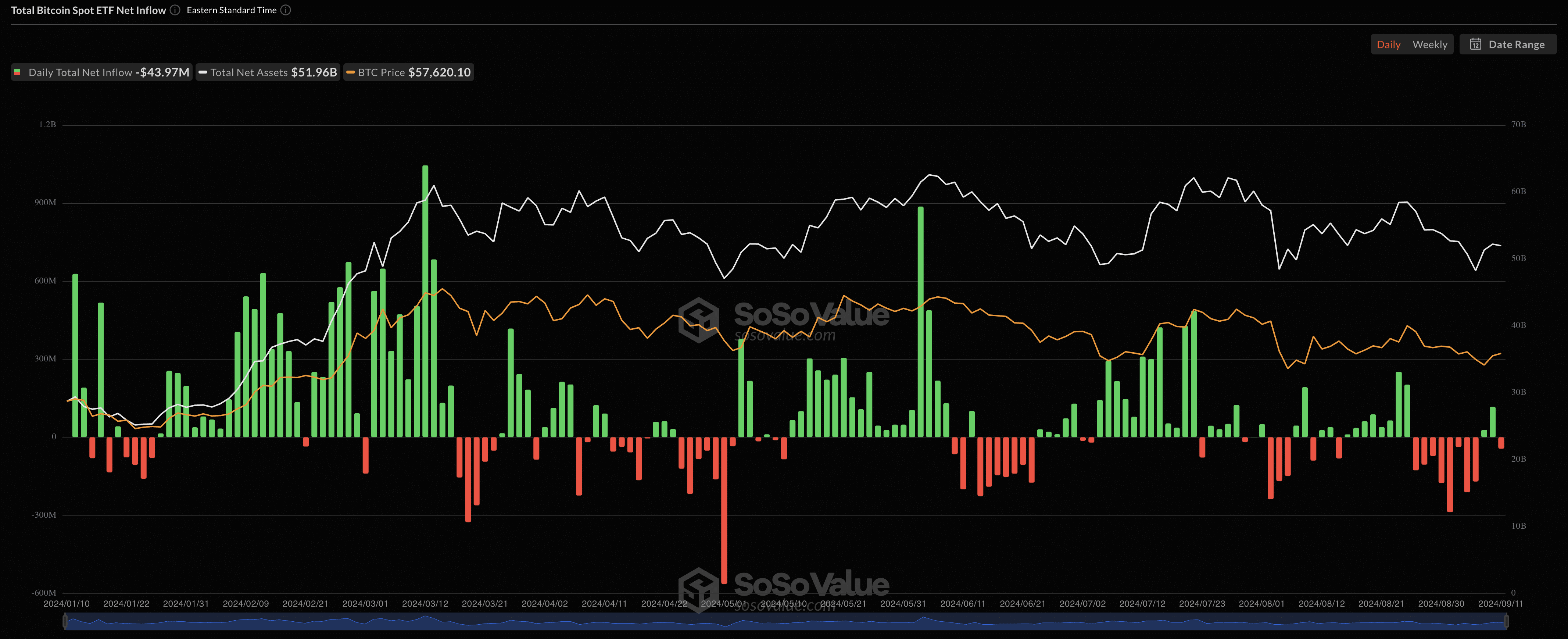

But BTC ETFs have faced plenty of turbulence in recent weeks — with the market racking up eight consecutive days of outflows from August 27 to September 6.

That coincided with the world’s biggest cryptocurrency tumbling to lows of $52,598.70, with some doomsayers predicting that a prolonged dip below $50,000 was a possibility.

Zooming out, and it’s undeniable that jitters surrounding the state of the U.S. economy are to blame for the recent tepid performance of BTC ETFs.

Although inflation has now fallen to 2.5% — not far from the Federal Reserve’s target of 2% — “anemic” jobs numbers have left some traders fretful that a recession may be round the corner.

The Bank of England and the European Central Bank have already moved to cut interest rates, but we’re yet to see whether Fed Chairman Jerome Powell will follow suit next week.

According to the CME FedWatch Tool, which tracks sentiment among interest rate traders, there’s an 85% chance of a 25 basis point cut on September 18.

Meanwhile, 15% expect the U.S. central bank to go even further than this — and predict that the reduction could amount to 0.5 percentage points.

Powell has been extremely cautious to act until now, insisting he wanted to see more data to prove that inflation is under control, but some critics now fear this cut may be too late.

All of this could indicate why there’s so much weariness in the crypto markets right now — with a score of 37 on the Fear & Greed Index reflecting nervousness among traders.

But the bigger question now is this: what lies ahead for Bitcoin ETFs in the rest of the year, and are there any trends from the year to date?

Who’s buying Bitcoin ETFs?

You could argue that there has been an unfair expectation that BTC ETF inflows would be “up only,” and would continue to surge in a straight line.

But pullbacks are to be expected — and given how Bitcoin remains a relatively new asset class, it’s pretty understandable that some investors may get cold feet because of its volatility.

Jim Bianco, the president of Bianco Research, shared some interesting analysis into how exchange-traded funds based on BTC’s spot price have fared since January.

His research reveals inflows have slowed substantially of late — and while inflows hit $12 billion across all BTC ETFs in the first two months, that slowed to $4 billion in the six months after.

When Bitcoin sank to lows of $52,900 back on Friday, holders were collectively sitting on unrealized losses of $2.2 billion — a record high.

While BTC ETFs have been touted as an avenue for institutional investors and high net worth individuals to finally gain exposure to crypto’s price swings without owning the asset directly, Bianco argues that “small tourist online retail” represents their biggest audience.

Overall, average trade sizes stand at $12,000 for these exchange-traded funds, which he noted amounts to a fraction of the trades seen for ETFs in other sectors.

What’s more, Bianco estimates that just 15% of adoption for Bitcoin ETFs is coming from traditional finance institutions, meaning there’s a lot more work to be done.

He wrote on X that it may take another four years for momentum to pick up — and institutional investors may need further convincing before they decide to start allocating funds:

The first eight months of Spot BTC trading have shown that “build it (Spot BTC ETFs), and the boomer will come” was never “a thing.” Patience and another couple of seasons (including a winter or two) and development breakthroughs are needed first.