Ethereum is set to outperform Bitcoin as the spot ETH ETF narrative comes into play, analysts say

Analysts at QCP Capital note that despite Bitcoin’s quick drop to $59,000, funding is back to sensible levels and the more likely scenario is the outperformance of the ETH/BTC pair.

In a volatile overnight session, Bitcoin (BTC) quickly set a new all-time high of $69,400 only to undergo a rapid decline, plummeting to $59,200 within a matter of a few hours. This steep downturn resulted in the liquidation of over $1 billion worth of leveraged long positions on Binance alone.

However, as noted by analysts at QCP Capital, the market quickly rebounded as the dip was aggressively bought up, with the $60,000 level demonstrating robust support. According to analysts, funding rates have returned to “sensible levels,” hovering around 30% annually on Binance. Therefore, analysts at QCP Capital anticipate Ethereum (ETH) to outperform Bitcoin, noting that the narrative surrounding a spot Ethereum exchange-traded fund (ETF) gains traction.

“[…] the likely scenario is the outperformance of ETHBTC as the ETH spot ETF narrative comes into play.”

QCP Capital

Despite the leverage unwinding, term futures are still trading at a significant premium to spot prices, analysts emphasized, adding there has been a surge in client activity aimed at selling the spot-forward spread, particularly for contracts expiring between September and December this year, allowing investors to secure risk-free yields for the year.

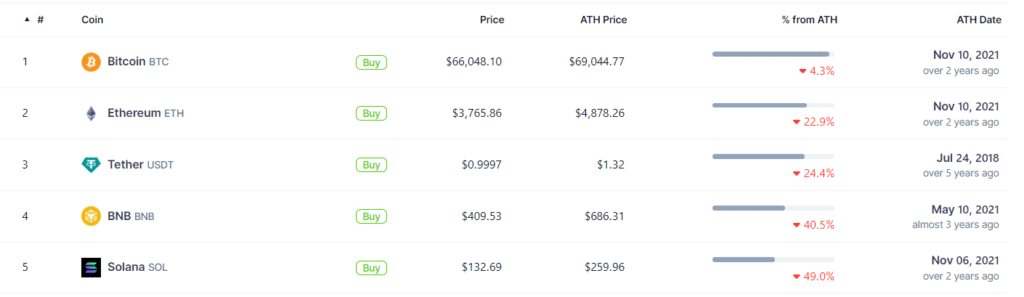

As of press time, Ethereum remains significantly distant from its all-time high compared to Bitcoin, suggesting a potential for rapid value appreciation. While Bitcoin trails only 4.3% from its historical peak reached on Mar. 5, Ethereum lags behind its 2021 record by over 20%, according to CoinGecko data.

As the crypto landscape evolves, Wall Street behemoths are intensifying efforts to introduce more spot crypto ETFs, following the U.S. Securities and Exchange Commission’s (SEC) approval of all applications for spot Bitcoin ETFs earlier in January. Reports indicate ongoing discussions between the SEC and Ethereum ETF applicants, with decisions on spot Ethereum ETFs delayed until May at the earliest. VanEck’s filing, in particular, awaits a response by May 23, alongside applications from BlackRock, Franklin Templeton Grayscale, and Invesco Galaxy.