Ethereum price targets $5k in April as whales buy $3.1B ETH in 10-days

Ethereum price closed March 2024 at $3,646.8, sealing a modest 11.8% growth for the month: recent trends observed among ETH whale investors could set the pace for a positive start to April.

Ethereum price started March 2024 positively, but struggled for momentum after the Dencun Upgrade deployed on March 13. Recent trends shows the catalyst behind the ETH price stickiness appear to have flipped bullish. How will ETH prices react in April 2024?

After Dencun upgrade sell-off, ETH whales are buying again

In the first twelve days of March 2024, Ethereum gained 25%, reaching a new yearly peak of $4,092. But things took a negative turn around March 13, just as the Ethereum dev team deployed the widely-anticipated Dencun Upgrade.

Strategic swing traders selling-the-news and large stakeholders taking precautionary measures to mitigate possible network disruptions, all flooded the market, leading to a 13% dip within a week of the landmark network event.

However, vital market data trends show that investors started to take on a positive disposition again over the past two weeks.

Indicatively, Santiment’s chart below shows real-time changes in ETH supply held by top 10,000 holder addresses.

Since March 20, Ethereum top 10,000 wallets have acquired 860,000 ETH worth approximately $3.1 billion, after having offloaded 30 million ETH in the week that followed the Dencun Upgrade.

While the 860,000 ETH is only a fraction of what the whales initially sold in mid-March, the sustained acquisition of is likely to aid a positive start to April 2024 for two main reasons.

Firstly, whale investors wield significant influence on price action as well as the behavior of other retail investors. Hence, the whales’ $3.1 billion acquisition in the last 10-days could send bullish signals to retail investors and potential new entrants that ETH market is now in recovery phase after the market-wide sell-off experienced in the second half March.

Secondly, whale investors are known to have a longer investment horizon, which could keep a significant portion of the $3.1 billion purchase off the market supply in the near-term.

These key factors could set the stage for Ethereum price to make a positive start to April 2024.

Ethereum market supply has dropped by $1.3 billion

Further corroborating the bullish stance above, another critical Ethereum on-chain metric shows that the number of ETH coins readily available to be traded across exchanges in now in decline.

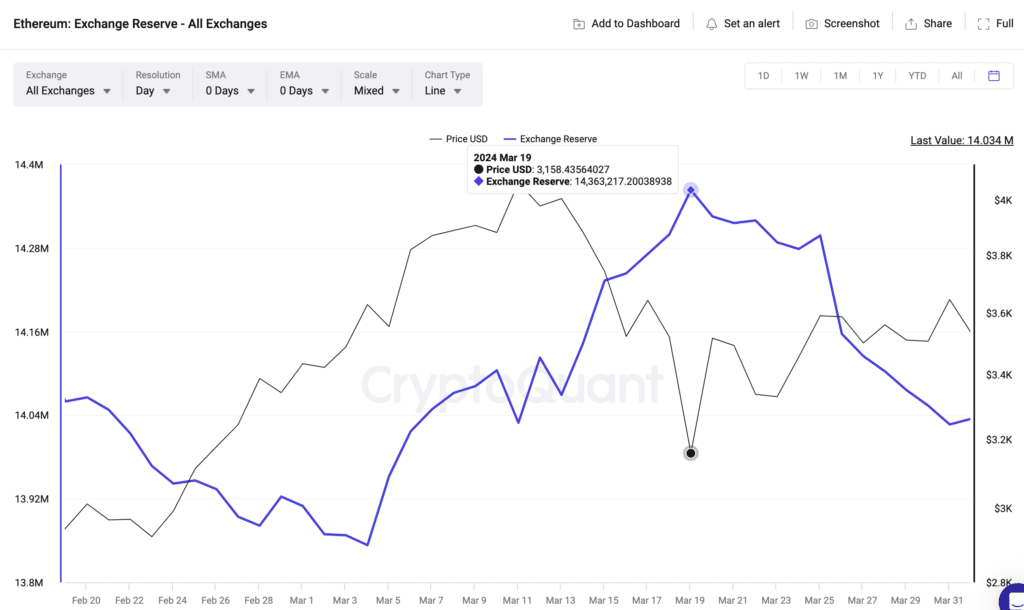

Cryptoquant’ exchange reserves metric tracks the total ETH coins that investors currently have deposited across various crypto exchanges and trading platforms.

Since the whale wallets began buying again on March 20, crypto exchanges have witnessed a persistent drop-off in active ETH market supply.

As seen in the chart above, investors held a total of 14.4 million ETH in exchange-hosted wallets at the close of March 19. But at the time of writing on April 1, that figure has now dwindled by 363,000 ETH.

When valued at the current prices of about $3,560 per coin, it implies over $1.3 billion worth of liquidity has been pulled from ETH spot markets over the last two weeks.

Going by the cardinal law of demand, this massive decline in ETH market supply, albeit temporarily, puts Ethereum price in a prime position to enter an accelerate breakout during the next demand surge in April 2024.

Ethereum (ETH) price forecast: $3,700 resistance looms large

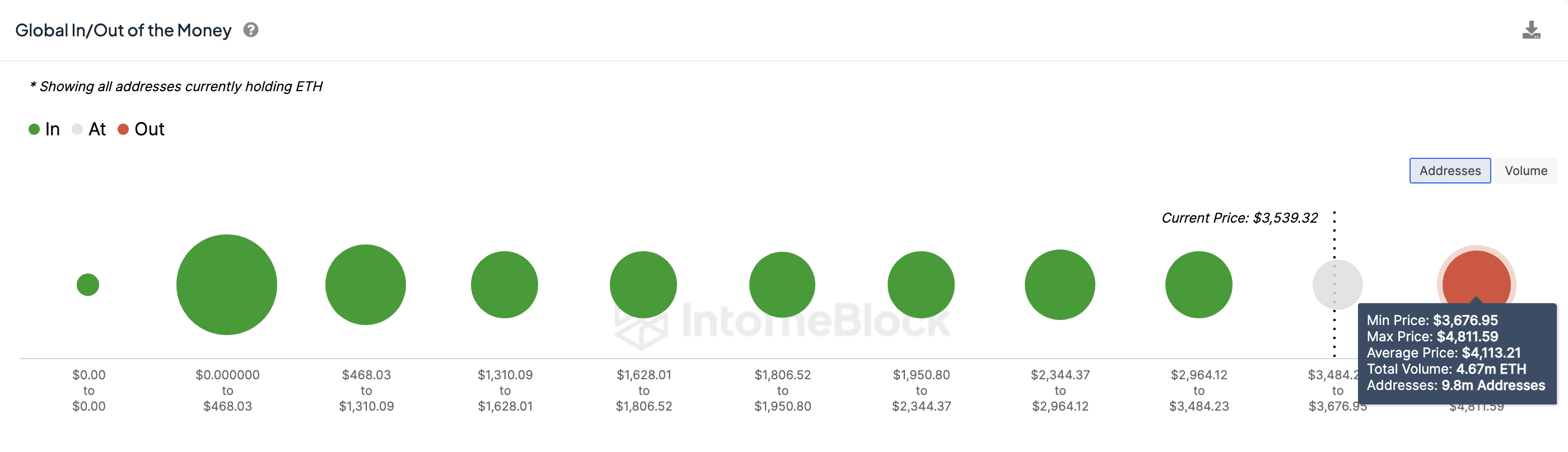

Drawing inferences from the on-chain insights, Ethereum price is on track to enter a parabolic breakout above $4,000 in April 2024. But first IntoTheBlock’s global in/out of the money chart shows the bulls face a formidable short-term resistance at the $3,700.

As depicted below, 9.8 million addresses that acquired 4.7 million ETH will break-even once Ethereum prices approach the $3,676 area. If majority of them opt to exit early, ETH price rally could experience significant downward pressure.

But given the whales $3.1 billion fresh acquisition and the $1.3 billion decline in short-term market supply, ETH price will likely scale that sell-wall and reach for new heights above the $4,000 territory.

On the flip side, if the crypto market bull rally runs of steam, Ethereum bears could regain control once ETH price tumbles below $3,200. However, this seems unlikely within the current market dynamics, as analyzed above.

Moreso, the 9.1 million addresses that bought 7.7 million ETH at the average price of $3,484 could make proactive defensive purchases to prevent a major downswing below $3,500.