ETH 2.0 Staking Rate Grows to 10.72% as The Merge Approaches

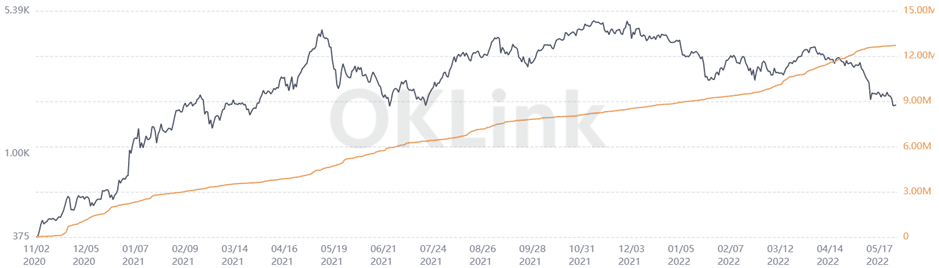

As Ethereum continues its transition to the proof-of-stake consensus mechanism, the number of staking ETH 2.0 deposit contract addresses has reached the level of 12.7 million (more than 10% of altcoin’s total market supply).

ETH 2.0 Staking Growth

The transition to Ethereum 2.0 constitutes the major project for Ethereum’s developers in the following months as it will contribute to reaching higher scalability and effective cost optimization in the future. During the transition period, Ethereum encourages a steady increase in the rates of staking, appealing to more effective operations that can be achieved as well as environmental benefits. The general requirement is that an ETH holder should deposit at least 32 ETH to activate the validator software. At the same time, various pooling solutions are available for enabling even minor holders to participate in staking and earn rewards.

Despite the overall ETH price decline within the past 6 months, the amount of ETH staked continues to grow at a stable rate during the analyzed period. The reason is that the growing number of people recognize additional possibilities associated with earning some passive rewards by allocating some of their ETH holdings to staking.

As many validators are also Ethereum’s holders, they demonstrate a strong conviction in its long-term growth, thus demonstrating their additional support for the transition. The overall progression towards Ethereum 2.0 also confirms the higher confidence in the long-term perspectives of the project for members of a broader crypto community.

ETH 2.0 Staking Market

At the present moment, the Ethereum 2.0 staking market is comparatively mature and allows achieving a high level of overall stability, indicating the maximum likelihood of the successful transition to the proof-of-stake mechanism in 2022-2023. The total amount of ETH staked equals 13.27 million. More than 10.7% of the ETH total market is currently staked. In this manner, the system can effectively maintain its overall flexibility and stability, while, at the same time, enabling the harmonization of all major stakeholders’ interests. The total number of validators exceeded 395,000, indicating the high degree of the network’s decentralization.

Every ETH holder can become a member of a broader staking community by selecting one of the following options: participating in solo staking, staking as a service, or pooled staking. All of these options have their specific structure of potential rewards and risks. Ethereum’s consultants may assist in recommending a specific option for different individuals, although a number of relevant factors, including ETH holdings, risk preference, and willingness to collaborate with other members should be considered in order to make better-supported choices. Despite the changing structure of staking options, the overall staking trend remains stable over time.

Ethereum’s Price Potential

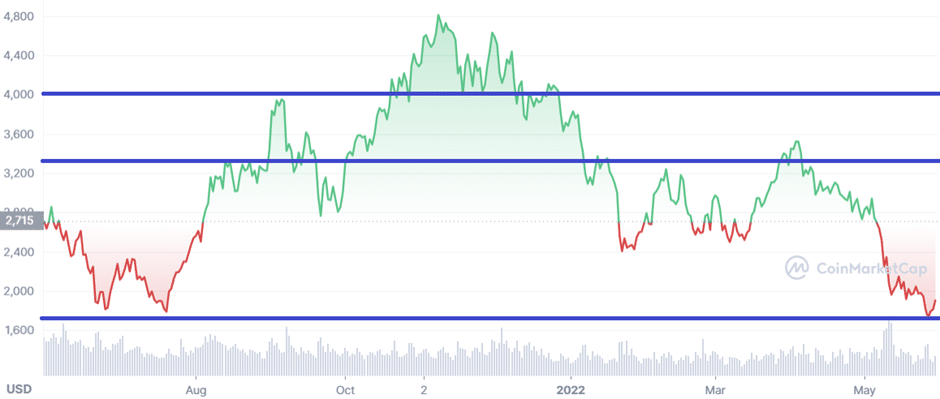

Ethereum has been seriously affected by the recent market collapse due to the rapidly declined activity of DeFi and NFT users which negatively influenced their demand for ETH. Moreover, Ethereum is not perceived as a store of value by most crypto holders who mostly prefer Bitcoin for such a purpose, especially during “crypto winters”. However, the current market conditions indicate some ETH price consolidation with a high likelihood of the local trend’s reversal in the following weeks. Technical analysis allows identifying the major support and resistance levels that may be used for determining the points of entry and maximizing investment returns in the long term.

The major support level of $1,750 allows preventing ETH from capitulating to absolute minimums and losing its position as the major altcoin. Ethereum successfully uses this level for approaching a new cycle of price growth with the major target that corresponds to the resistance level of $3,300. This level process is historically significant for confirming or negating the previous trends. In case Ethereum overcomes it, the next major goal is $4,000 which will be the final resistance before testing the all-time high levels.

The growing staking activity in Ethereum’s network constitutes one of the major factors that increase the demand for ETH and create the optimal conditions for its price appreciation at least to the first major resistance level of $3,300 within the next few months. The subsequent dynamics will largely depend on the monetary policy implemented by the Federal Reserve and investors’ access to cheap credit resources.