Ethereum dips as PEPE whales take profits

In the past week, ethereum’s price has seen a slight 4% dip, coinciding with PEPE whales taking profits, as the token dropped 20%.

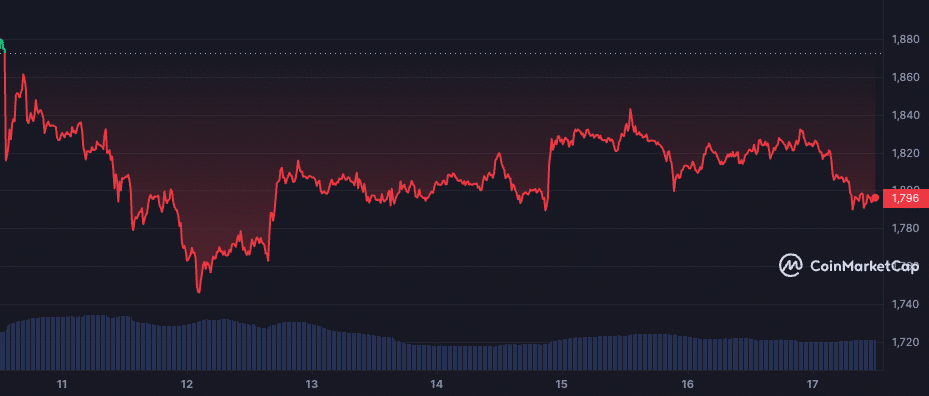

Over the past week, ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization, has seen a slight downturn in its value.

According to CoinMarketCap data, ethereum, which stood at $1,879 seven days ago, is now valued at $1,796, marking a 3.97% decrease in its weekly valuation.

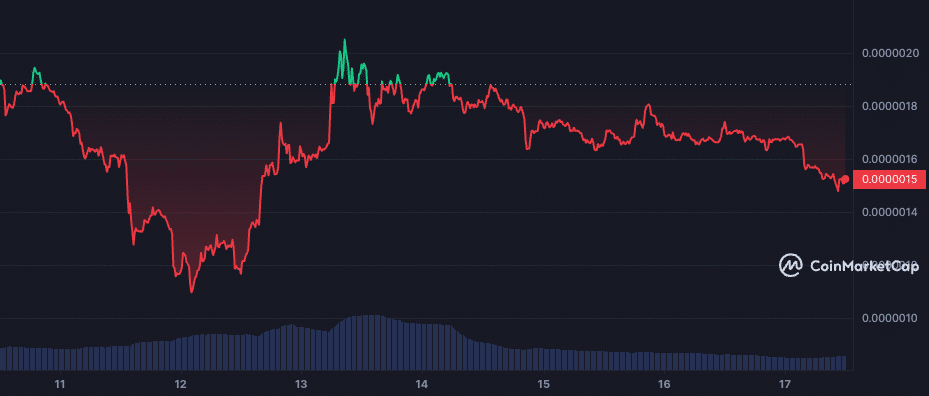

Simultaneously, a different story has been unfolding in the case of PEPE, a relatively lesser-known token affiliated with the popular Pepe the Frog internet meme.

The PEPE token, although not mainstream, has generated a buzz within the crypto community recently. Seven days ago, the token was valued at $0.00000169 and today it stands at $0.00000151 with a 20.33% decline in price.

A considerable number of PEPE whales – large holders of the token – have recently decided to realize profits. This activity is suspected to be one of the factors affecting ethereum’s price dip.

While the decrease in ethereum’s weekly price could be attributed to the larger volatility inherent to the crypto market, the timing of this dip coincides with the shift in the investment behavior of PEPE whales.

Nevertheless, despite the weekly dip, ethereum continues to hold a firm position in the market, standing as the platform of choice for numerous decentralized applications (dApps) and smart contract operations. Its long-term performance continues to be a central point of interest for investors and market analysts.

PEPE, initially created as a humorous nod to an internet meme, has managed to gain traction.

PEPE has become a very popular token in a short amount of time, and ethereum continues to hold on to the second position in the global crypto pantheon as measured by market cap.