Ethereum perpetual futures open interest reaches record high

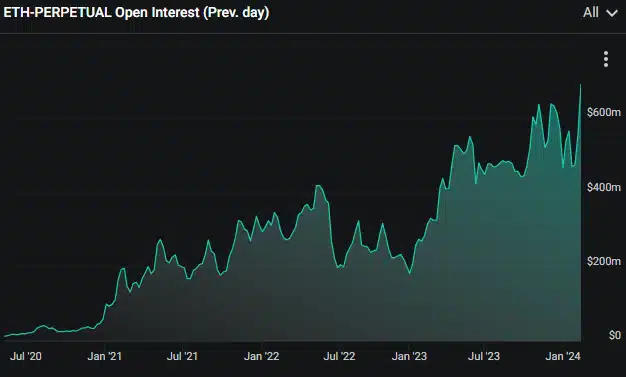

Ethereum has seen open interest in perpetual futures increase across major centralized crypto derivatives exchanges since early February.

The cumulative open interest for ETH futures is now over $10.1 billion, as reported by CoinGlass.

Crypto derivatives exchange Derebit has recorded an all-time high in the total number of outstanding perpetual futures contracts for ether, with open interest exceeding $690 million.

Unlike traditional futures, perpetual contracts do not have an expiration date, allowing traders to maintain positions indefinitely.

The recent surge in open interest indicates a boost in trading activity and interest in ether derivatives, possibly due to speculation, market attention, or hedging strategies related to the cryptocurrency.

This uptrend coincides with anticipations of potential market-moving events, such as the possible approval of a spot Ether ETF by the US Securities and Exchange Commission.

Among other investment firms, Franklin Templeton has recently initiated steps towards launching a spot ether ETF, indicating growing institutional interest.

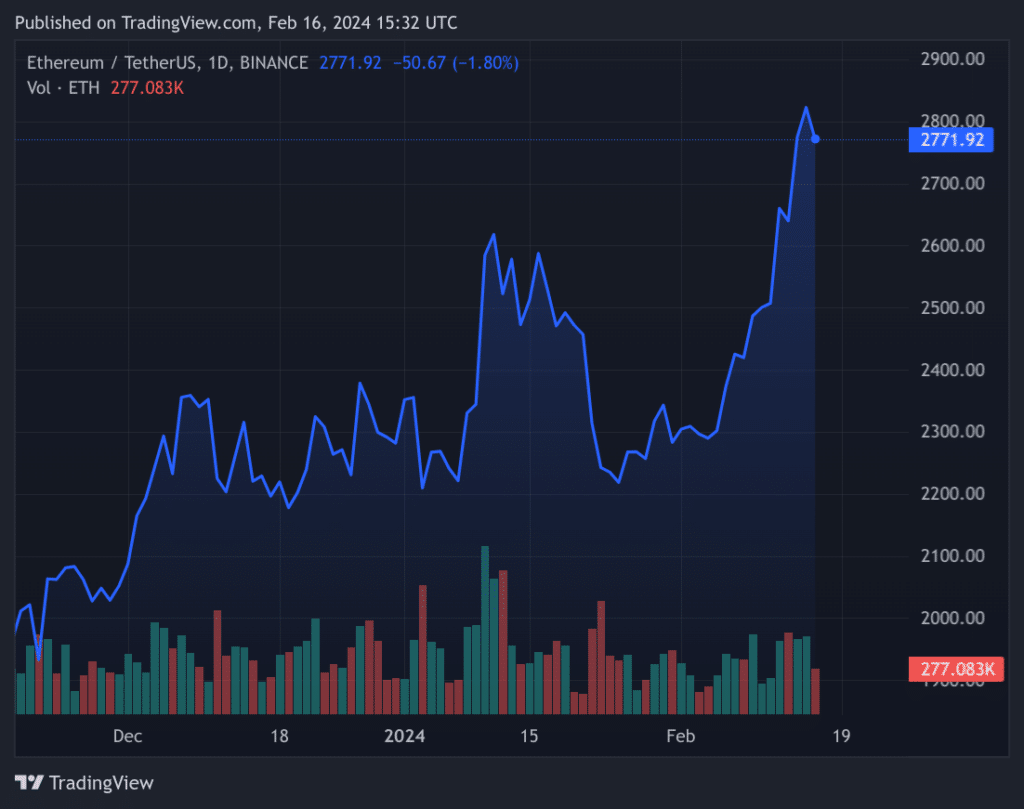

Additionally, the funding rate for ether perpetual futures on Deribit has risen from 0.00045% to 0.035% since February’s start, signaling an increased demand for long positions.

This shift suggests a bullish sentiment among traders, forecasting a potential price increase for ETH, which recently rose 1.57% to $2,841.